Dish Network 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

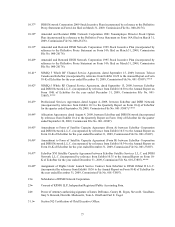

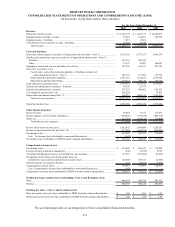

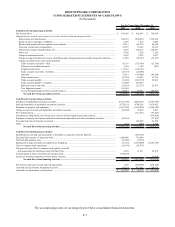

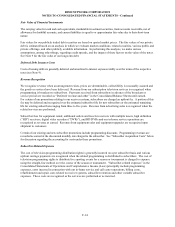

DISH NETWORK CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

F-7

2009 2008 2007

Cash Flows From Operating Activities:

Net income (loss)....................................................................................................................................................... 635,403$ 902,947$ 756,054$

Adjustments to reconcile net income (loss) to net cash flows from operating activities:

Depreciation and amortization.............................................................................................................................. 940,033 1,000,230 1,329,410

Equity in losses (earnings) of affiliates................................................................................................................. 4,149 1,519 5,866

Realized and unrealized losses (gains) on investments......................................................................................... 13,811 169,370 45,620

Non-cash, stock-based compensation .................................................................................................................. 12,227 15,349 23,016

Deferred tax expense (benefit) (Note 10)............................................................................................................. 4,630 392,318 398,931

Other, net.............................................................................................................................................................. 8,505 7,328 7,529

Change in noncurrent assets.................................................................................................................................. 6,507 7,832 2,657

Change in long-term deferred revenue, distribution and carriage payments and other long-term liabilities......... 31,658 (98,957) (15,475)

Changes in current assets and current liabilities:

Trade accounts receivable - other..................................................................................................................... 56,536 (138,768) (25,764)

Allowance for doubtful accounts...................................................................................................................... 1,165 1,188 (987)

Prepaid income taxes........................................................................................................................................ 113,641 (148,747) -

Trade accounts receivable - EchoStar............................................................................................................... (16,777) (20,604) -

Inventory........................................................................................................................................................... 51,411 (158,498) (88,364)

Other current assets .......................................................................................................................................... (35,593) 18,403 13,783

Trade accounts payable .................................................................................................................................... (33,420) (120,739) 32,019

Trade accounts payable - EchoStar .................................................................................................................. (27,088) 297,629 -

Deferred revenue and other............................................................................................................................... (14,116) (27,317) 25,473

Tivo litigation accrual....................................................................................................................................... 361,024 - -

Accrued programming and other accrued expenses.......................................................................................... 80,837

87,861

106,952

Net cash flows from operating activities .................................................................................................. 2,194,543 2,188,344 2,616,720

Cash Flows From Investing Activities:

Purchases of marketable investment securities.......................................................................................................... (6,017,798) (4,648,931) (3,653,939)

Sales and maturities of marketable investment securities.......................................................................................... 4,570,124 4,708,338 3,078,432

Purchases of property and equipment........................................................................................................................ (1,037,190) (1,129,890) (1,444,522)

Change in restricted cash and marketable investment securities................................................................................ (58,209) 79,638 2,267

FCC authorizations.................................................................................................................................................... - (711,871) (97,463)

Investment in Sling Media, net of in-process research and development and cash acquired..................................... - - (319,928)

Purchase of strategic investments included in noncurrent marketable and other investment securities .................... (62,142) - (71,903)

Proceeds from sale of strategic investment................................................................................................................ - 106,200 33,474

Other.......................................................................................................................................................................... (341) (955) 2,750

Net cash flows from investing activities ................................................................................................... (2,605,556) (1,597,471) (2,470,832)

Cash Flows From Financing Activities:

Distribution of cash and cash equivalents to EchoStar in connection with the Spin-off ........................................... - (585,147) -

Proceeds from issuance of long-term debt................................................................................................................. 1,400,000 750,000 -

Deferred debt issuance costs ..................................................................................................................................... (23,090) (4,972) -

Repayment of long-term debt and capital lease obligations....................................................................................... (51,301) (1,510,000) (1,043,708)

Class A common stock repurchases........................................................................................................................... (18,594) (82,733) -

Net proceeds from Class A common stock options exercised

and issued under the Employee Stock Purchase Plan............................................................................................. 5,418 21,011 54,674

Cash dividend on Class A and Class B common stock.............................................................................................. (894,150) - -

Excess tax benefits recognized on stock option exercises ........................................................................................ - -

13,018

Net cash flows from financing activities ................................................................................................... 418,283 (1,411,841) (976,016)

Net increase (decrease) in cash and cash equivalents ............................................................................................... 7,270 (820,968) (830,128)

Cash and cash equivalents, beginning of period........................................................................................................ 98,574 919,542 1,749,670

Cash and cash equivalents, end of period.................................................................................................................. 105,844$ 98,574$ 919,542$

For the Years Ended December 31,