Dish Network 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

42

You should read the following discussion and analysis of our financial condition and results of operations together

with the audited consolidated financial statements and notes to the financial statements included elsewhere in this

annual report. This management’s discussion and analysis is intended to help provide an understanding of our

financial condition, changes in financial condition and results of our operations and contains forward-looking

statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather

are based on current expectations, estimates, assumptions and projections about our industry, business and future

financial results. Our actual results could differ materially from the results contemplated by these forward-looking

statements due to a number of factors, including those discussed in this report, including under the caption “Item

1A. Risk Factors” in this Annual Report on Form 10-K.

EXECUTIVE SUMMARY

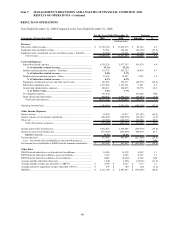

Overview

DISH Network added approximately 422,000 net new subscribers during the year ended December 31, 2009 as a

result of higher gross subscriber additions and reduced churn. Our increased gross subscriber additions were

primarily a result of our sales and marketing promotions during the last half of 2009. Churn was positively

impacted by, among other things, the completion of our security access device replacement program, an increase in

our new subscriber commitment period and initiatives to retain subscribers. Historically, we have experienced

slightly higher churn in the months following the expiration of commitments for new subscribers. In February 2008,

we extended the required new subscriber commitment from 18 to 24 months. During the last half of 2009, due to

the change in promotional mix, we had fewer expiring new subscriber commitments. We continue to focus on

addressing operational inefficiencies specific to DISH Network which we believe will contribute to long-term

subscriber growth. ARPU has been negatively impacted by promotional discounts on programming offered to new

subscribers and our initiatives to retain subscribers, both of which negatively impacted our subscriber-related

margins. “Subscriber-related expenses” continued to be negatively impacted by increased programming costs and

initiatives to retain subscribers, migrate certain subscribers to make more efficient use of transponder capacity, and

improve customer service.

The current overall economic environment has negatively impacted many industries including ours. In addition, the

overall growth rate in the pay-TV industry has slowed in recent years. Within this maturing industry, competition

has intensified with the rapid growth of fiber-based pay-TV services offered by telecommunications companies.

Furthermore, programming offered over the Internet has become more prevalent as the speed and quality of

broadband networks have improved. Significant changes in consumer behavior with regard to the means by which

they obtain video entertainment and information in response to this emerging digital media competition could

materially adversely affect our business, results of operations and financial condition or otherwise disrupt our

business.

While economic factors have impacted the entire pay-TV industry, our relative performance has been mostly driven

by issues specific to DISH Network. In recent years, DISH Network’s position as the low cost provider in the pay-

TV industry has been eroded by increasingly aggressive promotional pricing used by our competitors to attract new

subscribers and similarly aggressive promotions and tactics used to retain existing subscribers. Some competitors

have been especially aggressive and effective in marketing their service. Furthermore, our subscriber growth has

been adversely affected by signal theft and other forms of fraud and by operational inefficiencies at DISH Network.

We have not always met our own standards for performing high-quality installations, effectively resolving

subscriber issues when they arise, answering subscriber calls in an acceptable timeframe, effectively communicating

with our subscriber base, reducing calls driven by the complexity of our business, improving the reliability of certain

systems and subscriber equipment, and aligning the interests of certain third party retailers and installers to provide

high-quality service.

Our distribution relationship with AT&T was a substantial contributor to our gross and net subscriber additions in

prior years, accounting for approximately 17% of our gross subscriber additions for the year ended December 31,

2008. This distribution relationship ended January 31, 2009. Consequently, beginning with the second quarter

2009, AT&T no longer contributed to our gross subscriber additions. In addition, nearly one million of our current

subscribers were acquired through our distribution relationship with AT&T and subscribers acquired through this

channel have historically churned at a higher rate than our overall subscriber base. Although AT&T is not permitted