Dish Network 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-34

closing price of the class A common stock on the last business day of each calendar quarter in which such shares of

class A common stock are deemed sold to an employee under the ESPP. The ESPP shall terminate upon the first to

occur of (i) October 1, 2007 or (ii) the date on which the ESPP is terminated by the Board of Directors. During

2000, 2001 and 2002 employees purchased approximately 58,000; 80,000 and 108,000 shares of class A common

stock through the ESPP, respectively.

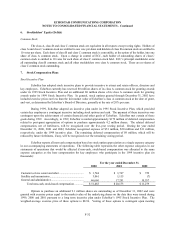

401(k) Employee Savings Plan

EchoStar sponsors a 401(k) Employee Savings Plan (the “401(k) Plan”) for eligible employees. Voluntary

employee contributions to the 401(k) Plan may be matched 50% by EchoStar, subject to a maximum annual

contribution by EchoStar of $1,000 per employee. Matching 401(k) contributions totaled approximately $1.6

million, $2.1 million and $2.4 million during the years ended December 31, 2000, 2001 and 2002, respectively.

EchoStar also may make an annual discretionary contribution to the plan with approval by EchoStar’s Board of

Directors, subject to the maximum deductible limit provided by the Internal Revenue Code of 1986, as amended.

These contributions may be made in cash or in EchoStar stock. Forfeitures of unvested participant balances which

are retained by the 401(k) Plan may be used to fund matching and discretionary contributions. Expense recognized

relating to discretionary contributions was approximately $7 million, $225 thousand and $17 million during the years

ended December 31, 2000, 2001 and 2002, respectively.

9. Commitments and Contingencies

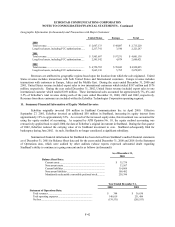

Leases

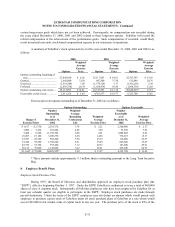

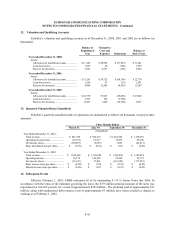

Future minimum lease payments under noncancelable operating leases as of December 31, 2002, are as follows

(in thousands):

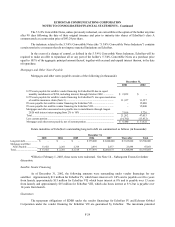

Year ending December 31,

2003 ................................................................................................... $ 17,274

2004 ................................................................................................... 14,424

2005 ................................................................................................... 11,285

2006 ................................................................................................... 7,698

2007 ................................................................................................... 3,668

Thereafter........................................................................................... 1,650

Total minimum lease payments................................................... 55,999

Total rent expense for operating leases approximated $9 million, $14 million and $16 million in 2000, 2001

and 2002, respectively.

Purchase Commitments

As of December 31, 2002, EchoStar’s purchase commitments totaled approximately $359 million. The

majority of these commitments relate to EchoStar receiver systems and related components. All of the purchases related

to these commitments are expected to be made during 2003. EchoStar expects to finance these purchases from existing

unrestricted cash balances and future cash flows generated from operations.

Patents and Intellectual Property

Many entities, including some of EchoStar’s competitors, now have and may in the future obtain patents and

other intellectual property rights that cover or affect products or services directly or indirectly related to those that

EchoStar offers. EchoStar may not be aware of all patents and other intellectual property rights that its products may

potentially infringe. Damages in patent infringement cases can include a tripling of actual damages in certain cases.

Further, EchoStar cannot estimate the extent to which it may be required in the future to obtain licenses with respect to