Dish Network 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

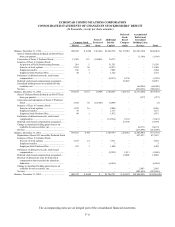

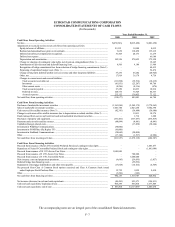

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-11

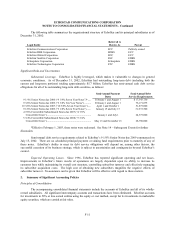

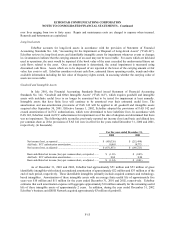

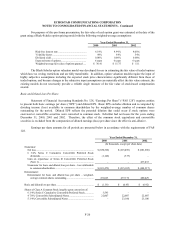

The following table summarizes the organizational structure of EchoStar and its principal subsidiaries as of

December 31, 2002:

Legal Entity

Referred to

Herein As Parent

EchoStar Communications Corporation ECC Publicly owned

EchoStar DBS Corporation EDBS ECC

EchoStar Orbital Corporation EOC ECC

EchoStar Satellite Corporation ESC EDBS

Echosphere Corporation Echosphere EDBS

EchoStar Technologies Corporation ETC EDBS

Significant Risks and Uncertainties

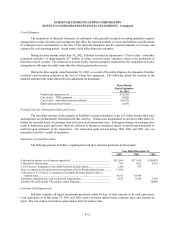

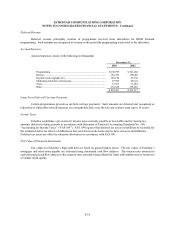

Substantial Leverage. EchoStar is highly leveraged, which makes it vulnerable to changes in general

economic conditions. As of December 31, 2002, EchoStar had outstanding long-term debt (including both the

current and long-term portions) totaling approximately $5.7 billion. EchoStar has semi-annual cash debt service

obligations for all of its outstanding long-term debt securities, as follows:

Semi-Annual Payment

Dates

Semi-Annual Debt

Service Requirements

9 1/4% Senior Notes due 2006 (“9 1/4% Seven Year Notes”)*..... February 1 and August 1 $ 17,343,750

9 3/8% Senior Notes due 2009 (“9 3/8% Ten Year Notes”) .......... February 1 and August 1 76,171,875

10 3/8% Senior Notes due 2007 (“10 3/8% Seven Year Notes”)..... April 1 and October 1 51,875,000

9 1/8% Senior Notes due 2009 (“9 1/8% Seven Year Notes”)....... January 15 and July 15 31,937,500

4 7/8% Convertible Subordinated Notes due 2007 (“4 7/8%

Convertible Notes”).................................................................... January 1 and July 1 24,375,000

5 3/4% Convertible Subordinated Notes due 2008 (“5 3/4%

Convertible Notes”).................................................................... May 15 and November 15 28,750,000

*Effective February 1, 2003, these notes were redeemed. See Note 14 – Subsequent Events for further

discussion.

Semi-annual debt service requirements related to EchoStar’s 9 1/8% Senior Notes due 2009 commenced on

July 15, 2002. There are no scheduled principal payment or sinking fund requirements prior to maturity of any of

these notes. EchoStar’s ability to meet its debt service obligations will depend on, among other factors, the

successful execution of its business strategy, which is subject to uncertainties and contingencies beyond EchoStar’s

control.

Expected Operating Losses. Since 1996, EchoStar has reported significant operating and net losses.

Improvements in EchoStar’s future results of operations are largely dependent upon its ability to increase its

customer base while maintaining its overall cost structure, controlling subscriber turnover and effectively managing

its subscriber acquisition costs. The high cost of obtaining new subscribers magnifies the negative effects of

subscriber turnover. No assurance can be given that EchoStar will be effective with regard to these matters.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of EchoStar and all of its wholly-

owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. EchoStar accounts

for investments in 50% or less owned entities using the equity or cost method, except for its investments in marketable

equity securities, which are carried at fair value.