Dish Network 2002 Annual Report Download - page 69

Download and view the complete annual report

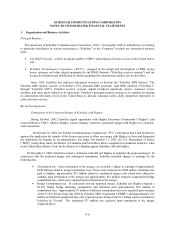

Please find page 69 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-9

• Ticking fees: A fee of .50% per year on the aggregate bridge financing commitment outstanding was

payable quarterly, in arrears, until termination of the agreements relating to the bridge commitments.

These fees were expensed as incurred as a component of interest expense. EchoStar recorded charges to

earnings of approximately $5 million and approximately $17 million during the years ended December

31, 2001 and 2002, respectively, related to bridge financing ticking fees.

Under the terms of the settlement, Hughes retained its 81% ownership interest in PanAmSat, which EchoStar was

previously obligated to purchase at a price of $22.47 per share, or approximately $2.7 billion.

Vivendi Universal

In connection with Vivendi’s purchase of our Series D convertible preferred stock during January 2002,

Vivendi received contingent value rights. The terms of those rights provided that if, as of the settlement date

specified below, the average price of EchoStar’s class A common stock was above the $26.04 class A common stock

equivalent price per share paid by Vivendi, then no amount would be payable to Vivendi. If the average price of

EchoStar’s class A common stock during the relevant 20 day period was below that price, then we were obligated to

pay Vivendi the difference between $26.04, the price paid by Vivendi, and the then current average price of

EchoStar’s class A common stock, up to a maximum payment of $525 million. Any amount owed under these rights,

which was payable in cash or in EchoStar’s class A common stock at EchoStar’s option, would have been settled 30

months after termination of the merger agreement and the PanAmSat stock purchase agreement. The terms of the

contingent value rights also provided that, generally, in the event that the price of EchoStar’s class A common stock

was at or above $31.25 for 90 consecutive calendar days prior to maturity of the contingent value rights, the rights

automatically expired.

The class A common stock equivalent per share conversion price for the Series D convertible preferred

stock was set at $26.04 upon execution of the investment agreement on December 14, 2001. Further, the effective

class A common stock equivalent per share value of the Series D convertible preferred stock excluding the

contingent value rights was calculated as $25.51. However, the investment was not consummated until January 22,

2002, when the price of EchoStar’s class A common stock was $26.58. Since the price as of the date of

consummation of the investment was above the effective per share value and since consummation of the investment

was contingent upon regulatory approval, the Series D preferred stock was deemed to be issued with a beneficial

conversion feature. This feature required the difference between the effective per share value and the price as of the

date of consummation to be recorded as a discount on the Series D convertible preferred stock. Since the Series D

convertible preferred stock was immediately convertible at the holder’s option, the discount on Series D convertible

preferred stock related to the beneficial conversion feature was accreted as a charge to retained earnings of

approximately $61.9 million as of the date of issuance.

EchoStar used a Black-Scholes pricing model, a widely accepted tool which is commonly used to value

financial instruments such as options, warrants, etc., and applied certain other assumptions and judgments to value

the contingent rights from the date of their issuance through December 17, 2002, the date on which EchoStar and

Vivendi agreed to a repurchase of this stake as discussed below. Changes in the estimated value were recorded as

charges to earnings from January 22, 2002 through December 17, 2002. The contingent value rights were originally

assigned a value of $30.7 million. This amount was recorded as a discount on the Series D convertible preferred

stock at the date of issuance. As of December 17, 2002, the estimated value of the contingent value rights was

approximately $62.3 million. The issuance costs of approximately $16.5 million related to the Series D convertible

preferred stock were also recorded as a discount on the Series D convertible preferred stock at the date of issuance.

Effective December 23, 2002, EchoStar repurchased Vivendi’s stake in EchoStar. As part of this

transaction, immediately prior to the repurchase Vivendi converted its Series D Convertible Preferred stock into

approximately 57.6 million shares of EchoStar class A Common stock. These shares were then acquired by us at a

price of $18.50 per common share, for a total transaction price of approximately $1.066 billion. As a result of this

transaction, Vivendi’s contingent value rights terminated in accordance with the original terms of the Contingent