Dish Network 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

marketable investment securities of approximately $110 million. This increase in interest expense was partially offset

by an increase in interest income and capitalized interest during 2001.

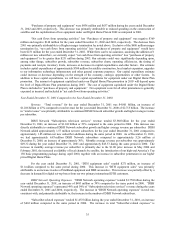

Net loss. “Net loss” was $215 million during the year ended December 31, 2001, an improvement of $435

million compared to “Net loss” of $650 million for the same period in 2000. This improvement is primarily

attributable to increases in “Subscription television services” revenue discussed above.

Net loss attributable to common shareholders. “Net loss attributable to common shareholders” was $216

million during the year ended December 31, 2001, an improvement of $435 million compared to “Net loss available to

common shareholders” of $651 million for the same period in 2000. This improvement is primarily attributable to the

improvement in “Net loss”, as discussed above.

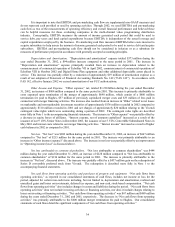

Net cash flows from operating activities and purchases of property and equipment. “Net cash flows from

operating activities,” as reported in our consolidated statements of cash flows, includes net income or loss for the

period, adjusted for certain non-cash items including, but not limited to, depreciation and amortization, realized and

unrealized gains and losses on investments, deferred tax expense, and non-cash, stock-based compensation. “Net cash

flows from operating activities” also includes changes in assets and liabilities during the period. “Net cash flows from

operating activities” does not include investing activities or financing activities, nor does it include charges relating to

losses on investing or financing activities. “Net cash flows from operating activities” was $489 million and negative

$119 million during the years ended December 31, 2001 and 2000, respectively. The improvement in “net cash flows

from operating activities” was primarily attributable to the improvement in net loss. Our consolidated statements of

cash flows detail the significant components of “net cash flows from operating activities.”

“Purchases of property and equipment” were $637 million and $331 million during the years ended December

31, 2001 and 2000, respectively. This increase was primarily attributable to increased spending on the construction of

satellites and an increase of equipment capitalized under our Digital Home Plan in 2001 as compared to 2000.

“Net cash flows from operating activities” less “Purchases of property and equipment” was negative $148

million and negative $450 million for the years ended December 31, 2001 and 2000, respectively.

LIQUIDITY AND CAPITAL RESOURCES

Cash Sources

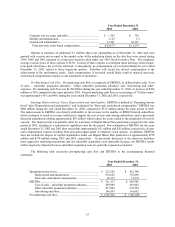

As of December 31, 2002, our restricted and unrestricted cash, cash equivalents and marketable investment

securities totaled $2.848 billion, including $151 million of cash reserved for satellite insurance and approximately $10

million of other restricted cash, compared to $2.952 billion, including $122 million of cash reserved for satellite

insurance and $1 million of other restricted cash, as of December 31, 2001. For the years ended December 31, 2002

and 2001, we reported net cash flows from operating activities of $67 million and $489 million, respectively. Net cash

flows from operating activities during 2002 includes approximately $600 million of expenses related to termination of

the merger with Hughes.

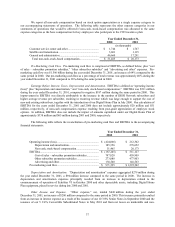

We expect that our future working capital, capital expenditure and debt service requirements will be satisfied

primarily from existing cash and investment balances and cash generated from operations. Our ability to generate

positive future operating and net cash flows is dependent upon, among other things, our ability to retain existing DISH

Network subscribers. There can be no assurance that we will be successful in achieving any or all of our goals. The

amount of capital required to fund our 2003 working capital and capital expenditure needs will vary, depending, among

other things, on the rate at which we acquire new subscribers and the cost of subscriber acquisition, including

capitalized costs associated with our Digital Home Plan. Our capital expenditures will also vary depending on the

number of satellites under construction at any point in time. Our working capital and capital expenditure requirements

could increase materially in the event of increased competition for subscription television customers, significant

satellite failures, or in the event of continued general economic downturn, among other factors. These factors could

require that we raise additional capital in the future.

From time to time we evaluate opportunities for strategic investments or acquisitions that would complement

our current services and products, enhance our technical capabilities or otherwise offer growth opportunities. As a