Dish Network 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-13

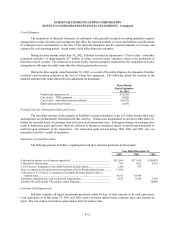

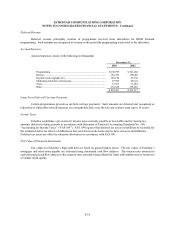

Marketable and Non-Marketable Investment Securities and Restricted Cash

EchoStar currently classifies all marketable investment securities as available-for-sale. In accordance with

generally accepted accounting principles, EchoStar adjusts the carrying value of its available-for-sale marketable

investment securities to fair market value and reports the related temporary unrealized gains and losses as a separate

component of stockholders’ deficit, net of related deferred income tax, if applicable. Declines in the fair market value of

a marketable investment security which are estimated to be “other than temporary” must be recognized in the statement

of operations, thus establishing a new cost basis for such investment. EchoStar evaluates its marketable investment

securities portfolio on a quarterly basis to determine whether declines in the market value of these securities are other

than temporary. This quarterly evaluation consists of reviewing, among other things, the fair value of EchoStar’s

marketable investment securities compared to the carrying value of these securities, the historical volatility of the price

of each security and any market and company specific factors related to each security. Generally, absent specific factors

to the contrary, declines in the fair value of investments below cost basis for a period of less than six months are

considered to be temporary. Declines in the fair value of investments for a period of six to nine months are evaluated on

a case by case basis to determine whether any company or market-specific factors exist which would indicate that such

declines are other than temporary. Declines in the fair value of investments below cost basis for greater than nine

months are considered other than temporary and are recorded as charges to earnings, absent specific factors to the

contrary.

As of December 31, 2002, EchoStar recorded unrealized gains of approximately $6 million as a separate

component of stockholders’ deficit. During the year ended December 31, 2002, EchoStar also recorded an aggregate

charge to earnings for other than temporary declines in the fair market value of certain of its marketable investment

securities of approximately $117 million, and established a new cost basis for these securities. This amount does not

include realized gains of approximately $12 million on the sales of marketable investment securities. EchoStar’s

approximately $2.8 billion of restricted and unrestricted cash, cash equivalents and marketable investment securities

include debt and equity securities which EchoStar owns for strategic and financial purposes. The fair market value of

these strategic marketable investment securities aggregated approximately $73 million as of December 31, 2002. During

the year ended December 31, 2002, EchoStar’s portfolio generally, and EchoStar’s strategic investments particularly,

experienced and continue to experience volatility. If the fair market value of EchoStar’s marketable securities portfolio

does not remain above cost basis or if EchoStar becomes aware of any market or company specific factors that indicate

that the carrying value of certain of its securities is impaired, EchoStar may be required to record additional charges to

earnings in future periods equal to the amount of the decline in fair value.

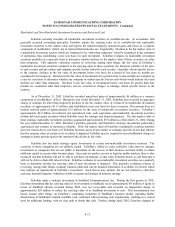

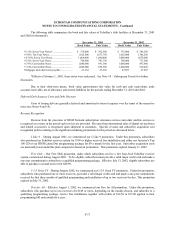

EchoStar also has made strategic equity investments in certain non-marketable investment securities. The

securities of these companies are not publicly traded. EchoStar’s ability to create realizable value from its strategic

investments in companies that are not public is dependent on the success of their business and their ability to obtain

sufficient capital to execute their business plans. Since private markets are not as liquid as public markets, there is also

increased risk that EchoStar will not be able to sell these investments, or that when EchoStar desires to sell them that it

will not be able to obtain full value for them. EchoStar evaluates its non-marketable investment securities on a quarterly

basis to determine whether the carrying value of each investment is impaired. This quarterly evaluation consists of

reviewing, among other things, company business plans and current financial statements, if available, for factors which

may indicate an impairment in EchoStar’s investment. Such factors may include, but are not limited to, cash flow

concerns, material litigation, violations of debt covenants and changes in business strategy.

EchoStar made a strategic investment in StarBand Communications, Inc. During the first quarter of 2002,

EchoStar determined that the carrying value of its investment in StarBand, net of approximately $8 million of equity in

losses of StarBand already recorded during 2002, was not recoverable and recorded an impairment charge of

approximately $28 million to reduce the carrying value of its StarBand investment to zero. This determination was

based, among other things, on EchoStar’s continuing evaluation of StarBand’s business model, including further

deterioration of StarBand’s limited available cash, combined with increasing cash requirements, resulting in a critical

need for additional funding, with no clear path to obtain that cash. Further, during April 2002, EchoStar changed its