Dish Network 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

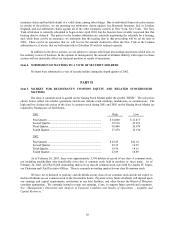

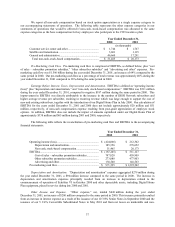

33

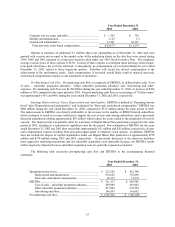

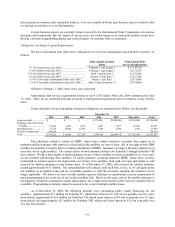

Year Ended December 31

2001 2002

Customer service center and other ............................................ $ 1,767 $ 729

Satellite and transmission .......................................................... 1,115 (7)

General and administrative........................................................ 17,291 10,557

Total non-cash, stock-based compensation ........................... $ 20,173 $ 11,279

Options to purchase an additional 9.1 million shares are outstanding as of December 31, 2002 and were

granted with exercise prices equal to the market value of the underlying shares on the date they were issued during

1999, 2000 and 2001 pursuant to a long term incentive plan under our 1995 Stock Incentive Plan. The weighted-

average exercise price of these options is $8.96. Vesting of these options is contingent upon meeting certain longer-

term goals which have not yet been achieved. Consequently, no compensation was recorded during the year ended

December 31, 2002 related to these long-term options. EchoStar will record the related compensation at the

achievement of the performance goals. Such compensation, if recorded, would likely result in material non-cash,

stock-based compensation expense in our statements of operations.

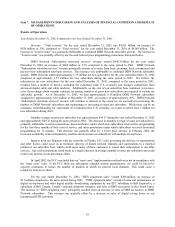

Pre-Marketing Cash Flow. Pre-marketing cash flow is comprised of EBITDA, as defined below, plus “Cost

of sales – subscriber promotion subsidies,” “Other subscriber promotion subsidies” and “Advertising and other”

expenses. Pre-marketing cash flow was $1.982 billion during the year ended December 31, 2002, an increase of $386

million or 24% compared to the same period in 2001. Our pre-marketing cash flow as a percentage of “Total revenue”

was approximately 41% and 40% during the years ended December 31, 2002 and 2001, respectively.

Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA is defined as “Operating income

(loss)” plus “Depreciation and amortization,” and is adjusted for “Non-cash, stock-based compensation.” EBITDA was

$806 million during the year ended December 31, 2002, compared to $511 million during the same period in 2001.

The improvement in EBITDA was directly attributable to the increase in the number of DISH Network subscribers,

which continues to result in revenue sufficient to support the cost of new and existing subscribers, and to previously

discussed adjustments totaling approximately $53 million which reduce the costs related to the production of receiver

systems. The improvement was partially offset by a decrease in Digital Home Plan penetration compared to the same

period in 2001, resulting in a reduction in capitalized costs for the period. Our calculation of EBITDA for the years

ended December 31, 2002 and 2001 does not include approximately $11 million and $20 million, respectively, of non-

cash compensation expense resulting from post-grant appreciation of employee stock options. In addition, EBITDA

does not include the impact of capital expenditures under our Digital Home Plan promotion of approximately $278

million and $338 million during 2002 and 2001, respectively. As previously discussed, to the extent we introduce

more aggressive marketing promotions and our subscriber acquisition costs materially increase, our EBITDA results

will be negatively impacted because subscriber acquisition costs are generally expensed as incurred.

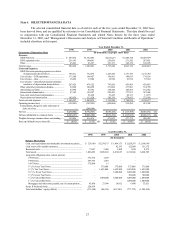

The following table reconciles pre-marketing cash flow and EBITDA to the accompanying financial

statements:

Year Ended December 31,

2001 2002

Operating income (loss)............................................................. $ 212,302 $ 421,348

Depreciation and amortization........................................... 278,652 372,958

Non-cash, stock-based compensation................................ 20,173 11,279

EBITDA..................................................................................... $ 511,127 $ 805,585

Cost of sales – subscriber promotion subsidies................. 459,909 439,863

Other subscriber promotion subsidies ............................... 477,903 574,750

Advertising and other......................................................... 146,563 161,662

Pre-marketing cash flow............................................................ $ 1,595,502 $ 1,981,860