Dish Network 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

these persons on commercially reasonable terms or, if we were unable to obtain such licenses, that we would be able

to redesign our products to avoid infringement.

Certain Gemstar patents are currently being reviewed by the International Trade Commission. An adverse

decision could temporarily halt the import of our receivers and could require us to materially modify certain user-

friendly electronic programming guides and related features we currently offer to consumers.

Obligations and Future Capital Requirements

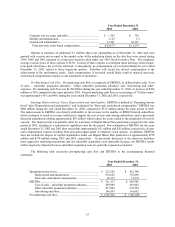

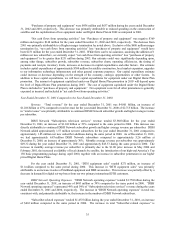

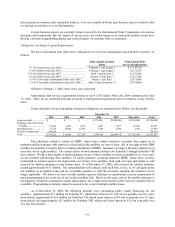

We have semi-annual cash debt service obligations for all of our outstanding long-term debt securities, as

follows:

Semi-Annual Payment

Dates

Semi-Annual Debt

Service Requirements

9 1/4% Senior Notes due 2006*................................... February 1 and August 1 $ 17,343,750

9 3/8% Senior Notes due 2009..................................... February 1 and August 1 76,171,875

10 3/8% Senior Notes due 2007..................................... April 1 and October 1 51,875,000

9 1/8% Senior Notes due 2009..................................... January 15 and July 15 31,937,500

4 7/8% Convertible Subordinated Notes due 2007 ...... January 1 and July 1 24,375,000

5 3/4% Convertible Subordinated Notes due 2008 ...... May 15 and November 15 28,750,000

*Effective February 1, 2003, these notes were redeemed.

Semi-annual debt service requirements related to our 9 1/8% Senior Notes due 2009 commenced on July

15, 2002. There are no scheduled principal payment or sinking fund requirements prior to maturity of any of these

notes.

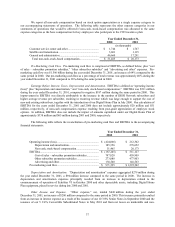

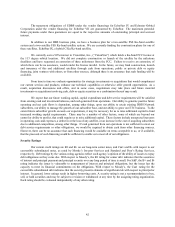

Future maturities of our outstanding contractual obligations are summarized as follows (in thousands):

December 31,

2003 2004 2005 2006 2007 Thereafter Total

Long-term debt ..................... $ – $ – $ – $ 375,000 $2,000,000 $3,325,000 $5,700,000

Mortgages and Other Notes

Payable.............................. 13,432 2,241 2,318 2,491 2,677 23,894 47,053

Operating leases.................... 17,274 14,424 11,285 7,698 3,668 1,650 55,999

Purchase commitments......... 358,555 – – – – – 358,555

Total...................................... $ 389,261 $ 16,665 $ 13,603 $ 385,189 $2,006,345 $ 3,350,544 $ 6,161,607

The indentures related to certain of EDBS’ senior notes contain restrictive covenants that require us to

maintain satellite insurance with respect to at least half of the satellites we own or lease. All of our eight in-orbit DBS

satellites are currently owned by direct or indirect subsidiaries of EDBS. Insurance coverage is therefore required for at

least four of our eight satellites. The launch and/or in-orbit insurance policies for EchoStar I through EchoStar VIII

have expired. We have been unable to obtain insurance on any of these satellites on terms acceptable to us. As a result,

we are currently self-insuring these satellites. To satisfy insurance covenants related to EDBS’ senior notes, we have

reclassified an amount equal to the depreciated cost of four of its satellites from cash and cash equivalents to cash

reserved for satellite insurance on our balance sheet. As of December 31, 2002, cash reserved for satellite insurance

totaled approximately $151 million. The reclassifications will continue until such time, if ever, as we can again insure

our satellites on acceptable terms and for acceptable amounts, or until the covenants requiring the insurance are no

longer applicable. We believe we have in-orbit satellite capacity sufficient to expeditiously recover transmission of

most programming in the event one of our in-orbit satellites fails. However, the cash reserved for satellite insurance is

not adequate to fund the construction, launch and insurance for a replacement satellite in the event of a complete loss of

a satellite. Programming continuity cannot be assured in the event of multiple satellite losses.

As of December 31, 2002, the following amounts were outstanding under vendor financings for our

satellites: Approximately $11 million for EchoStar IV, which bears interest at 8 1/4% and is payable over five years

from launch; approximately $15 million for EchoStar VII, which bears interest at 8% and is payable over 13 years

from launch; and approximately $15 million for EchoStar VIII, which also bears interest at 8 % but is payable over

14 years from launch.