Dish Network 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

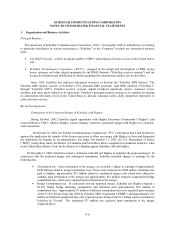

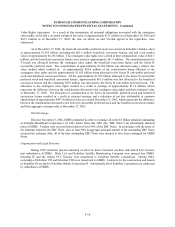

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-16

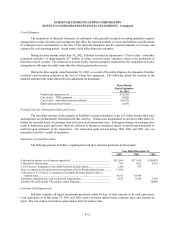

Deferred Revenue

Deferred revenue principally consists of prepayments received from subscribers for DISH Network

programming. Such amounts are recognized as revenue in the period the programming is provided to the subscriber.

Accrued Expenses

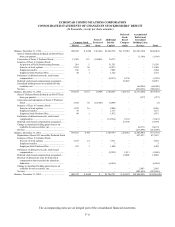

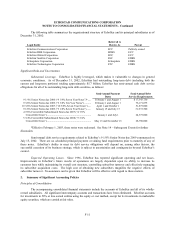

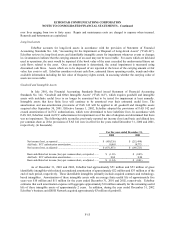

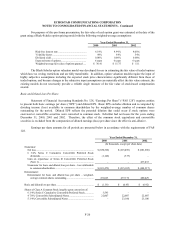

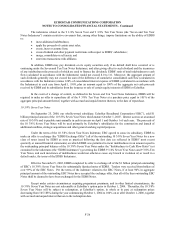

Accrued expenses consist of the following (in thousands):

December 31,

2001 2002

Programming......................................................................................... $ 250,795 $ 301,282

Interest ................................................................................................... 142,789 170,108

Royalties and copyright fees ................................................................. 145,140 93,156

Marketing and dealer commissions....................................................... 67,996 89,221

Taxes...................................................................................................... 17,933 31,244

Other...................................................................................................... 234,640 238,206

$ 859,293 $ 923,217

Long-Term Deferred Carriage Payments

Certain programmers provide us up-front carriage payments. Such amounts are deferred and recognized as

reductions to Subscriber-related expenses on a straight-line basis over the relevant contract term (up to 10 years).

Income Taxes

EchoStar establishes a provision for income taxes currently payable or receivable and for income tax

amounts deferred to future periods in accordance with Statement of Financial Accounting Standards No. 109,

“Accounting for Income Taxes” (“FAS 109”). FAS 109 requires that deferred tax assets or liabilities be recorded for

the estimated future tax effects of differences that exist between the book and tax basis of assets and liabilities.

Deferred tax assets are offset by valuation allowances in accordance with FAS 109.

Fair Value of Financial Instruments

Fair values for EchoStar’s high-yield debt are based on quoted market prices. The fair values of EchoStar’s

mortgages and other notes payable are estimated using discounted cash flow analyses. The interest rates assumed in

such discounted cash flow analyses reflect interest rates currently being offered for loans with similar terms to borrowers

of similar credit quality.