Dish Network 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-32

6. Stockholders’ Equity (Deficit)

Common Stock

The class A, class B and class C common stock are equivalent in all respects except voting rights. Holders of

class A and class C common stock are entitled to one vote per share and holders of class B common stock are entitled to

10 votes per share. Each share of class B and class C common stock is convertible, at the option of the holder, into one

share of class A common stock. Upon a change in control of ECC, each holder of outstanding shares of class C

common stock is entitled to 10 votes for each share of class C common stock held. ECC’s principal stockholder owns

all outstanding class B common stock and all other stockholders own class A common stock. There are no shares of

class C common stock outstanding.

7. Stock Compensation Plans

Stock Incentive Plan

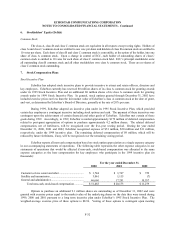

EchoStar has adopted stock incentive plans to provide incentive to attract and retain officers, directors and

key employees. EchoStar currently has reserved 80 million shares of its class A common stock for granting awards

under its 1995 Stock Incentive Plan and an additional 80 million shares of its class A common stock for granting

awards under its 1999 Stock Incentive Plan. In general, stock options granted through December 31, 2002 have

included exercise prices not less than the fair market value of EchoStar’s class A common stock at the date of grant,

and vest, as determined by EchoStar’s Board of Directors, generally at the rate of 20% per year.

During 1999, EchoStar adopted an incentive plan under its 1995 Stock Incentive Plan, which provided

certain key employees a contingent incentive including stock options and cash. The payment of these incentives was

contingent upon the achievement of certain financial and other goals of EchoStar. EchoStar met certain of these

goals during 1999. Accordingly, in 1999, EchoStar recorded approximately $179 million of deferred compensation

related to post-grant appreciation of options to purchase approximately 4.2 million shares. The related deferred

compensation, net of forfeitures, will be recognized over the five-year vesting period. During the year ended

December 31, 2000, 2001 and 2002, EchoStar recognized expense of $51 million, $20 million and $11 million,

respectively, under the 1999 incentive plan. The remaining deferred compensation of $9 million, which will be

reduced by future forfeitures, if any, will be recognized over the remaining vesting period.

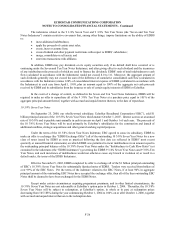

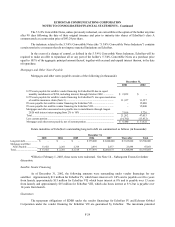

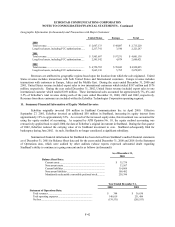

EchoStar reports all non-cash compensation based on stock option appreciation as a single expense category

in our accompanying statements of operations. The following table represents the other expense categories in our

statements of operations that would be affected if non-cash, stock-based compensation was allocated to the same

expense categories as the base compensation for key employees who participate in the 1999 incentive plan (in

thousands):

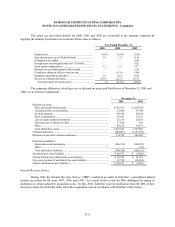

For the year ended December 31.

2000 2001

2002

Customer service center and other ................................... $ 1,744 $ 1,767 $ 729

Satellite and transmission ................................................. 3,061 1,115 (7)

General and administrative............................................... 46,660 17,291 10,557

Total non-cash, stock-based compensation ............. $ 51,465 $ 20,173 $ 11,279

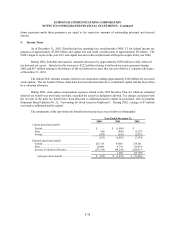

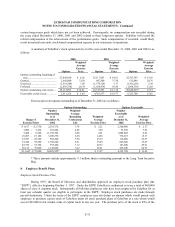

Options to purchase an additional 9.1 million shares are outstanding as of December 31, 2002 and were

granted with exercise prices equal to the market value of the underlying shares on the date they were issued during

1999, 2000 and 2001 pursuant to a long term incentive plan under EchoStar’s 1995 Stock Incentive Plan. The

weighted-average exercise price of these options is $8.96. Vesting of these options is contingent upon meeting