Dish Network 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

of sales – subscriber promotion subsidies”, “Other subscriber promotion subsidies” and DISH Network acquisition

marketing expenses. “Cost of sales – subscriber promotion subsidies” includes the cost of EchoStar receiver systems

sold to retailers and other distributors of our equipment and receiver systems sold directly by EchoStar to subscribers.

“Other subscriber promotion subsidies” includes net costs related to our free installation promotion and other

promotional incentives.

During the year ended December 31, 2002, our subscriber acquisition costs totaled approximately

$1.163 billion, or approximately $421 per new subscriber activation. Comparatively, our subscriber acquisition costs

during the year ended December 31, 2001 totaled approximately $1.074 billion, or approximately $395 per new

subscriber activation. Total subscriber acquisition costs for the year ended December 31, 2002 include favorable

adjustments which reduced the costs related to the production of EchoStar receiver systems. During 2002, we recorded

adjustments of approximately $48 million as a result of favorable litigation developments and the completion of royalty

arrangements with more favorable terms than estimated amounts previously accrued. The increase in total subscriber

acquisition costs primarily resulted from an increase in “Other subscriber promotion subsidies” related to additional

subsidies on second receiver installations and a decrease in the sales price of manufactured equipment, as well as an

increase in “Advertising and other” expense related to acquisition marketing and our 2002 marketing promotions. A

decrease in Digital Home Plan penetration in 2002 as compared to 2001 also contributed to this increase. This increase

was partially offset by reductions in the cost of manufactured equipment and an increase in installations we perform on

behalf of retailers. Our subscriber acquisition costs, both in the aggregate and on a per new subscriber activation basis,

may materially increase in the future to the extent that we introduce other more aggressive promotions if we determine

that they are necessary to respond to competition, or for other reasons.

We exclude equipment capitalized under our Digital Home Plan promotion from our calculation of subscriber

acquisition costs. We also exclude payments and certain returned equipment received from disconnecting Digital

Home Plan subscribers from our calculation of subscriber acquisition costs. Equipment capitalized under our Digital

Home Plan promotion totaled approximately $278 million and $338 million for the years ended December 31, 2002

and 2001, respectively. Payments and returned equipment received from disconnecting Digital Home Plan subscribers,

which became available for sale through other promotions rather than being redeployed in the Digital Home Plan,

totaled approximately $38 million and $16 million during the years ended December 31, 2002 and 2001, respectively.

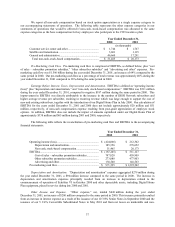

General and Administrative Expenses. “General and administrative” expenses totaled $387 million during the

year ended December 31, 2002, an increase of $9 million compared to the same period in 2001. The increase in

“G&A” expenses was primarily attributable to increased personnel and infrastructure expenses to support the growth of

the DISH Network. This increase was partially offset by a decrease in legal expenses and litigation settlements.

“G&A” expenses represented 8% and 9% of “Total revenue” during the years ended December 31, 2002 and 2001,

respectively.

Non-cash, Stock-based Compensation. During 1999, we adopted an incentive plan under our 1995 Stock

Incentive Plan, which provided certain key employees with incentives including stock options. The payment of

these incentives was contingent upon our achievement of certain financial and other goals. We met certain of these

goals during 1999. Accordingly, during 1999 we recorded approximately $179 million of deferred compensation

related to post-grant appreciation of stock options granted pursuant to the 1999 incentive plan. The related deferred

compensation, net of forfeitures, will be recognized over the five-year vesting period. Accordingly, during the year

ended December 31, 2002 we recognized $11 million of compensation under this performance-based plan, a

decrease of $9 million compared to the same period in 2001. This decrease is primarily attributable to proportionate

vesting and stock option forfeitures. The remaining deferred compensation of $9 million, which will be reduced by

future forfeitures, if any, will be recognized over the remaining vesting period.

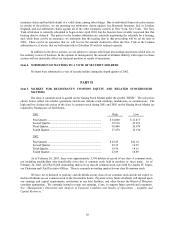

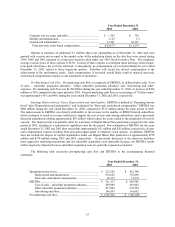

We report all non-cash compensation based on stock option appreciation as a single expense category in

our accompanying statements of operations. The following table represents the other expense categories in our

statements of operations that would be affected if non-cash, stock-based compensation was allocated to the same

expense categories as the base compensation for key employees who participate in the 1999 incentive plan (in

thousands):