Dish Network 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-15

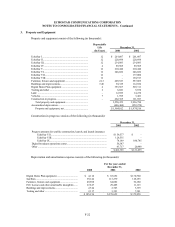

over lives ranging from two to forty years. Repair and maintenance costs are charged to expense when incurred.

Renewals and betterments are capitalized.

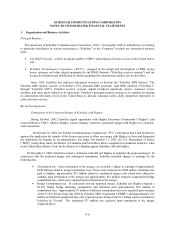

Long-lived assets

EchoStar accounts for long-lived assets in accordance with the provision of Statement of Financial

Accounting Standards No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“FAS 44”).

EchoStar reviews its long-lived assets and identifiable intangible assets for impairment whenever events or changes

in circumstances indicate that the carrying amount of an asset may not be recoverable. For assets which are held and

used in operations, the asset would be impaired if the book value of the asset exceeded the undiscounted future net

cash flows related to the asset. Once an impairment is determined, the actual impairment is measured using

discounted cash flows. Assets which are to be disposed of are reported at the lower of the carrying amount or fair

value less costs to sell. EchoStar considers relevant cash flow, estimated future operating results, trends and other

available information including the fair value of frequency rights owned, in assessing whether the carrying value of

assets are recoverable.

Goodwill and Intangible Assets

In July 2001, the Financial Accounting Standards Board issued Statement of Financial Accounting

Standards No. 142, “Goodwill and Other Intangible Assets” (“FAS 142”), which requires goodwill and intangible

assets with indefinite useful lives to no longer be amortized but to be tested for impairment at least annually.

Intangible assets that have finite lives will continue to be amortized over their estimated useful lives. The

amortization and non-amortization provisions of FAS 142 will be applied to all goodwill and intangible assets

acquired after September 30, 2001. Effective January 1, 2002, EchoStar adopted the provisions of FAS 142 and

ceased amortization of its FCC authorizations, which were determined to have indefinite lives. In accordance with

FAS 142, EchoStar tested its FCC authorizations for impairment as of the date of adoption and determined that there

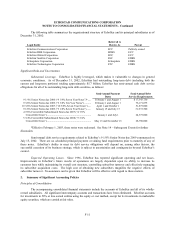

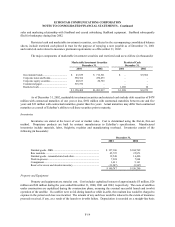

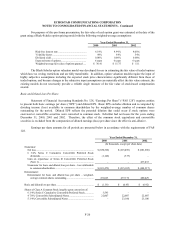

was no impairment. The following table reconciles previously reported net income (loss) and basic and diluted loss

per common share as if the provisions of FAS 142 were in effect for the years ended December 31, 2000 and 2001,

respectively, (in thousands).

For the years ended December 31,

2000 2001

Net income (loss), as reported .................................................................. $ (650,326) $ (215,498)

Add back: FCC authorization amortization............................................. 18,493 18,775

Net income (loss), as adjusted ................................................................. $ (631,833) $ (196,723)

Basic and diluted net income (loss) per common share, as reported ....... $ (1.38) $ (0.45)

Add back: FCC authorization amortization............................................. 0.04 0.04

Basic and diluted net income (loss) per common share, as adjusted ....... $ (1.34) $ (0.41)

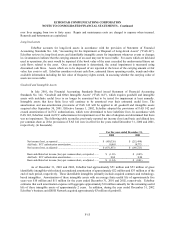

As of December 31, 2001 and 2002, EchoStar had approximately $51 million and $53 million of gross

identifiable intangibles with related accumulated amortization of approximately $22 million and $33 million as of the

end of each period, respectively. These identifiable intangibles primarily include acquired contracts and technology-

based intangibles. Amortization of these intangible assets with an average finite useful life of approximately five

years was $10 million and $11 million for the years ended December 31, 2001 and 2002, respectively. EchoStar

estimates that such amortization expense will aggregate approximately $10 million annually for the remaining useful

life of these intangible assets of approximately 2 years. In addition, during the year ended December 31, 2002

EchoStar’s business unit DISH Network acquired approximately $3 million of goodwill.