Cisco 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

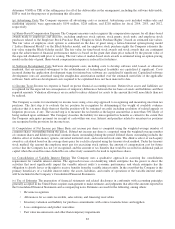

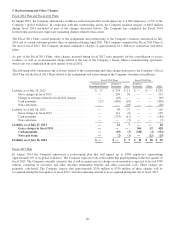

5. Restructuring and Other Charges

Fiscal 2014 Plan and Fiscal 2011 Plans

In August 2013, the Company announced a workforce reduction plan that would impact up to 4,000 employees, or 5% of the

Company’s global workforce. In connection with this restructuring action, the Company incurred charges of $418 million

during fiscal 2014 (included as part of the charges discussed below). The Company has completed the Fiscal 2014

restructuring and does not expect any remaining charges related to this action.

The Fiscal 2011 Plans consist primarily of the realignment and restructuring of the Company’s business announced in July

2011 and of certain consumer product lines as announced during April 2011. The Company completed the Fiscal 2011 Plans at

the end of fiscal 2013. The Company incurred cumulative charges of approximately $1.1 billion in connection with these

plans.

As part of the Fiscal 2011 Plans, other charges incurred during fiscal 2012 were primarily for the consolidation of excess

facilities, as well as an incremental charge related to the sale of the Company’s Juarez, Mexico manufacturing operations,

which sale was completed in the first quarter of fiscal 2012.

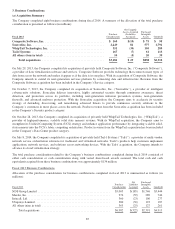

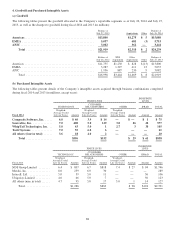

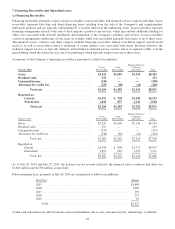

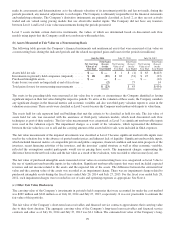

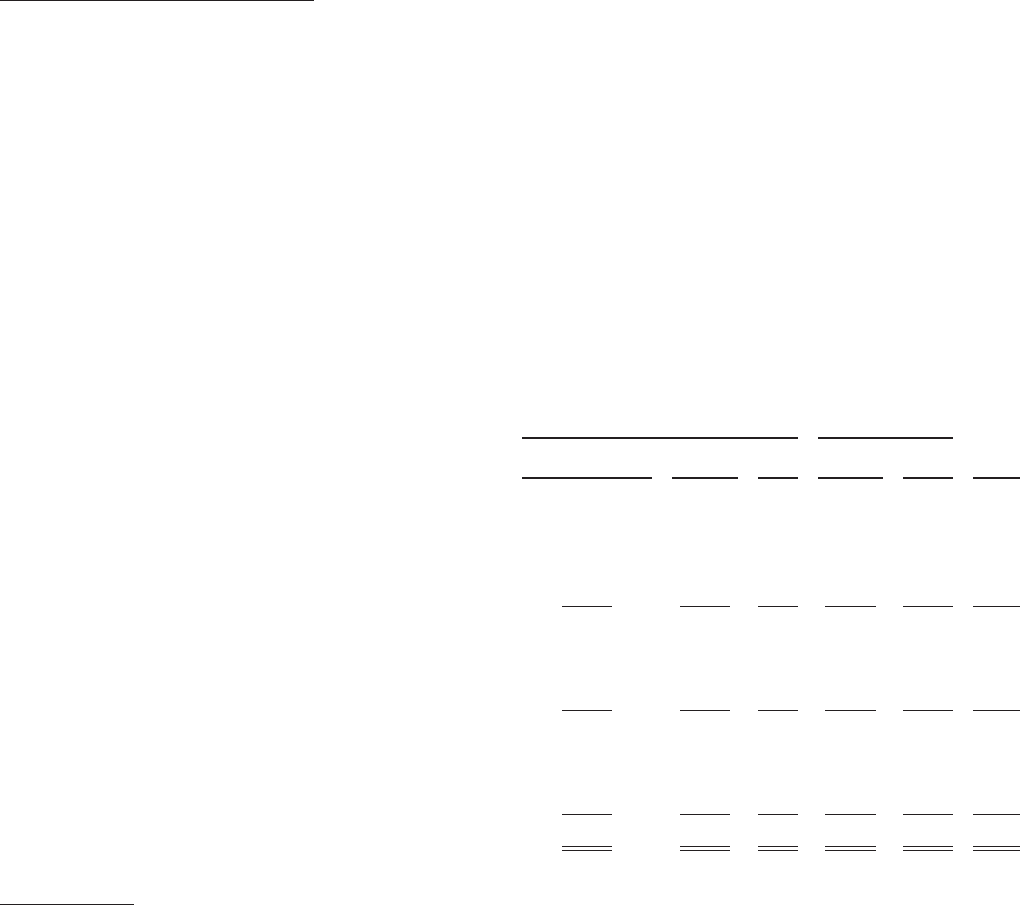

The following table summarizes the activities related to the restructuring and other charges pursuant to the Company’s Fiscal

2014 Plan and the Fiscal 2011 Plans related to the realignment and restructuring of the Company’s business (in millions):

Fiscal 2011 Plans Fiscal 2014 Plan

Voluntary Early

Retirement Program

Employee

Severance Other

Employee

Severance Other Total

Liability as of July 30, 2011 ........................... $ 17 $ 234 $ 11 $ — $ — $262

Gross charges in fiscal 2012 ....................... — 299 54 — — 353

Change in estimate related to fiscal 2011 charges ...... — (49) — — — (49)

Cash payments .................................. (17) (401) (18) — — (436)

Non-cash items ................................. — — (20) — — (20)

Liability as of July 28, 2012 ........................... — 83 27 — — 110

Gross charges in fiscal 2013 ....................... — 111 (6) — — 105

Cash payments .................................. — (173) (11) — — (184)

Non-cash items ................................. — — (3) — — (3)

Liability as of July 27, 2013 .......................... — 217——28

Gross charges in fiscal 2014 ...................... — — — 366 52 418

Cash payments ................................. — (19) (3) (326) (4) (352)

Non-cash items ................................. — (2) (1) — (22) (25)

Liability as of July 26, 2014 .......................... $— $— $ 3 $ 40 $ 26 $ 69

Fiscal 2015 Plan

In August 2014 the Company announced a restructuring plan that will impact up to 6,000 employees, representing

approximately 8% of its global workforce. The Company expects to take action under this plan beginning in the first quarter of

fiscal 2015. The Company currently estimates that it will recognize pre-tax charges in an amount not expected to exceed $700

million, consisting of severance and other one-time termination benefits and other associated costs. These charges are

primarily cash-based. The Company expects that approximately $250 million to $350 million of these charges will be

recognized during the first quarter of fiscal 2015, with the remaining amount to be recognized during the rest of fiscal 2015.

90