Cisco 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

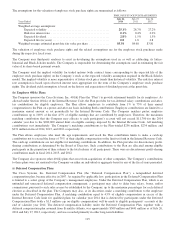

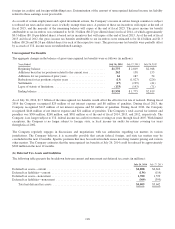

13. Shareholders’ Equity

(a) Cash Dividends on Shares of Common Stock

During fiscal 2014, the Company declared and paid cash dividends of $0.72 per common share, or $3.8 billion, on the

Company’s outstanding common stock. During fiscal 2013, the Company declared and paid cash dividends of $0.62 per

common share, or $3.3 billion, on the Company’s outstanding common stock.

On August 26, 2014, the Company’s Board of Directors declared a quarterly dividend of $0.19 per common share to be paid

on October 22, 2014 to all shareholders of record as of the close of business on October 2, 2014. Any future dividends will be

subject to the approval of the Company’s Board of Directors.

(b) Stock Repurchase Program

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 26, 2014, the Company’s

Board of Directors had authorized an aggregate repurchase of up to $97 billion of common stock under this program, and the

remaining authorized repurchase amount was $8.6 billion, with no termination date. A summary of the stock repurchase activity under

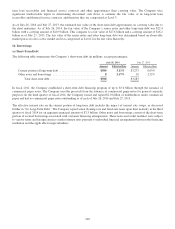

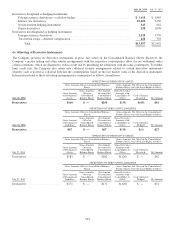

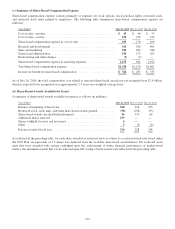

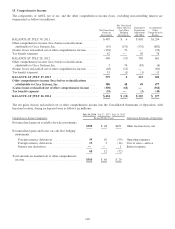

the stock repurchase program, reported based on the trade date, is summarized as follows (in millions, except per-share amounts):

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Cumulative balance at July 28, 2012 ......................................... 3,740 $20.36 $76,133

Repurchase of common stock under the stock repurchase program (1) ............... 128 21.63 2,773

Cumulative balance at July 27, 2013 ....................................... 3,868 20.40 78,906

Repurchase of common stock under the stock repurchase program (1) ........... 420 22.71 9,539

Cumulative balance at July 26, 2014 ....................................... 4,288 $20.63 $88,445

(1) Includes stock repurchases of $126 million, which were pending settlement as of July 26, 2014. There were no stock

repurchases pending settlement as of July 27, 2013.

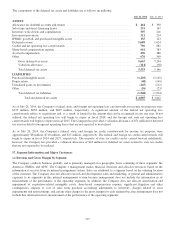

The purchase price for the shares of the Company’s stock repurchased is reflected as a reduction to shareholders’ equity. The

Company is required to allocate the purchase price of the repurchased shares as (i) a reduction to retained earnings and (ii) a

reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benefit related to employee

stock incentive plans are recorded as an increase to common stock and additional paid-in capital.

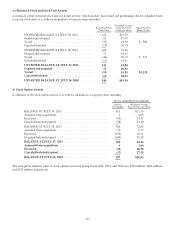

(c) Restricted Stock Unit Withholdings

For the years ended July 26, 2014 and July 27, 2013, the Company repurchased approximately 18 million and 16 million

shares, or $430 million and $330 million, of common stock, respectively, in settlement of employee tax withholding

obligations due upon the vesting of restricted stock or stock units.

(d) Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights, preferences, and

terms of the Company’s authorized but unissued shares of preferred stock.

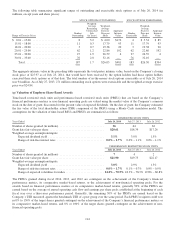

14. Employee Benefit Plans

(a) Employee Stock Incentive Plans

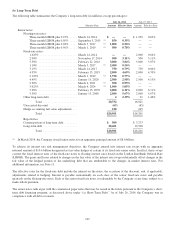

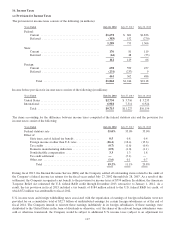

Stock Incentive Plan Program Description As of July 26, 2014, the Company had four stock incentive plans: the 2005 Stock

Incentive Plan (the “2005 Plan”); the 1996 Stock Incentive Plan (the “1996 Plan”); the Cisco Systems, Inc. SA Acquisition Long-

Term Incentive Plan (the “SA Acquisition Plan”); and the Cisco Systems, Inc. WebEx Acquisition Long-Term Incentive Plan (the

“WebEx Acquisition Plan”). In addition, the Company has, in connection with the acquisitions of various companies, assumed the

share-based awards granted under stock incentive plans of the acquired companies or issued share-based awards in replacement

thereof. Share-based awards are designed to reward employees for their long-term contributions to the Company and provide

incentives for them to remain with the Company. The number and frequency of share-based awards are based on competitive

practices, operating results of the Company, government regulations, and other factors. Since the inception of the stock incentive

plans, the Company has granted share-based awards to a significant percentage of its employees, and the majority has been

granted to employees below the vice president level. The Company’s primary stock incentive plans are summarized as follows:

2005 Plan As of July 26, 2014, the maximum number of shares issuable under the 2005 Plan over its term was 694 million

shares, plus the number of any shares underlying awards outstanding on November 15, 2007 under the 1996 Plan, the SA

Acquisition Plan, and the WebEx Acquisition Plan that are forfeited or are terminated for any other reason before being

110