Cisco 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

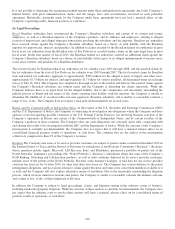

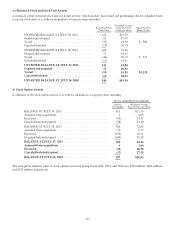

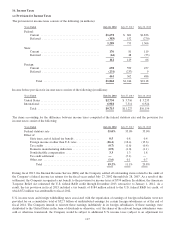

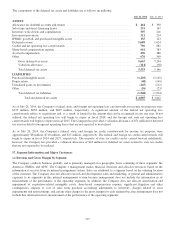

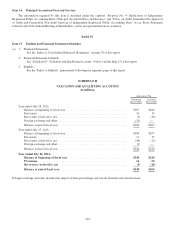

The components of the deferred tax assets and liabilities are as follows (in millions):

July 26, 2014 July 27, 2013

ASSETS

Allowance for doubtful accounts and returns ............................................ $ 464 $ 390

Sales-type and direct-financing leases .................................................. 231 167

Inventory write-downs and capitalization ............................................... 307 216

Investment provisions .............................................................. 212 214

IPR&D, goodwill, and purchased intangible assets ....................................... 135 123

Deferred revenue .................................................................. 1,689 1,624

Credits and net operating loss carryforwards ............................................ 796 681

Share-based compensation expense .................................................... 661 783

Accrued compensation .............................................................. 496 486

Other ........................................................................... 676 560

Gross deferred tax assets ........................................................ 5,667 5,244

Valuation allowance ........................................................... (114) (98)

Total deferred tax assets ........................................................ 5,553 5,146

LIABILITIES

Purchased intangible assets .......................................................... (1,229) (1,101)

Depreciation ...................................................................... (48) (169)

Unrealized gains on investments ...................................................... (245) (211)

Other ........................................................................... (26) (23)

Total deferred tax liabilities ...................................................... (1,548) (1,504)

Total net deferred tax assets ................................................. $ 4,005 $ 3,642

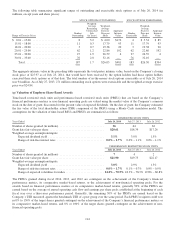

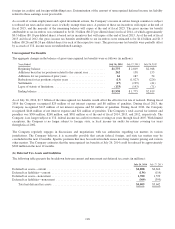

As of July 26, 2014, the Company’s federal, state, and foreign net operating loss carryforwards for income tax purposes were

$233 million, $658 million, and $699 million, respectively. A significant amount of the federal net operating loss

carryforwards relates to acquisitions and, as a result, is limited in the amount that can be recognized in any one year. If not

utilized, the federal net operating loss will begin to expire in fiscal 2018, and the foreign and state net operating loss

carryforwards will begin to expire in fiscal 2015. The Company has provided a valuation allowance of $71 million for deferred

tax assets related to foreign net operating losses that are not expected to be realized.

As of July 26, 2014, the Company’s federal, state, and foreign tax credit carryforwards for income tax purposes were

approximately $8 million, $710 million, and $13 million, respectively. The federal and foreign tax credit carryforwards will

begin to expire in fiscal 2014 and 2027, respectively. The majority of state tax credits can be carried forward indefinitely;

however, the Company has provided a valuation allowance of $43 million for deferred tax assets related to state tax credits

that are not expected to be realized.

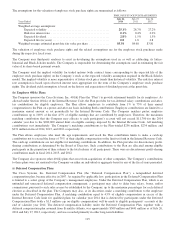

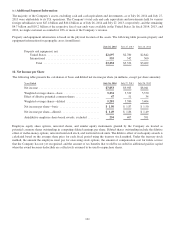

17. Segment Information and Major Customers

(a) Revenue and Gross Margin by Segment

The Company conducts business globally and is primarily managed on a geographic basis consisting of three segments: the

Americas, EMEA, and APJC. The Company’s management makes financial decisions and allocates resources based on the

information it receives from its internal management system. Sales are attributed to a segment based on the ordering location

of the customer. The Company does not allocate research and development, sales and marketing, or general and administrative

expenses to its segments in this internal management system because management does not include the information in its

measurement of the performance of the operating segments. In addition, the Company does not allocate amortization and

impairment of acquisition-related intangible assets, share-based compensation expense, significant litigation and other

contingencies, impacts to cost of sales from purchase accounting adjustments to inventory, charges related to asset

impairments and restructurings, and certain other charges to the gross margin for each segment because management does not

include this information in its measurement of the performance of the operating segments.

119