Cisco 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Cisco Systems, Inc.

Annual Report 2014

Letter to Shareholders

to do, and our customers are recognizing us as the leader

in SDN. Similarly, we have enhanced our oering to service

providers, as they embrace network function virtualization,

by launching new products intended to make network

infrastructure more open, programmable, virtualized, and

automated than ever before.

During the year, we expanded our leadership in cloud

infrastructure and the private and hybrid cloud markets by

introducing new cloud solutions designed to address the

public cloud opportunity and the fragmentation of cloud

environments. By facilitating the interconnection of private,

hybrid, and public clouds to create our “Intercloud” oering,

we are enabling customers to move their cloud workloads

across heterogeneous clouds according to their needs,

with the necessary policy, management, and security. We

are focused on delivering high-value cloud services and

expanding our Intercloud ecosystem with partners who are

embracing the Cisco ACI vision and our open approach in

order to dierentiate their cloud oers through the value of

the network.

We augmented our own internal development with eight

strategic acquisitions in scal 2014, four in the software

space and two each in the areas of data center and

security, which, we believe, will enable us to extend

our market leadership and create new opportunities.

We recognize the growing shift in our customer base

toward software-enabled business models as well as

subscription- and license-based consumption models,

and we are constantly evaluating companies that have built

and rened capabilities that deliver value to customers.

We are particularly pleased that several of our acquisitions,

Sourcere and Meraki being two examples, are now

growing more quickly within Cisco than they were as

standalone companies. This momentum, in our view,

highlights the value of integrating leading technologies into

broader architectures and solutions.

We also continue to take the bold steps necessary to

transform our business model. As a company, we have

always embraced change, and that has enabled us to

lead in the market for almost 30 years. Three years

ago, we saw that the changes occurring in our market,

many of which are being driven by the network, would

require transformational change for Cisco. To address

the accelerating pace of change in the market, we began

a transformation plan to drive greater innovation, speed,

agility, and eciency in our business and to transform Cisco

from a company selling networking boxes into one selling

architectures, solutions, and business outcomes.

In fiscal 2014, that transformation continued but has

not finished yet. We continue to align our employees

and resources to high-priority growth opportunities and

to develop, retain, and attract the skills, capabilities,

experience, and knowledge we need in our future

workforce. In fiscal 2014, we restructured our engineering

team in order to implement a more agile, cross-functional

development model. We also began the integration of our

product and services sales teams into a unified solutions

sales force, a significant step forward in the acceleration

of our strategy. The customer has always been our

number-one priority, but today, more than ever, we are

realigning ourselves to deliver the business outcomes for

which our customers are asking.

Winning in the Market

We are the market leader in most of our markets, with

one of the broadest portfolios, providing a differentiated

competitive advantage. We win, in our view, by delivering

innovations such as Application Centric Infrastructure

and security and in integrated architectures and solutions

that enable our customers to accelerate their business

opportunities, cut their costs, and reduce their risk.

We are investing aggressively in the growth markets that

are most important to our customers. As we look to the

future, we see long-term opportunities to continue to

drive profitable growth, most notably in cloud, data center,

mobility, security, collaboration, services, and software. We

realize that we must rebalance our resources and continue

to invest in innovation and talent in order to capitalize on

these opportunities and continue to lead in this dynamic

environment.

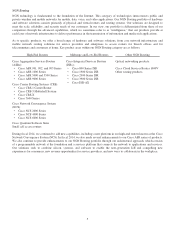

Financial Highlights

For fiscal 2014, revenue was $47.1 billion, a decrease

of 3% compared with fiscal 2013. Product revenue was

$36.2 billion, a decrease of 5%, while Service revenue

increased 4% to $11.0 billion, accounting for 23% of total

revenue. Deferred revenue increased by 5% from the

prior year, due partly to increased subscription offerings.

We expect both deferred and recurring revenue to grow

as software revenues increase in the overall mix. Net

income was $7.9 billion, down 21% from fiscal 2013, while

earnings per share on a fully diluted basis were $1.49,

down 20% year over year.

Our balance sheet remains strong, with total assets in fiscal

2014 of $105.1 billion, representing a 4% increase from