Cisco 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

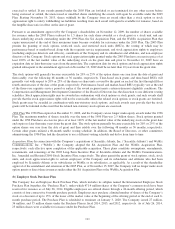

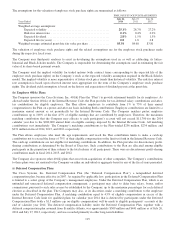

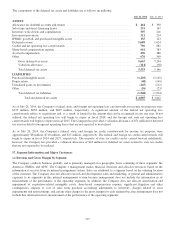

(c) Additional Segment Information

The majority of the Company’s assets, excluding cash and cash equivalents and investments, as of July 26, 2014 and July 27,

2013 were attributable to its U.S. operations. The Company’s total cash and cash equivalents and investments held by various

foreign subsidiaries were $47.4 billion and $40.4 billion as of July 26, 2014 and July 27, 2013, respectively, and the remaining

$4.7 billion and $10.2 billion at the respective fiscal year ends were available in the United States. In fiscal 2014, 2013, and

2012, no single customer accounted for 10% or more of the Company’s revenue.

Property and equipment information is based on the physical location of the assets. The following table presents property and

equipment information for geographic areas (in millions):

July 26, 2014 July 27, 2013 July 28, 2012

Property and equipment, net:

United States .................................... $2,697 $2,780 $2,842

International .................................... 555 542 560

Total ...................................... $3,252 $3,322 $3,402

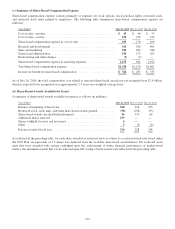

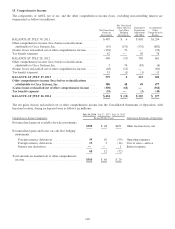

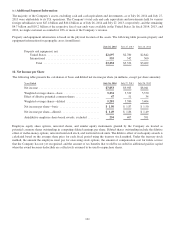

18. Net Income per Share

The following table presents the calculation of basic and diluted net income per share (in millions, except per-share amounts):

Years Ended July 26, 2014 July 27, 2013 July 28, 2012

Net income ......................................... $7,853 $9,983 $8,041

Weighted-average shares—basic ........................ 5,234 5,329 5,370

Effect of dilutive potential common shares ................ 47 51 34

Weighted-average shares—diluted ...................... 5,281 5,380 5,404

Net income per share—basic ........................... $ 1.50 $ 1.87 $ 1.50

Net income per share—diluted .......................... $ 1.49 $ 1.86 $ 1.49

Antidilutive employee share-based awards, excluded ........ 254 407 591

Employee equity share options, unvested shares, and similar equity instruments granted by the Company are treated as

potential common shares outstanding in computing diluted earnings per share. Diluted shares outstanding include the dilutive

effect of in-the-money options, unvested restricted stock, and restricted stock units. The dilutive effect of such equity awards is

calculated based on the average share price for each fiscal period using the treasury stock method. Under the treasury stock

method, the amount the employee must pay for exercising stock options, the amount of compensation cost for future service

that the Company has not yet recognized, and the amount of tax benefits that would be recorded in additional paid-in capital

when the award becomes deductible are collectively assumed to be used to repurchase shares.

121