Cisco 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Equity Price Risk

The fair value of our equity investments in publicly traded companies is subject to market price volatility. We may hold equity

securities for strategic purposes or to diversify our overall investment portfolio. Our equity portfolio consists of securities with

characteristics that most closely match the Standard & Poor’s 500 Index or NASDAQ Composite Index. These equity

securities are held for purposes other than trading. To manage our exposure to changes in the fair value of certain equity

securities, we may enter into equity derivatives designated as hedging instruments.

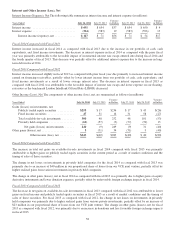

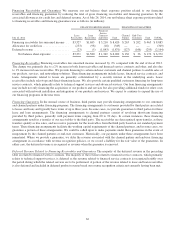

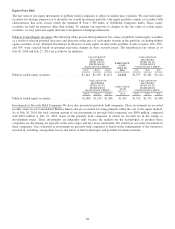

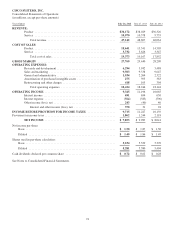

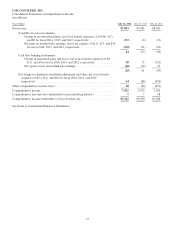

Publicly Traded Equity Securities The following tables present the hypothetical fair values of publicly traded equity securities

as a result of selected potential decreases and increases in the price of each equity security in the portfolio, excluding hedged

equity securities, if any. Potential fluctuations in the price of each equity security in the portfolio of plus or minus 10%, 20%,

and 30% were selected based on potential near-term changes in those security prices. The hypothetical fair values as of

July 26, 2014 and July 27, 2013 are as follows (in millions):

VALUATION OF

SECURITIES

GIVEN AN X%

DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 26,

2014

VALUATION OF

SECURITIES

GIVEN AN X%

INCREASE IN

EACH STOCK’S PRICE

(30)% (20)% (10)% 10% 20% 30%

Publicly traded equity securities ................... $1,144 $1,307 $1,471 $1,634 $1,797 $1,961 $2,124

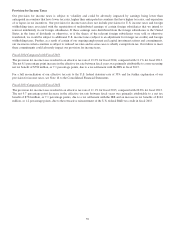

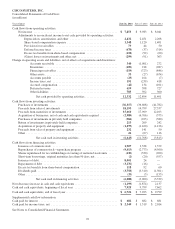

VALUATION OF

SECURITIES

GIVEN AN X%

DECREASE IN

EACH STOCK’S PRICE

FAIR VALUE

AS OF

JULY 27,

2013

VALUATION OF

SECURITIES

GIVEN AN X%

INCREASE IN

EACH STOCK’S PRICE

(30)% (20)% (10)% 10% 20% 30%

Publicly traded equity securities ................... $1,000 $1,143 $1,286 $1,429 $1,572 $1,715 $1,858

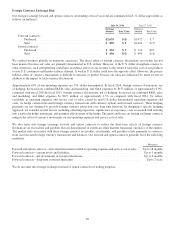

Investments in Privately Held Companies We have also invested in privately held companies. These investments are recorded

in other assets in our Consolidated Balance Sheets and are accounted for using primarily either the cost or the equity method.

As of July 26, 2014, the total carrying amount of our investments in privately held companies was $899 million, compared

with $833 million at July 27, 2013. Some of the privately held companies in which we invested are in the startup or

development stages. These investments are inherently risky because the markets for the technologies or products these

companies are developing are typically in the early stages and may never materialize. We could lose our entire investment in

these companies. Our evaluation of investments in privately held companies is based on the fundamentals of the businesses

invested in, including, among other factors, the nature of their technologies and potential for financial return.

68