Cincinnati Bell 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Each of the Named Executive Officers participates in the Cincinnati Bell Management Pension Plan (the

“Management Pension Plan”), which is a qualified defined benefit plan, and a nonqualified excess benefit plan

(the provision for this excess benefit is contained in the qualified defined benefit pension plan document), which

applies the same benefit formula to that portion of the base wages and annual bonus payment that exceeds the

maximum compensation that can be used in determining benefits under a qualified defined benefit pension plan.

All salaried and non-union hourly employees of the Company also participate in the Management Pension Plan

on the same basis and their benefits vest over a five-year period at the rate of 20% per year. Covered

compensation for purposes of calculating benefits include base wages — including any applicable overtime

wages paid — plus annual bonus payments. Upon separation from employment, vested benefits are payable

either as a lump-sum, a single life annuity or, for married participants, a 50% joint and survivor, which provides

a reduced benefit for the employee in order to provide a benefit equal to 50% of that amount if the employee dies

before his/her spouse. The Management Pension Plan is described in further detail on page 56.

Finally, Mr. Cassidy is also covered under a nonqualified supplemental retirement plan – Cincinnati Bell

Pension Program (“SERP”). The SERP provides covered participants with a benefit equal to 50% of their

average monthly compensation, which is the average monthly compensation for the highest 36 month period

during the participants last five years of employment, less an offset for any benefits payable from the qualified

and nonqualified provisions of the Cincinnati Bell Management Pension Plan and the participant’s projected age

65 social security benefit. Benefits are reduced 2.5% per point for age and service to the extent the sum of the

participant’s age plus years of service equals less than 75. Participants are also provided with an additional

payment equal to their estimated age 62 social security benefit until they reach age 62. Benefits are normally

payable as an annuity — either single life or 50% joint and survivor for married participants — or as a 15-year

installment. Under the terms of the Program, a participant must be at least age 55 and have attained at least 10

years of service to be vested in their benefit.

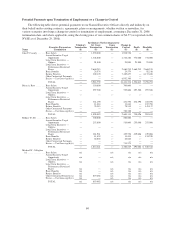

Each of the employment agreements also provide for severance payments upon termination of employment

as a result of death or disability, termination by the Company without cause or termination upon a change of

control. The payments to the Named Executive Officers upon termination or a change in control are described on

page 60.

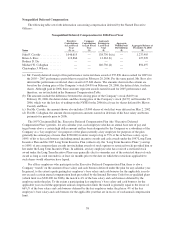

Long-term Incentives

The Compensation Committee has divided the total long-term incentives granted to the Named Executive

Officers approximately equally between stock option grants and performance unit grants because such an

allocation (i) prevents an excessive portion of long-term compensation being aligned solely on the achievement

of stock price appreciation and (ii) provides an equivalent opportunity for an executive to be rewarded based on

the Company achieving its more objective quantitative operating results that are consistent with its long-term

business strategy. Prior to 2006, the Compensation Committee also granted performance restricted shares to the

Named Executive Officers. The long-term incentives granted to the Named Executive Officers are described in

the Compensation Discussion and Analysis that begins on page 37.

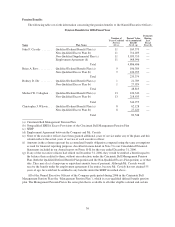

Other Benefits

Each Named Executive Officer is eligible to participate in the Cincinnati Bell Inc. Flexible Perquisite

Reimbursement Program and to receive the Company’s matching contribution under the qualified defined

contribution plan in which all salaried employees of the company are eligible to participate. The flexible

perquisite program provides each eligible executive with an annual allowance (Mr. Cassidy — $35,000, Mr. Dir

— $23,000, Mr. Ross — $23,000, Mr. Callaghan — $23,000 and Mr. Wilson — $13,000) that may be used to

cover a variety of expenses, including

•automobiles (up to 60% of their annual allowance),

•tax planning and preparation,

•financial and estate planning,

•legal fees (excluding legal fees incurred in connection with an action against the Company),

51

Proxy Statement