Cincinnati Bell 2006 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

01-9 requires the consideration given be recorded as a liability at the time of the sale of the equipment and, also,

provides guidance for the classification of the expense. EITF 06-1 is effective for the first fiscal year that begins

after June 15, 2007. Implementation of this Statement is not expected to have a material impact on the

Company’s financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value

Measurements” (“SFAS 157”). The objective of the Statement is to define fair value, establish a framework for

measuring fair value and expand disclosures about fair value measurements. SFAS 157 will be effective for

interim and annual reporting periods beginning after November 15, 2007. The Company has not yet assessed the

impact of this Statement on the Company’s financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159, “The Fair Value

Option for Financial Assets and Financial Liabilities” (“SFAS 159”). The Statement permits entities to choose to

measure many financial instruments and certain other items at fair value that are not currently required to be

measured at fair value. The objective is to improve financial reporting by providing entities with the opportunity

to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without

having to apply complex hedge accounting provisions. SFAS 159 will be effective for the first fiscal year that

begins after November 15, 2007. The Company has not yet assessed the impact of this Statement on the

Company’s financial statements.

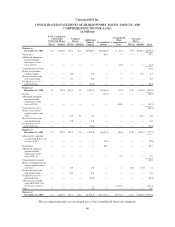

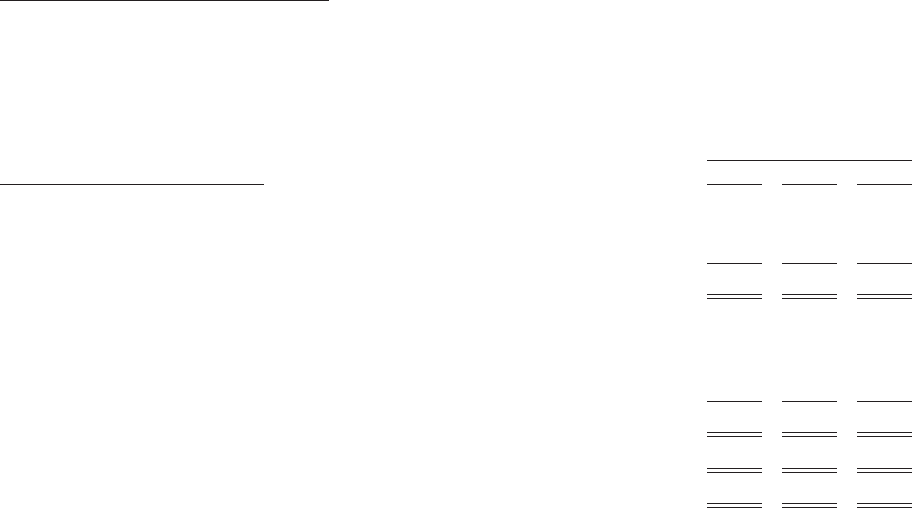

2. Earnings (Loss) Per Common Share

Basic earnings (loss) per common share (“EPS”) is based upon the weighted average number of common

shares outstanding during the period. Diluted EPS reflects the potential dilution that would occur if common

stock equivalents were exercised, but only to the extent that they are considered dilutive to the Company’s

diluted EPS. The following table is a reconciliation of the numerators and denominators of the basic and diluted

EPS computations:

Year Ended December 31,

(in millions, except per share amounts) 2006 2005 2004

Numerator:

Net income (loss) .................................................... $ 86.3 $ (64.5) $ 64.2

Preferred stock dividends .............................................. (10.4) (10.4) (10.4)

Numerator for basic and diluted EPS ..................................... $ 75.9 $ (74.9) $ 53.8

Denominator:

Denominator for basic EPS — weighted average common shares outstanding .... 246.8 245.9 245.1

Warrants ........................................................... 5.1 — 4.9

Stock-based compensation arrangements ................................. 1.4 — 0.5

Denominator for diluted EPS ........................................... 253.3 245.9 250.5

Basic earnings (loss) per common share .................................... $ 0.31 $ (0.30) $ 0.22

Diluted earnings (loss) per common share ................................... $ 0.30 $ (0.30) $ 0.21

For 2006, the diluted EPS denominator properly excludes potential conversions to common stock of 20.4

million stock options, 12.4 million warrants, 0.5 million shares of performance based awards and time-based

restricted stock, and the 3.1 million shares of 6

3

⁄

4

% cumulative convertible preferred stock (each preferred share

convertible into 1.44 common shares), either as a result of the treasury stock method or because these items, on

an individual basis, have an anti-dilutive effect.

For 2005, the assumed conversions to common stock of 22.8 million stock options, 17.5 million warrants,

0.2 million shares of time-based restricted stock, and the 3.1 million shares of 6

3

⁄

4

% cumulative convertible

preferred stock (each preferred share convertible into 1.44 common shares) are excluded from the 2005 diluted

EPS computations as these items, on an individual basis, have an anti-dilutive effect on diluted EPS.

66