Cincinnati Bell 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

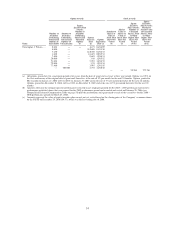

Miscellaneous Items

Stock Ownership Guidelines

The Compensation Committee recognizes that executive stock ownership is an important means of aligning

the interests of the Company’s executives with those of its shareholders. To that end, the Compensation

Committee has established the following stock ownership guidelines:

Chief Executive Officer — 3 times base salary

Other named executive officers — 1.5 times base salary

Since the personal situation of each executive may vary, the Compensation Committee has not set a specific

period of time in which the ownership level must be achieved, but does expect each executive to make

measurable progress on a year-over-year basis as evidenced by the number of shares owned multiplied by the fair

market value of the Company’s stock. Aside from the Company’s actual performance from one year to the next,

the price of the Company’s stock price may vary due to the general condition of the general economy, which may

also be reflected in the trend of the stock market. Therefore, the Compensation Committee may measure an

executive’s progress more on the basis of the year-over-year increase in the number of shares owned than the

actual market value in relation to the executive’s ownership goal. For purposes of measuring ownership, only

shares owned outright by the executive (including shares owned by the executive’s spouse and/or dependent

children, and shares owned through the Company’s savings plan and/or deferred compensation plan) are

included. Shares represented by vested stock options or any other form of equity for which some condition

remains to be completed before the executive has earned a right to and actually received the shares (except as

may have been electively deferred to a future date) are not included in determining the executive’s level of

ownership.

As of February 28, 2007, Mr. Cassidy owned shares valued at approximately 125% of his ownership target

of three times his base salary. In addition, as of February 28, 2007, Mr. Dir, who joined the Company in July

2005, has achieved approximately 45% of his ownership goal; Mr. Wilson has achieved approximately 46% of

his ownership goal and Mr. Ross has achieved approximately 95% of his ownership goal. The ownership target

changes as the executive’s base salary is adjusted.

Severance/Change-in-Control Payments and Benefits

The severance and change-in-control payments and benefits described in more detail beginning on page 60

were important to ensure the retention of Mr. Cassidy and the other named executive officers at the time they

were promoted to their present positions and to their continued retention. The payments and benefits are

comparable to those that their predecessors in office were receiving and are reasonable and consistent with

market practice. Market survey data indicates that the level of payments and benefits is comparable to that

provided by other companies to employees at a similar level. Providing employment agreements to these key

executives provides several advantages to the Company. These agreements give the Company the flexibility to

make changes in key executive positions, if such change is determined by the Company or the Board to be in the

best interests of the Company. Under the provisions of the employment agreements, the Company and the Board

have the flexibility to make such a change with or without a showing of cause and the provisions of the

agreements minimize the potential for litigation by establishing separation terms in advance and requiring that

any dispute be resolved through an arbitration process. Additionally, the Company considers the employment

agreements to be important in situations involving a possible change-in-control because they provide the

executives with sufficient compensation and clarity of terms, should a change in control occur. Thus, the

executives are able to devote their full attention to fairly evaluate the potential transaction and its benefit to the

Company and its shareholders rather than being distracted by the transaction’s possible effect on their personal

employment situation. In addition, other employment termination scenarios covered by the agreements include

disability, death, termination by the Company for cause, and the executive’s voluntary termination.

Mr. Callaghan’s employment agreement included a provision, that was amended into his agreement on

February 3, 2003, whereby he was entitled to a payment equal to two times the sum of his base salary plus target

bonus should he elect to terminate his employment with the Company by December 31, 2006. In addition,

Mr. Callaghan was entitled to continue his medical, dental, vision and life insurance at active employee

45

Proxy Statement