Cincinnati Bell 2006 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

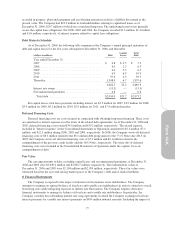

Accumulated Other Comprehensive Loss

The Company’s shareowners’ deficit includes an accumulated other comprehensive loss and is comprised of

pension and postretirement unrecognized prior service cost, unrecognized transition (asset) obligation and

unrecognized actuarial losses, net of taxes, of $174.5 million and $49.6 million at December 31, 2006 and 2005,

respectively. The increase from December 31, 2005 was primarily due to the adoption of SFAS 158. Refer to

Note 9 for further discussion.

12. Commitments and Contingencies

Commitments

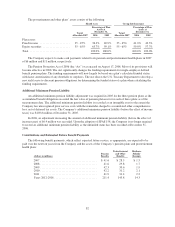

The Company leases certain circuits, facilities and equipment used in its operations. Operating lease

expense was $22.9 million, $21.2 million and $24.8 million in 2006, 2005, and 2004, respectively. Operating

leases include tower site leases that provide for renewal options with fixed rent escalations beyond the initial

lease term. In 2004, the Company recorded a $3.2 million adjustment related to prior periods to account for

certain rent escalations associated with its tower site leases on a straight-line basis. These rent escalations are

associated with lease renewal options that were deemed to be reasonably assured of renewal, thereby extending

the initial term of the leases. The adjustment was not considered material to the 2004 earnings or to any prior

years’ earnings, earnings trends or individual financial statement line items.

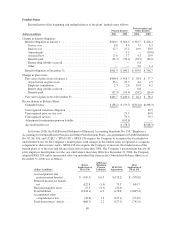

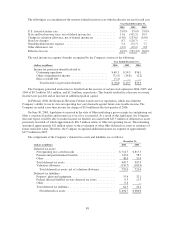

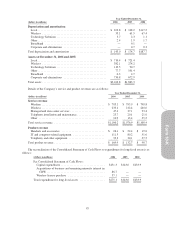

At December 31, 2006, future minimum lease payments required under operating leases, excluding certain

data center leases which are recorded as a restructuring liability (refer to Note 3), having initial or remaining

non-cancelable lease terms in excess of one year are as follows:

(dollars in millions)

2007 .............................. $ 16.5

2008 .............................. 15.1

2009 .............................. 14.2

2010 .............................. 13.9

2011 .............................. 14.1

Thereafter .......................... 179.3

Total ............................ $253.1

Vendor Concentration

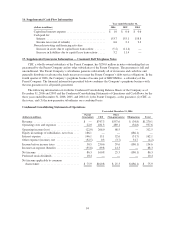

In 1998, the Company entered into a ten-year contract with Convergys Corporation (“Convergys”), a

provider of billing, customer service and other services, which, in 2004, was extended to December 31, 2010.

The contract states that Convergys will be the primary provider of certain data processing, professional and

consulting and technical support services for the Company within CBT’s operating territory. In return, the

Company will be the exclusive provider of local telecommunications services to Convergys. The contract

extension reduced the Company’s annual commitment in 2004 and 2005 to $35.0 million from $45.0 million.

Beginning in 2006, the minimum commitment is reduced 5% annually. The Company paid $34.3 million, $36.1

million and $37.5 million under the contract in 2006, 2005 and 2004, respectively.

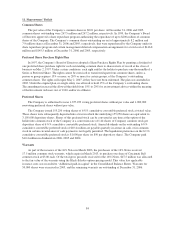

Contingencies

In the normal course of business, the Company is subject to various regulatory and tax proceedings,

lawsuits, claims and other matters. The Company believes adequate provision has been made for all such asserted

and unasserted claims in accordance with accounting principles generally accepted in the United States. Such

matters are subject to many uncertainties and outcomes that are not predictable with assurance.

In re Broadwing Inc. Securities Class Action Lawsuits, (Gallow v. Broadwing Inc., et al), U.S. District Court,

Southern District of Ohio, Western Division, Case No. C-1-02-795

Between October and December 2002, five virtually identical class action lawsuits were filed against

Broadwing Inc. and two of its former Chief Executive Officers in U.S. District Court for the Southern District

of Ohio.

85