Cincinnati Bell 2006 Annual Report Download - page 196

Download and view the complete annual report

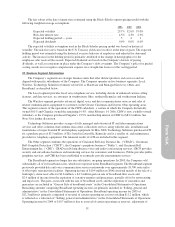

Please find page 196 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These complaints were filed on behalf of purchasers of the Company’s securities between January 17, 2001

and May 20, 2002, inclusive, and alleged violations of Section 10(b) and 20(a) of the Securities and Exchange

Act of 1934 by, inter alia, (1) improperly recognizing revenue associated with Indefeasible Right of Use (“IRU”)

agreements; and (2) failing to write-down goodwill associated with the Company’s 1999 acquisition of IXC

Communications, Inc. The plaintiffs sought unspecified compensatory damages, attorney’s fees, and expert

expenses.

On April 28, 2006, the Company and plaintiffs entered into a Memorandum of Understanding (“MOU”),

which set forth an agreement in principle to settle this matter. For these lawsuits and the derivative complaint

discussed below, the Company reserved $6.3 million in the first quarter of 2006 to reflect its contribution to the

settlement fund and to cover other settlement-related expenses. Under the MOU agreement, the Company and

certain of its insurance carriers agreed to contribute a total of $36 million to settle the claims in this matter and

obtain in exchange a release of all claims from the class members.

On July 12, 2006, the Company and plaintiffs entered into a definitive Stipulation and Agreement of

Settlement reflecting the terms of the above-referenced MOU. On July 21, 2006, Judge Rice issued a Preliminary

Order approving the notice and proof of claim forms to be mailed to class members and scheduled a Settlement

Fairness Hearing. The Settlement Fairness Hearing took place on September 6, 2006. On December 1, 2006, all

objections to the proposed settlement were withdrawn and the court gave final approval of the settlement and

dismissed all claims with prejudice.

In re Broadwing Inc. Derivative Complaint, (Garlich v. Broadwing Inc., et al), Hamilton County Court of

Common Pleas, Case No. A0302720.

This derivative complaint was filed against Broadwing Inc. and ten of its current and former directors on

April 9, 2003 alleging breaches of fiduciary duty arising out of the same allegations discussed in In re Broadwing

Inc. Securities Class Action Lawsuits above. Pursuant to a stipulation between the parties, defendants were not

required, absent further order by the Court, to answer, move, or otherwise respond to this complaint until 30 days

after the federal court rendered a ruling on the defendants’ motion to dismiss in In re Broadwing Inc. Securities

Class Action Lawsuits.

On April 28, 2006, the Company and plaintiffs entered into a MOU, which sets forth an agreement in

principle to settle this matter. For this derivative lawsuit and the lawsuits discussed above, the Company reserved

$6.3 million in the first quarter of 2006 to reflect its contribution to the settlement fund and to cover other

settlement-related expenses. On July 12, 2006, the Company and plaintiffs entered into a definitive Stipulation

and Agreement of Settlement reflecting the terms of the MOU. The Settlement Fairness Hearing took place on

September 6, 2006 and the court has issued an order approving the Stipulation and Agreement of Settlement as

submitted by the parties. Accordingly, this case has been dismissed with prejudice.

In re Broadwing Inc. ERISA Class Action Lawsuits, (Kurtz v. Broadwing Inc., et al), U.S. District Court,

Southern District of Ohio, Western Division, Case No. C-1-02-857.

Between November 18, 2002 and March 17, 2003, five putative class action lawsuits were filed against

Broadwing Inc. and certain of its current and former officers and directors in the United States District Court for

the Southern District of Ohio. Fidelity Management Investment Trust Company was also named as a defendant in

these actions.

These cases, which purport to be brought on behalf of the Cincinnati Bell Inc. Savings and Security Plan,

the Broadwing Retirement Savings Plan, and a class of participants in the Plans, generally alleged that the

defendants breached their fiduciary duties under the Employee Retirement Income Security Act of 1974

(“ERISA”) by improperly encouraging the Plan participant-plaintiffs to elect to invest in the Company stock fund

within the relevant Plan and by improperly continuing to make employer contributions to the Company stock

fund within the relevant Plan.

On February 22, 2006, the Company entered into a Stipulation and Agreement of Settlement of ERISA

Actions (the “Agreement”) providing for the settlement of the consolidated case with no finding or admission of

any wrongdoing by any of the defendants in the lawsuit. Under the Agreement, defendants were obligated to pay

86