Cincinnati Bell 2006 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

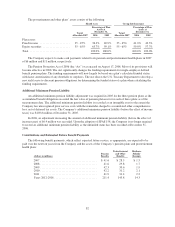

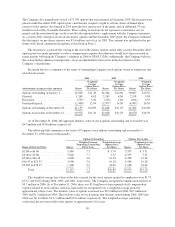

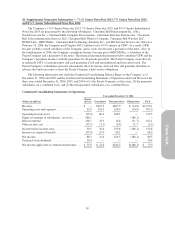

The fair values at the date of grant were estimated using the Black-Scholes option-pricing model with the

following weighted-average assumptions:

2006 2005 2004

Expected volatility ........................................ 29.7% 32.0% 35.0%

Risk-free interest rate ...................................... 4.5% 4.3% 2.9%

Expected holding period — years ............................543

Expected dividends ....................................... 0.0% 0.0% 0.0%

The expected volatility assumption used in the Black-Scholes pricing model was based on historical

volatility. The risk-free rate is based on the U.S. Treasury yield curve in effect at the time of grant. The expected

holding period was estimated using the historical exercise behavior of employees and adjusted for abnormal

activity. The increase in the holding period is primarily attributed to the change in demographics for the

employees who received the awards. Expected dividends are based on the Company’s history of paying

dividends, as well as restrictions in place under the Company’s debt covenants. The Company’s policy for graded

vesting awards is to recognize compensation expense on a straight-line basis over the vesting period.

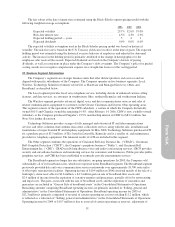

15. Business Segment Information

The Company’s segments are strategic business units that offer distinct products and services and are

aligned with specific subsidiaries of the Company. The Company operates in five business segments: Local,

Wireless, Technology Solutions (formerly referred to as Hardware and Managed Services), Other, and

Broadband, as described below.

The Local segment provides local voice telephone service, including dozens of enhanced custom calling

features, and data services, to customers in southwestern Ohio, northern Kentucky and southeastern Indiana.

The Wireless segment provides advanced, digital voice and data communications services and sales of

related communications equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas.

This segment consists of the operations of the CBW subsidiary, a venture in which the Company historically

owned 80.1% and Cingular owned the remaining 19.9%. After February 14, 2006, CBW is now a wholly-owned

subsidiary as the Company purchased Cingular’s 19.9% membership interest in CBW for $83.2 million. See

Note 5 for further discussion.

Technology Solutions provides a range of fully managed and outsourced IT and telecommunications

services and offers solutions that combine data center collocation services along with the sale, installation and

maintenance of major branded IT and telephony equipment. In May 2006, Technology Solutions purchased ATI

for a purchase price of $3.5 million. ATI is based in Louisville, Kentucky and is a reseller of, and maintenance

provider for, telephony equipment. The financial results of ATI are included in this segment.

The Other segment combines the operations of Cincinnati Bell Any Distance Inc. (“CBAD”), Cincinnati

Bell Complete Protection (“CBCP”), the Company’s payphone business (“Public”), and Cincinnati Bell

Entertainment Inc. (“CBE”). CBAD resells long distance voice and audio-conferencing services, CBCP provides

security and surveillance hardware and monitoring services for consumers and businesses, Public provides public

payphone services, and CBE has been established to eventually provide entertainment services.

The Broadband segment no longer has any substantive, on-going operations. In 2003, the Company sold

substantially all of its broadband assets, which were reported in the Broadband segment. The Broadband segment

previously provided data and voice communication services nationwide over approximately 18,700 route miles

of fiber-optic transmission facilities. Operating income of $10.4 million in 2006 consisted mainly of the sale of a

bankruptcy claim receivable for $3.6 million, a $4.7 million gain on sale of broadband fiber assets and

$2.9 million of income from the expiration of certain warranties and guarantees, partially offset by restructuring

and legal costs. The gains associated with the sale of broadband assets and the expiration of warranties and

guarantees are included in “Gain on Sale of broadband assets” in the Consolidated Statements of Operations.

Remaining amounts comprising Broadband operating income are primarily included in “Selling, general and

administrative” in the Consolidated Statements of Operations. Broadband operating income for 2005 of

$12.3 million is primarily comprised of reversal of certain operating tax reserves totaling $11.2 million, which

is reflected as a reduction of “Selling, general and administrative” in the Consolidated Statements of Operations.

Operating income for 2004 of $10.7 million is due to reversal of certain operating tax reserves, adjustment of

91