Cincinnati Bell 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accrual of a contingent liability in prior years. Historically, the Company has evaluated uncorrected differences

utilizing the rollover approach. The Company believes the impact of not recording the operating taxes was not

material to prior fiscal years under the rollover method. However, under SAB 108, adopted in 2006, the

Company must assess materiality using both the rollover method and the iron-curtain method, which resulted in

the $9.0 million adjustment to opening retained earnings.

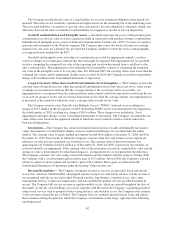

The expense from the cumulative error arose from the following periods:

(dollars in millions) 2005 2004 Prior to 2004

Expense adjustment before income taxes ................. $5.3 $3.1 $5.8

Expense adjustment after income taxes .................. $3.3 $2.0 $3.7

The after-tax amounts for 2006 associated with the first three quarters of the year were $0.9 million in the

first quarter, $0.9 million in the second quarter, and $0.6 million in the third quarter, and have been determined to

be immaterial to those quarters. Accordingly, the entire impact for 2006 has been recorded in the fourth quarter.

The Company believes it has meritorious defenses related to the payment of these operating taxes and

intends to defend its position in order to limit the ultimate payment of the fees.

Other Recently Issued Accounting Standards

In February 2006, the FASB issued Statement of Financial Accounting Standards No. 155, “Accounting for

Certain Hybrid Financial Instruments: an amendment of FASB Statements No. 133 and 140.” The objective of

the Statement is to simplify accounting for certain hybrid financial instruments, eliminate interim guidance in

Statement 133 Implementation Issue No. D1 “Application of Statement 133 to Beneficial Interests in Securitized

Financial Assets,” and eliminate a restriction on the passive derivative instruments that a qualifying special-

purpose entity may hold. This Statement is effective for all financial instruments acquired or issued after the

beginning of the entity’s first fiscal year that begins after September 15, 2006. Implementation of this Statement

is not expected to have a material impact on the Company’s financial statements.

In June 2006, the FASB ratified Emerging Issues Task Force Issue No. 06-3, “How Taxes Collected from

Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement” (“EITF

06-3”). This guidance requires that taxes imposed by a governmental authority on a revenue producing

transaction between a seller and a customer should be shown in the income statement on either a gross or net

basis, based on the entity’s accounting policy. This policy should be disclosed pursuant to Accounting Principles

Board Opinion No. 22, “Disclosure of Accounting Policies.” In addition, any such taxes that are reported on a

gross basis, if material, should be disclosed. EITF 06-3 will be effective for interim and annual reporting periods

beginning after December 15, 2006. Implementation of this Statement is not expected to have a material impact

on the Company’s financial statements.

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes

— an interpretation of FASB Statement No. 109” (“FIN 48”), which clarifies the accounting for income taxes by

prescribing the minimum recognition threshold as “more-likely-than-not” that a tax position must meet before

being recognized in the financial statements. FIN 48 also provides guidance on derecognition, classification,

interest and penalties, accounting for income taxes in interim periods, financial statement disclosure and

transition rules. Under this Interpretation, a Company determines whether it is more likely than not that a tax

position will be sustained upon examination by respective taxing authorities, including resolution of any

litigation. A tax position that meets the more likely than not recognition threshold is measured to determine the

amount of benefit to recognize in the financial statements. The tax position is measured at the largest amount of

benefit that is more likely than not realized. The Company will be required to adopt the provisions of FIN 48

related to all of the Company’s tax positions in the fiscal year beginning January 1, 2007. The cumulative effect

of applying the provisions of the Interpretation will be reported as an adjustment to the opening balance of

retained earnings. The Company has not yet completed its evaluation of FIN 48.

In September 2006, FASB ratified Emerging Issues Task Force Issue No. 06-1, “Accounting for

Consideration Given by a Service Provider to Manufacturers or Resellers of Equipment Necessary for an

End-Customer to Receive Service from the Service Provider” (“EITF 06-1”). This guidance requires the

application of EITF 01-9, “Accounting for Consideration Given by a Vendor to a Customer” (“EITF 01-9”),

when consideration is given to a reseller or manufacturer for benefit to the service provider’s end customer. EITF

65