Cincinnati Bell 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

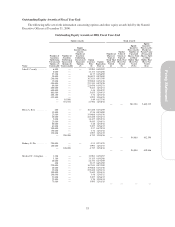

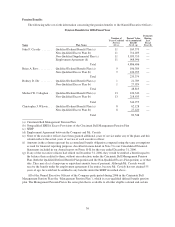

EXECUTIVE COMPENSATION

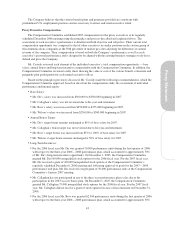

Summary Compensation Table

The following table sets forth information concerning the compensation of any person who served as the

principal executive officer (John F. Cassidy) or principal financial officer (Brian A. Ross) during the fiscal year

ended December 31, 2006, and the three most highly compensated persons who served as executive officers

(Rodney D. Dir, Michael W. Callaghan, Christopher J. Wilson) as of December 31, 2006 (collectively, the

“Named Executive Officers”):

Summary Compensation Table

Name and

Principal Position Year

Salary

($)

Bonus

($)

Stock

Awards

($)

Option

Awards

($) (c)

Change in Pension

Value and Non-

Qualified Deferred

Compensation

Earnings

($) (d)

All Other

Compensation

($) (e)

Total

($)

John F. Cassidy ............

President and Chief

Executive Officer

2006 645,000 887,004 1,232,087 (a) 54,164 870,473 37,459 3,726,187

Brian A. Ross ..............

Chief Financial Officer

2006 350,000 345,695 220,211 (a)(b) 9,050 48,990 31,400 1,005,346

Rodney D. Dir .............

Chief Operating Officer

2006 300,000 265,610 244,330 (a) 4,525 48,813 25,389 888,667

Michael W. Callaghan .......

Senior Vice President —

Corporate Development

2006 250,000 91,350 2,260 (b) — 54,788 851,176 1,249,574

Christopher J. Wilson ........

Vice President, General

Counsel and Secretary

2006 250,000 126,500 144,043 (a)(b) 4,525 18,905 20,148 564,121

(a) The stock awards for each of the named executives, excluding Mr. Callaghan, represent the amount of FAS 123(R) expense accrued in

2006 for the 2005 – 2006 cumulative period portion of the 2005 – 2007 performance period and the 2006 period under the 2006 – 2008

performance period that was payable based on free cash flow results as of the end of 2006 for the respective periods. The expense was

based on the actual payout earned and was based on the fair market value of the Company’s stock on the date the grants were first made;

January 28, 2005 at $4.295 per share, in the case of the 2005 – 2007 performance period and March 27, 2006 at $4.285 per share, in the

case of the 2006 – 2008 performance period. Additionally, the amounts include accrued expense for the 2006 – 2007 cumulative period

portion of the 2006 – 2008 performance period. For a discussion of these awards, see Note 14 to our Consolidated Financial Statements

included in our Annual Report on Form 10-K for the year ended December 31, 2006.

(b) The values also reflect the FAS 123(R) expense the Company recorded in 2006 related to time-based restricted stock awards granted to

Messrs. Ross, Callaghan and Wilson on February 5, 2004 and vesting on February 5, 2006. For a discussion of valuation assumptions

and methodology, see Note 14 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended

December 31, 2006.

(c) The values reflect the FAS 123(R) expense the Company recorded in 2006 related to stock options granted to each of the executives on

December 8, 2006, and the January 27, 2006 grant to Mr. Cassidy. For a discussion of valuation assumptions and methodology, see Note

14 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2006. The

actual stock option grants are shown in the Grant of Plan-Based Awards table on page 49.

(d) The amounts shown in this column for Messrs. Cassidy, Ross, Dir, Callaghan and Wilson represent the one-year increase in the value of

their qualified defined benefit plan and nonqualified excess plan as of December 31, 2006, projected forward to age 65 for each

executive with interest credited at the rate a terminated participant would be given (3.5%) and then discounted back to December 31,

2006 at the discount rate of 5.75% required under FAS 87. Mr. Cassidy’s total increase also includes an amount equal to $203,000,

which represents the change from 2005 to 2006 in the actuarial present value of the accumulated benefit for a contractual retirement

benefit in his employment agreement. Additionally, it includes $505,000, which represents the change from 2005 to 2006 in the actuarial

present value of the accumulated benefit under the SERP. None of the executives receive any preferential treatment under the

Company’s retirement plans.

47

Proxy Statement