Cincinnati Bell 2006 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

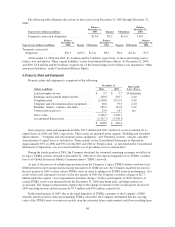

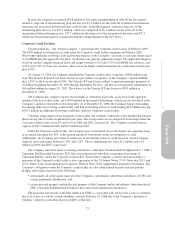

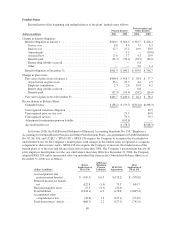

The following table presents detail of the purchase price allocated to intangible assets of CBW as of the date

of acquisition:

(dollars in millions)

Fair

Value

Weighted

Average

Amortization

Period

Intangible assets subject to amortization:

Customer relationships — subscribers .............................. $11.6 7 years

Customer relationships — collocation towers ........................ 2.6 15years

Contractual right — license ...................................... 0.7 1year

14.9 8 years

Intangible assets not subject to amortization:

FCC Licenses ................................................. 21.0 n/a

Trademarks ................................................... 6.2 n/a

Total intangible assets ............................................. $42.1

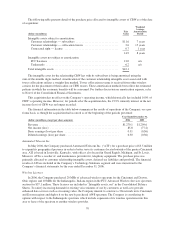

The intangible asset for the relationship CBW has with its subscribers is being amortized using the

sum-of-the-months digits method. Amortization of the customer relationship intangible asset associated with

tower collocations utilizes a straight-line method. Tower collocation revenue is received from other wireless

carriers for the placement of their radios on CBW towers. These amortization methods best reflect the estimated

patterns in which the economic benefits will be consumed. For further discussion on amortization expense, refer

to Note 6 of the Consolidated Financial Statements.

This acquisition has no effect on the Company’s operating income, which historically has included 100% of

CBW’s operating income. However, for periods after the acquisition date, the 19.9% minority interest in the net

income (loss) of CBW was no longer recorded.

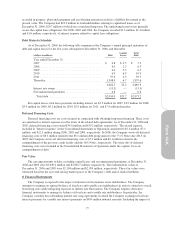

The financial information in the table below summarizes the results of operations of the Company, on a pro

forma basis, as though the acquisition had occurred as of the beginning of the periods presented:

Year Ended December 31,

(dollars in millions, except per share amounts) 2006 2005

Revenue ........................................................ $1,270.1 $1,209.6

Net income (loss) ................................................ 85.8 (77.2)

Basic earnings (loss) per share ...................................... 0.31 (0.36)

Diluted earnings (loss) per share ..................................... 0.30 (0.36)

Automated Telecom Inc.

In May 2006, the Company purchased Automated Telecom Inc. (“ATI”) for a purchase price of $3.5 million

to expand its geographical presence in order to better serve its customers located outside of the greater Cincinnati

area. ATI is based in Louisville, Kentucky, with offices also located in Grand Rapids, Michigan, and St. Louis,

Missouri. ATI is a reseller of, and maintenance provider for, telephony equipment. The purchase price was

primarily allocated to customer relationship intangible assets, deferred tax liabilities and goodwill. The financial

results of ATI are included in the Company’s Technology Solutions segment and were immaterial to the

Company’s financial statements for the year ended December 31, 2006.

Wireless Licenses

In 2006, the Company purchased 20 MHz of advanced wireless spectrum for the Cincinnati and Dayton,

Ohio regions and 10 MHz for the Indianapolis, Indiana region in the FCC Advanced Wireless Services spectrum

auction for $37.1 million. These licenses are included in “Intangible assets, net” in the Consolidated Balance

Sheets. To satisfy increasing demand for existing voice minutes of use by customers as well as to provide

enhanced data services such as streaming video, the Company intends to construct a 3G network in its Cincinnati

and Dayton regions and deploy it on the newly purchased AWS spectrum. The Company is considering its

options with respect to the Indianapolis spectrum, which include expansion of its wireless operations into this

area or lease of the spectrum to another wireless provider.

70