Cincinnati Bell 2006 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2006 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

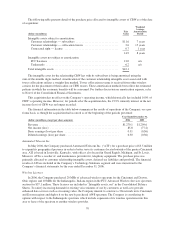

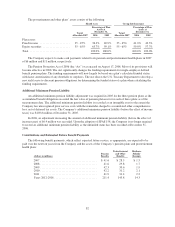

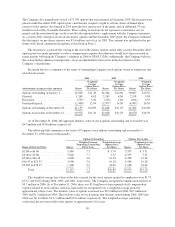

Funded Status

Reconciliation of the beginning and ending balances of the plans’ funded status follows:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2006 2005 2006 2005

Change in benefit obligation:

Benefit obligation at January 1, ............................... $500.1 $ 504.5 $ 356.7 $ 416.4

Service cost ............................................. 8.8 8.0 3.5 4.3

Interest cost ............................................. 27.7 27.2 19.9 20.5

Amendments ............................................ — 3.1 — (70.8)

Actuarial loss ............................................ 17.6 7.7 4.3 10.9

Benefits paid ............................................ (52.3) (50.4) (28.2) (26.0)

Retiree drug subsidy received ............................... — — 0.8 —

Other .................................................. — — 2.0 1.4

Benefit obligation at December 31, ............................ $501.9 $ 500.1 $ 359.0 $ 356.7

Change in plan assets:

Fair value of plan assets at January 1, ........................... $440.4 $ 458.7 $ 58.4 $ 77.7

Actual return on plan assets ................................ 53.1 29.5 4.6 2.5

Employer contribution .................................... 2.5 2.6 10.8 4.2

Retiree drug subsidy received ............................... — — 0.8 —

Benefits paid ............................................ (52.3) (50.4) (28.2) (26.0)

Fair value of plan assets at December 31, ........................ $443.7 $ 440.4 $ 46.4 $ 58.4

Reconciliation to Balance Sheet:

Unfunded status ............................................ $(58.2) $ (59.7) $(312.6) $(298.3)

Unrecognized transition obligation ............................. — 29.5

Unrecognized prior service cost ............................... 25.5 80.8

Unrecognized net loss ....................................... 79.3 79.7

Adjustment for minimum pension liability ....................... (103.8) —

Accrued benefit cost ........................................ $ (58.7) $(108.3)

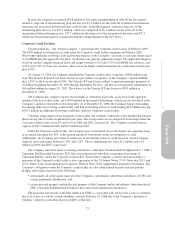

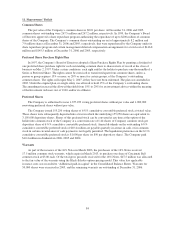

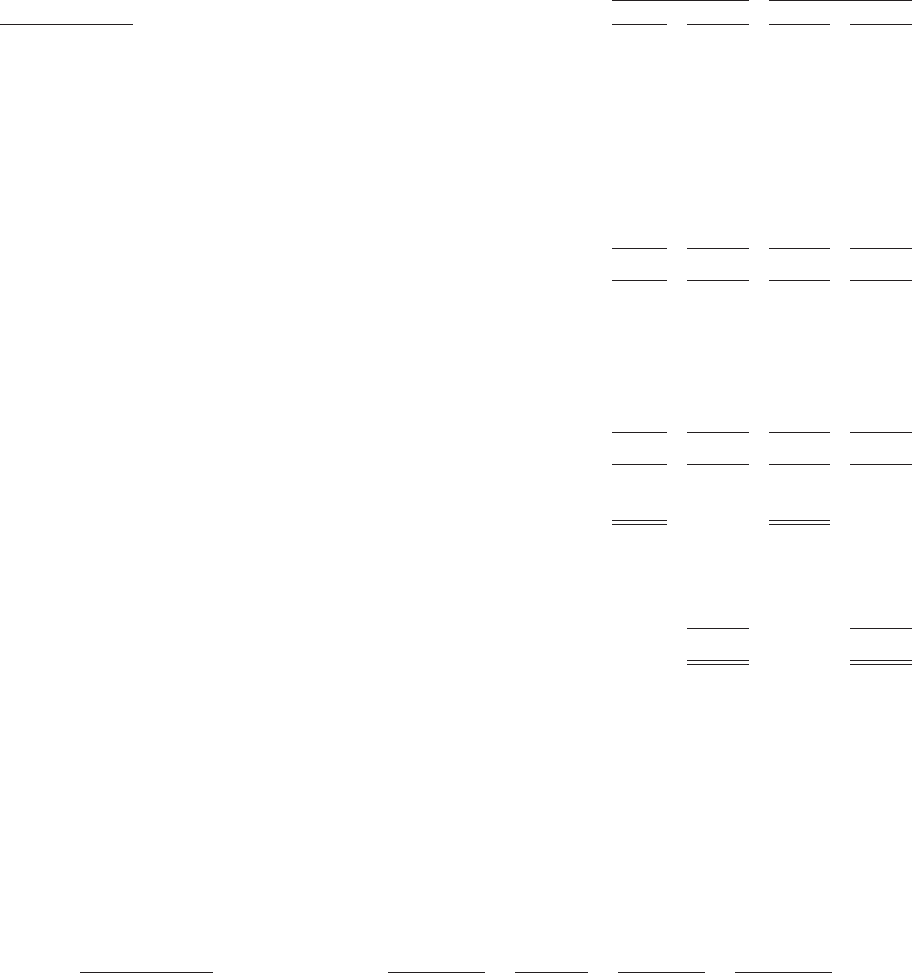

In October 2006, the FASB issued Statement of Financial Accounting Standards No. 158, “Employer’s

Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment of FASB Statements

No. 87, 88, 106, and 132(R)” (“SFAS 158”). SFAS 158 requires the Company to recognize the overfunded or

underfunded status for the Company’s benefit plans, with changes in the funded status recognized as a separate

component to shareowners’ equity. SFAS 158 also requires the Company to measure the funded status of the

benefit plans as of the year-end balance sheet date no later than 2008. The Company’s measurement date for all

of its employee benefit plans was the year-end balance sheet date. Effective December 31, 2006, the Company

adopted SFAS 158 and its incremental effect on individual line items in the Consolidated Balance Sheet as of

December 31, 2006 was as follows:

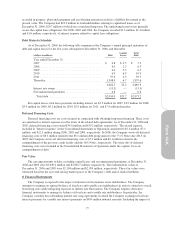

(dollars in millions)

Before

Application of

SFAS 158

Additional

Minimum

Pension

Liabilities

SFAS 158

Adjustments

After

Application of

SFAS 158

Accrued pension and

postretirement benefits ....... $ (199.5) $ 6.9 $(178.2) $ (370.8)

Deferred income tax benefit,

net ....................... 622.8 (1.4) 73.3 694.7

Pension intangible assets ....... 25.5 (3.3) (22.2) —

Total liabilities ............... (2,634.1) 6.9 (178.2) (2,805.4)

Accumulated other

comprehensive loss .......... (49.6) 2.2 (127.1) (174.5)

Total shareowners’ deficit ...... (666.7) 2.2 (127.1) (791.6)

80