Blackberry 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

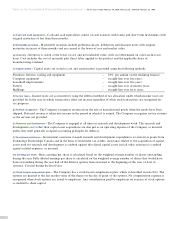

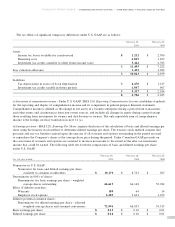

The tax effects of significant temporary differences under U.S. GAAP are as follows:

February 29, February 28,

2000 1999

Assets

Income tax losses available for carryforward $ 1,212 $ 2,760

Financing costs 4,819 1,679

Investment tax credits available to offset future income taxes 5,424 2,783

$11,455 $ 7,222

Less valuation allowance 1,432 3,023

$10,023 $ 4,199

Liabilities

Tax depreciation in excess of book depreciation $ 4,270 $ 1,217

Investment tax credits taxable in future periods 1,047 967

$5,317 $ 2,184

$ 4,706 $ 2,015

(c) Statements of comprehensive income – Under U.S. GAAP, SFAS 130, Reporting Comprehensive Income establishes standards

for the reporting and display of comprehensive income and its components in general-purpose financial statements.

Comprehensive income is defined as the change in net assets of a business enterprise during a period from transactions

and other events and circumstances from non-owner sources, and includes all changes in equity during a period except

those resulting from investments by owners and distributions to owners. The only reportable item of comprehensive

income is the foreign currency translation in note 14 (a).

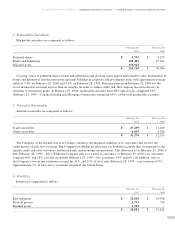

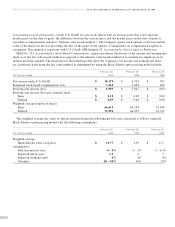

(d) Earnings per share – SFAS 128, Earnings Per Share, requires disclosure of the calculation of basic and diluted earnings per

share using the treasury stock method to determine diluted earnings per share. The treasury stock method assumes that

proceeds and any tax benefits received upon the exercise of all warrants and options outstanding in the period are used

to repurchase the Company’s shares at the average share price during the period. Under Canadian GAAP, proceeds on

the conversion of warrants and options are assumed to increase net income to the extent of the after tax investment

income that could be earned. The following table sets forth the computation of basic and diluted earnings per share

under U.S. GAAP.

February 29, February 28, February 28,

For the year ended 2000 1999 1998

Numerator in U.S. GAAP:

Numerator for basic and diluted earnings per share

available to common stockholders $ 10,170 $ 6,723 $ 387

Denominator in 000’s of shares:

Denominator for basic earnings per share – weighted

average shares outstanding 66,613 64,148 52,944

Effect of dilutive securities:

Warrants 180 64 14

Employee stock options 6,203 2,643 1,359

Dilutive potential common shares:

Denominator for diluted earnings per share – adjusted

weighted-average shares and assumed conversions 72,996 66,855 54,317

Basic earnings per share $ 0.15 $ 0.10 $ 0.01

Diluted earnings per share $ 0.14 $ 0.10 $ 0.01

31

Research In Motion Limited ■Incorporated Under the Laws of Ontario ■United States dollars, in thousands except per share data