Blackberry 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

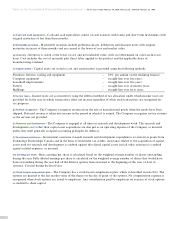

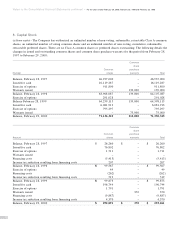

8. Capital Stock

(a) Share capital – The Company has authorized an unlimited number of non-voting, redeemable, retractable Class A common

shares, an unlimited number of voting common shares and an unlimited number of non-voting, cumulative, redeemable,

retractable preferred shares. There are no Class A common shares or preferred shares outstanding. The following details the

changes in issued and outstanding common shares and common share purchase warrants for the period from February 28,

1997 to February 29, 2000:

Common

share

Common purchase

Number shares warrants Total

Balance, February 28, 1997 46,937,000 – 46,937,000

Issued for cash 16,119,287 – 16,119,287

Exercise of options 911,800 – 911,800

Warrants issued – 139,000 139,000

Balance, February 28, 1998 63,968,087 139,000 64,107,087

Exercise of options 291,028 – 291,028

Balance February 28, 1999 64,259,115 139,000 64,398,115

Issued for cash 6,081,913 – 6,081,913

Exercise of options 795,297 – 795,297

Warrants issued – 75,000 75,000

Balance, February 29, 2000 71,136,325 214,000 71,350,325

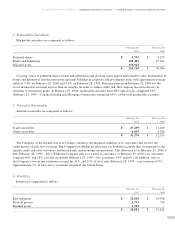

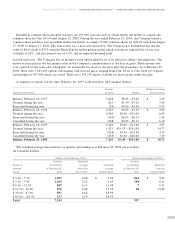

Common

share

Common purchase

Amount shares warrants Total

Balance, February 28, 1997 $ 26,260 $ – $ 26,260

Issued for cash 76,802 – 76,802

Exercise of options 1,711 – 1,711

Warrants issued – – –

Financing costs (5,413) – (5,413)

Income tax reduction resulting from financing costs 207 – 207

Balance, February 28, 1998 $99,567 – $ 99,567

Exercise of options 49 – 49

Financing costs (262) – (262)

Income tax reduction resulting from financing costs 519 – 519

Balance, February 28, 1999 $99,873 – $ 99,873

Issued for cash 196,744 – 196,744

Exercise of options 1,791 – 1,791

Warrants issued – 370 370

Financing costs (9,887) – (9,887)

Income tax reduction resulting from financing costs 4,370 – 4,370

Balance, February 29, 2000 $ 292,891 $ 370 $ 293,261

26

Notes to the Consolidated Financial Statements continued ■For the years ended February 29, 2000, February 28, 1999 and February 28, 1998