Blackberry 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

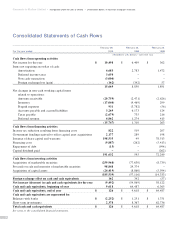

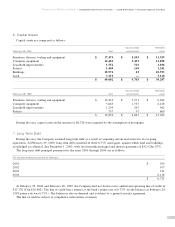

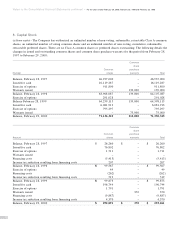

6. Capital Assets

Capital assets are comprised as follows:

Accumulated Net book

February 29, 2000 Cost amortization value

Furniture, fixtures, tooling and equipment $ 17,474 $ 5,545 $ 11,929

Computer equipment 14,481 3,453 11,028

Leasehold improvements 1,552 516 1,036

Patents 1,409 168 1,241

Buildings 10,976 23 10,953

Land 3,110 — 3,110

$ 49,002 $ 9,705 $ 39,297

Accumulated Net book

February 28, 1999 Cost amortization value

Furniture, fixtures, tooling and equipment $ 12,233 $ 2,971 $ 9,262

Computer equipment 5,665 1,537 4,128

Leasehold improvements 1,204 242 962

Patents 757 97 660

$ 19,859 $ 4,847 $ 15,012

During the year, capital assets in the amount of $6,726 were acquired by the assumption of mortgages.

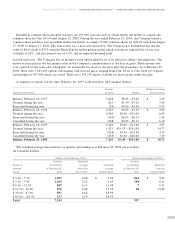

7. Long-Term Debt

During the year, the Company assumed long-term debt as a result of acquiring certain real estate for its on-going

operations. At February 29, 2000, long-term debt consisted of three 6.75% mortgages, against which land and buildings

are pledged as collateral, due December 1, 2003, with total monthly principal and interest payments of $52 (Cdn. $75).

The long-term debt principal payments for the years 2001 through 2004 are as follows:

For the year ending the last day of February,

2001 $ 185

2002 197

2003 211

2004 6,118

$ 6,711

At February 29, 2000 and February 28, 1999, the Company had not drawn on its authorized operating line of credit of

$13,776 (Cdn.$20,000). The line of credit bears interest at the bank’s prime rate of 6.75% on the balance (at February 28,

1999 prime rate was 6.75%). The balance is due on demand and is subject to a general security agreement.

The line of credit is subject to compliance with certain covenants.

25

Research In Motion Limited ■Incorporated Under the Laws of Ontario ■United States dollars, in thousands except per share data