Blackberry 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

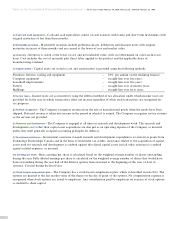

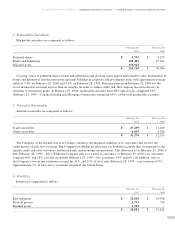

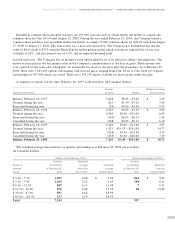

9. Commitments and Contingencies

(a) Lease commitment – The Company is committed to lease payments under operating leases for premises as follows:

For the year ending February 28, 2001 $ 445

For the year ending February 28, 2002 265

For the year ending February 28, 2003 167

For the year ending February 29, 2004 58

For the year ending February 28, 2005 39

(b) Contingency –During August 1999, the Company was served with a complaint alleging that certain of the Company’s

products infringe a patent held by another party. Although prior to filing the complaint, this party had offered to extend

to the Company a non-exclusive license under the patent for a one-time licencing fee of $4 million, the plaintiff has not

asserted any particular amount of damages in its complaint. Due to the early stages of this complaint, the likelihood of loss

and the ultimate amount, if any, which may exceed $4 million, are not determinable at this time. Accordingly, no amount

has been recorded in these financial statements.

10. Government Assistance

Agreements have been entered into with Technology Partnerships Canada (TPC) which provide partial funding for

various research and development projects.

The Company has entered into two project development agreements with TPC. Funding for the first project totaled

$3,900, which is repayable in the form of royalties of 2.2% on gross product revenues resulting from the project. The

Company is obligated to pay royalties on all project revenues up to February 28, 2003, after which time the royalty base is

expanded to include all of the Company’s revenues, and royalties will continue to be paid up to a maximum of $6,100.

The second agreement with TPC, which was entered into during the fiscal year, is a three year research and development

project under which total contributions paid by TPC will be a maximum of $23,300. This contribution will be repayable

in the form of royalties of 2.2% on gross product revenues resulting from the project, to a maximum of $39,300.

No amounts have been accrued with respect to these projects as the conditions for repayment have not yet been met.

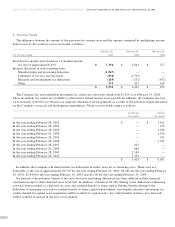

Government assistance, together with investment tax credits, has been applied to reduce research and development

expense as follows:

February 29, February 28, February 28,

For the year ended 2000 1999 1998

Research and development $ 12,234 $ 7,921 $ 4,356

Government funding 4,496 3,539 1,371

$ 7,738 $ 4,382 $ 2,985

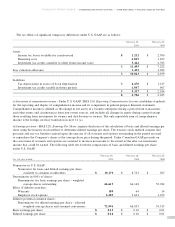

11. Interest and Income Taxes Paid

The following summarizes the interest and income taxes paid:

February 29, February 28, February 28,

For the year ended 2000 1999 1998

Interest paid $–$–$55

Income taxes paid 756 389 –

28

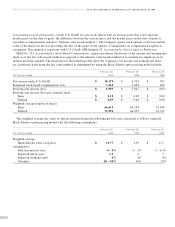

Notes to the Consolidated Financial Statements continued ■For the years ended February 29, 2000, February 28, 1999 and February 28, 1998