Blackberry 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

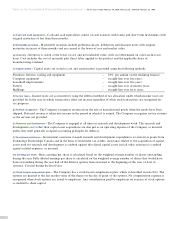

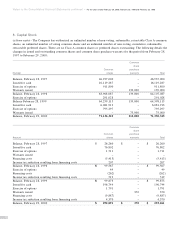

2. Marketable Securities

Marketable securities are comprised as follows:

February 29, February 28,

2000 1999

Preferred shares $ 4,702 $ 9,235

Bonds and debentures 102,489 47,761

Discount notes 110,925 –

$ 218,116 $ 56,996

Carrying values of preferred shares, bonds and debentures and discount notes approximate market value. Investments in

bonds and debentures and discount notes represent holdings in corporate and government notes with approximate average

yields of 5.4% on February 29, 2000 and 4.4% on February 28, 1999. Maturity dates from February 29, 2000 for the

above marketable securities are less than six months. In order to reduce credit risk, the Company has invested only in

securities of investment grade. At February 29, 2000, marketable securities from GE Capital Corp. comprised 34%

(February 28, 1999 – Canada Housing and Mortgage Corporation comprised 65% ) of the total marketable securities.

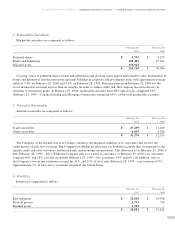

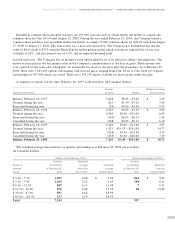

3. Amounts Receivable

Amounts receivable are comprised as follows:

February 29, February 28,

2000 1999

Trade receivables $ 27,239 $ 11,129

Other receivables 6,035 1,386

$ 33,274 $ 12,515

The Company, in the normal course of business, monitors the financial condition of its customers and reviews the

credit history of each new customer. The Company establishes an allowance for doubtful accounts that corresponds to the

specific credit risk of its customers, historical trends and economic circumstances. The allowance as at February 29, 2000 is

$64 (February 28, 1999 – $65). While the Company sells to a variety of customers, at February 29, 2000, two customers

comprise 46% and 18% of trade receivables (February 28, 1999 – two customers, 81% and 6% ). In addition, sales to

the Company’s two major customers account for 31% and 25% of total sales (February 28, 1999 – one customer, 69% ).

Approximately 7% of sales are to customers outside of the United States.

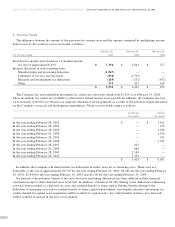

4. Inventory

Inventory is comprised as follows:

February 29, February 28,

2000 1999

Raw materials $ 32,616 $ 19,078

Work in process 2,733 734

Finished goods 1,503 –

$ 36,852 $ 19,812

23

Research In Motion Limited ■Incorporated Under the Laws of Ontario ■United States dollars, in thousands except per share data