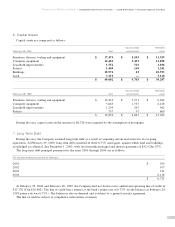

Blackberry 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

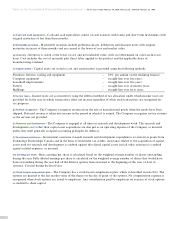

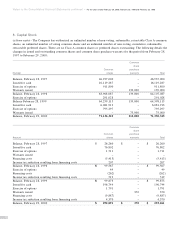

5. Income Taxes

The difference between the amount of the provision for income taxes and the amount computed by multiplying income

before taxes by the statutory rate is reconciled as follows:

February 29, February 28, February 28,

For the year ended 2000 1999 1998

Provision for income taxes based on a Canadian income

tax rate of approximately 45% $ 7,156 $ 3,861 $ 277

Increase (decrease) in taxes resulting from:

Manufacturing and processing deduction (1,067) ——

Utilization of tax loss carryforwards (838) (1,791) —

Research and development tax deductions (285) (252) (432)

Other 572 427 414

$ 5,538 $ 2,245 $ 259

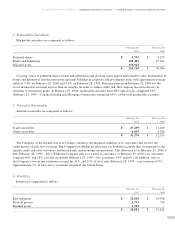

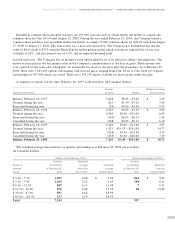

The Company has non-refundable investment tax credit carry-forwards which total $5,424 as at February 29, 2000.

These investment tax credits are available to offset future federal income taxes payable. In addition, the Company has loss

carry-forwards of $9,091 for Ontario tax purposes which have arisen primarily as a result of the provincial super-allowance

on the Company's research and development expenditures. These carry-forwards expire as follows:

Investment Ontario

tax credits tax losses

In the year ending February 28, 2001 $ — $ 1,412

In the year ending February 28, 2002 — 153

In the year ending February 28, 2003 — 1,284

In the year ending February 29, 2004 — 1,974

In the year ending February 28, 2005 — 921

In the year ending February 28, 2006 — 3,347

In the year ending February 28, 2007 247 —

In the year ending February 29, 2008 669 —

In the year ending February 28, 2009 2,184 —

In the year ending February 28, 2010 2,324 —

$ 5,424 $ 9,091

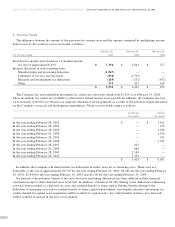

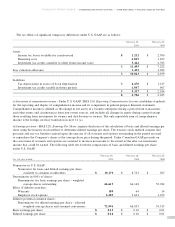

In addition the Company will claim further tax deductions in future years for its financing costs. These costs are

deductible at the rate of approximately $3,570 for the year ending February 28, 2001, $3,260 for the year ending February

28, 2002, $2,840 for the year ending February 28, 2003 and $2,100 for the year ending February 29, 2004.

No portion of the potential benefit of the carry-forwards and timing differences has been reflected in these financial

statements except to offset deferred taxes of $4,940. In addition, a benefit of $3,188 relating to the deduction of financing

costs has been recorded as a deferred tax asset and credited directly to share capital. Further benefit relating to the

deduction of financing costs will be credited directly to share capital when utilized. Any benefits related to investment tax

credits claimed for capital asset acquisitions will be credited to capital assets. Any other benefits of these carry-forwards

will be credited to income in the year of recognition.

24

Notes to the Consolidated Financial Statements continued ■For the years ended February 29, 2000, February 28, 1999 and February 28, 1998