Blackberry 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(e) Cash and cash equivalents – Cash and cash equivalents consist of cash balances with banks and short term investments with

original maturities of less than three months.

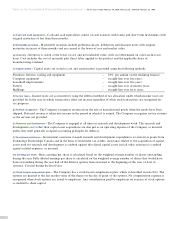

(f) Marketable securities – Marketable securities include preference shares, debentures and discount notes with original

maturities in excess of three months and are carried at the lower of cost and market value.

(g) Inventory – Inventory is stated at the lower of cost and net realizable value, with cost determined on a first-in-first-out

basis. Cost includes the cost of materials plus direct labor applied to the product and the applicable share of

manufacturing overhead.

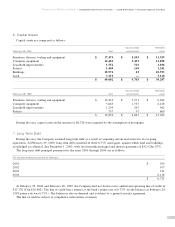

(h) Capital assets – Capital assets are stated at cost and amortization is provided using the following methods:

Furniture, fixtures, tooling and equipment – 20% per annum on the declining balance;

Computer equipment – straight-line over five years;

Leasehold improvements – straight-line over five years;

Patents – straight-line over seventeen years;

Buildings – straight-line over forty years.

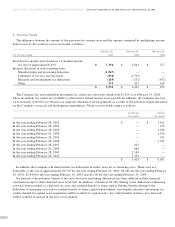

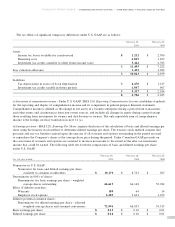

(i) Income taxes – Income taxes are accounted for using the deferral method of tax allocation under which income taxes are

provided for in the year in which transactions affect net income regardless of when such transactions are recognized for

tax purposes.

(j) Revenue recognition – The Company recognizes revenue from the sale of manufactured goods when the goods have been

shipped. Deferred revenue is taken into income in the period in which it is earned. The Company recognizes service revenue

as the services are provided.

(k) Research and development – The Company is engaged at all times in research and development work. The research and

development costs other than capital asset acquisitions are charged as an operating expense of the Company as incurred

unless they meet generally accepted accounting principles for deferral.

(l) Government assistance – Government assistance towards research and development expenditures is received as grants from

Technology Partnerships Canada and in the form of investment tax credits. Assistance related to the acquisition of capital

assets used for research and development is credited against the related capital assets and all other assistance is credited

against related expenses, as incurred.

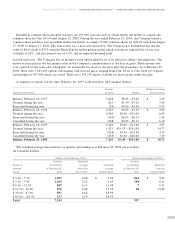

(m) Earnings per share – Basic earnings per share is calculated based on the weighted average number of shares outstanding

during the year. Fully diluted earnings per share is calculated on the weighted average number of shares that would have

been outstanding during the year had all the dilutive options been exercised at the beginning of the year, or date of

issuance, if issued during the fiscal year.

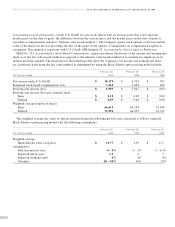

(n) Stock-based compensation plan – The Company has a stock-based compensation plan, which is described in note 8(b). The

options are granted at the fair market value of the shares on the day of grant of the options. No compensation expense is

recognized when stock options are issued to employees. Any consideration paid by employees on exercise of stock options

is credited to share capital.

22

Notes to the Consolidated Financial Statements continued ■For the years ended February 29, 2000, February 28, 1999 and February 28, 1998