Blackberry 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Nature of Business

Research In Motion Limited (the “Company”) is in the business of designing, manufacturing and marketing wireless

Internet appliances and services and radio modems for the mobile data communications market. The Company was

incorporated on March 7, 1984 under the Ontario Business Corporations Act. The Company’s shares trade publicly

on The Toronto Stock Exchange under the symbol RIM and on the Nasdaq National Market under the symbol RIMM.

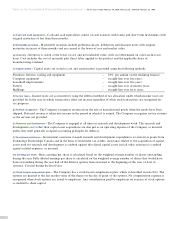

1. Summary of Significant Accounting Policies

(a) General – These consolidated financial statements have been prepared by management in accordance with accounting

principles generally accepted in Canada (“Canadian GAAP”) on a basis consistent with prior years, which conforms in all

material respects with accounting principles generally accepted in the United States (“U.S. GAAP”), except as presented in

note 14. Because a precise determination of assets and liabilities depends on future events, the preparation of financial

statements for any period necessarily involves the use of estimates and approximation. Actual amounts may differ from

these estimates. These financial statements have, in management’s opinion, been properly prepared within reasonable limits

of materiality and within the framework of the accounting policies summarized below.

(b) Basis of consolidation – During the year, the Company incorporated subsidiaries to hold investments in real and other

property. All of the subsidiaries are wholly owned. The consolidated financial statements include the accounts of the

subsidiaries with intercompany transactions and balances eliminated.

(c) Foreign currency translation – The Company has historically measured and presented its financial statements in Canadian

(“Cdn.”) dollars. Effective September 1, 1999, as a result of the Company’s increased economic activity in the United States

(“U.S.”), the U.S. dollar has become the functional currency of the Company’s operations and for the financial statements

of the Company. Effective the same date, the U.S. dollar has been adopted as the reporting currency.

For periods up to and including August 31, 1999, the monetary assets and liabilities of the Company denominated in

a currency other than the Canadian dollar were translated into Canadian dollars using the exchange rate in effect at the

period-end and revenues and expenses were translated at the average rate during the period. Any resulting gains or losses

were included in income. For periods subsequent to August 31, 1999, transactions which were incurred in currencies other

than the U.S. dollar (the new functional currency) have been converted to U.S. dollars at the exchange rate in effect at the

transaction date. Carrying values of non-U.S. dollar monetary assets and liabilities are adjusted at each balance sheet date

to reflect the functional currency rate in effect at that date and any gains and losses from this restatement are included in

income. Non-monetary assets are translated at the historical exchange rate on the date of acquisition.

Historical financial statements and notes thereto up to and including August 31, 1999 have been restated into U.S.

dollars, in accordance with accounting principles generally accepted in Canada, using the August 31, 1999 closing exchange

rate being a rate of Cdn.$1.4888 per U.S.$1.00.

(d) Financial instruments – The majority of the Company’s sales are realized in U.S. dollars while operating expenses, consisting

of salaries and overhead, are incurred primarily in Cdn. dollars. As a result, the Company is exposed to a risk relating to

foreign exchange fluctuations. The Company mitigates this risk by maintaining Cdn. dollar funds. At February 29, 2000,

approximately $198 of cash and cash equivalents, 18% of amounts receivable and 25% of accounts payable and accrued

liabilities are denominated in Cdn. dollars (February 28, 1999 – 67% , 24%, and 37% , respectively). Marketable securities

are subject to market risk in that their value will fluctuate as a result of changes in market prices. Unless otherwise noted,

the fair value of financial instruments approximates carrying values.

21

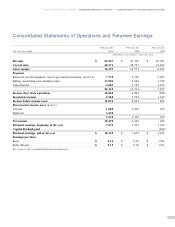

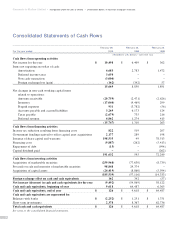

For the years ended February 29, 2000, February 28, 1999 and February 28, 1998