Blackberry 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

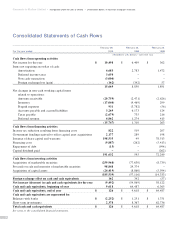

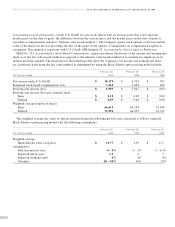

Consolidated Statements of Operations

February 29, February 28, February 28,

For the year ended 2000 1999 1998

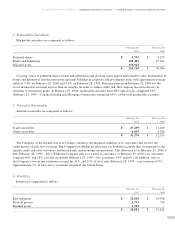

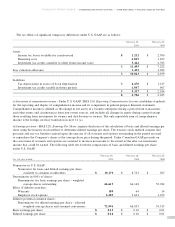

Net income under Canadian GAAP $ 10,498 $ 6,409 $ 362

Adjustment – Foreign currency translation (a) 8(22) 25

Adjustment – Deferred income taxes (b) (336) 336 –

Net income under U.S. GAAP $ 10,170 $ 6,723 $ 387

Earnings per share under U.S. GAAP

Basic $ 0.15 $ 0.10 $ 0.01

Diluted $ 0.14 $ 0.10 $ 0.01

Other comprehensive income (loss) (c):

Net income under U.S. GAAP 10,170 6,723 387

Foreign currency translation adjustment (a) 1,474 (6,236) (2,396)

Comprehensive income (loss) under U.S. GAAP $ 11,644 $ 487 $ (2,009)

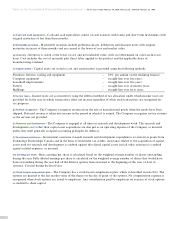

(a) Change in functional currency – Effective August 31, 1999, the Company adopted the U.S. dollar as its reporting currency.

Prior to this change the Canadian dollar had been used as the Company’s reporting currency. Under Canadian GAAP, the

Company’s financial statements for all periods presented through August 31, 1999 have been translated from Canadian

dollars to U.S. dollars using the exchange rate in effect at August 31, 1999. Under U.S. GAAP, the financial statements

for the periods prior to the change in reporting currency must be translated to U.S. dollars using the current rate method,

which uses specific year end and specific annual average exchange rates as appropriate. The significant differences arising

from the application of the current rate method to the periods presented are the effects on net income and comprehensive

income described above.

(b) Income taxes – For Canadian GAAP purposes the Company uses the deferral method of accounting for income taxes such

that deferred assets or liabilities arise from differences between financial statement income and taxable income. These

deferred income tax assets and/or liabilities are recorded using the income tax rate in effect at the time and are not affected

by subsequent changes in income tax rates. A deferred income tax asset may be recognized when there is “virtual certainty”

that these benefits would be realized. Under U.S. GAAP, deferred tax assets and liabilities arise from differences between

the financial statement carrying amounts of existing assets and liabilities and their respective tax basis, and are adjusted to

reflect expected tax rates. Under U.S. GAAP, deferred income tax assets are recorded net of a valuation allowance to the

extent that it is “more likely than not” that some or all of the deferred tax asset will not be recovered.

30

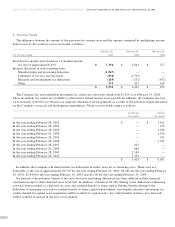

Notes to the Consolidated Financial Statements continued ■For the years ended February 29, 2000, February 28, 1999 and February 28, 1998