Blackberry 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

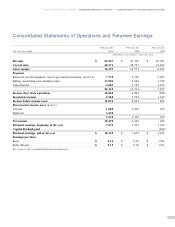

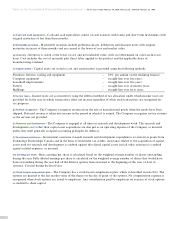

Amortization

Amortization expense increased to $4.7 million for

the year ended February 29, 2000 from $2.8 million

in the prior year. Amortization expense was 6% of

revenue in both years. Acquisitions of capital assets

totalling $31.1 million were made in the year ended

February 29, 2000 compared to acquisitions of $8.9

million for the 1999 fiscal year. Significant additions for

fiscal 2000 included land and office buildings, production

equipment and tooling, research and development

computers and equipment and computer infrastructure

for the BlackBerry solution.

Investment Income

Investment income increased to $6.0 million in the year

ended February 29, 2000 from $3.8 million in the prior

year. The increase reflects the Company’s higher average

cash, cash equivalents and marketable security balances

during the year and an increase in investment yields during

the latter part of the year.

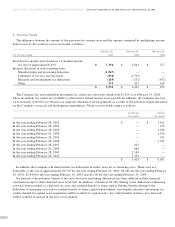

Income Taxes

An increase in the effective income tax rate to 35% for

the year ended February 29, 2000 compared to 26% in

the prior year reflects RIM’s continued profitability, as

the Company has used tax loss carry-forwards from prior

years and has incurred additional minimum taxes on the

Company’s asset base.

Net Income

Net income was $10.5 million, or 12% of revenue for

fiscal 2000 compared to $6.4 million, or 14% of revenue

for fiscal 1999. The decrease as a percentage of revenue

was primarily due to strategic expenditures for sales and

marketing initiatives and expansion of the Company’s

support of the distribution channels for the RIM Wireless

Handheld product line and BlackBerry.

Liquidity and Capital Resources

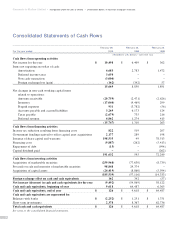

Cash used for operating activities was $15.7 million for

the year ended February 29, 2000 compared to cash

inflows of $1.3 million in the prior year. Significant

increases in accounts receivable and inventory during the

2000 fiscal year, as a result of increased sales volumes,

accounted for the increased use of cash.

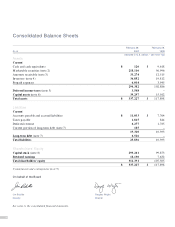

Cash, cash equivalents and marketable securities were

$218.2 million at February 29, 2000 compared to $66.6

million at February 28, 1999. The significant increase

was primarily due to the proceeds of an offering of 5.6

million common shares for net proceeds of $163.2 million

completed in the third quarter of fiscal 2000. Cash, cash

equivalents and marketable securities accounted for 65%

of total assets at February 29, 2000 compared to 57% in

the prior year.

15

Revenue by

Product

Fiscal 2000

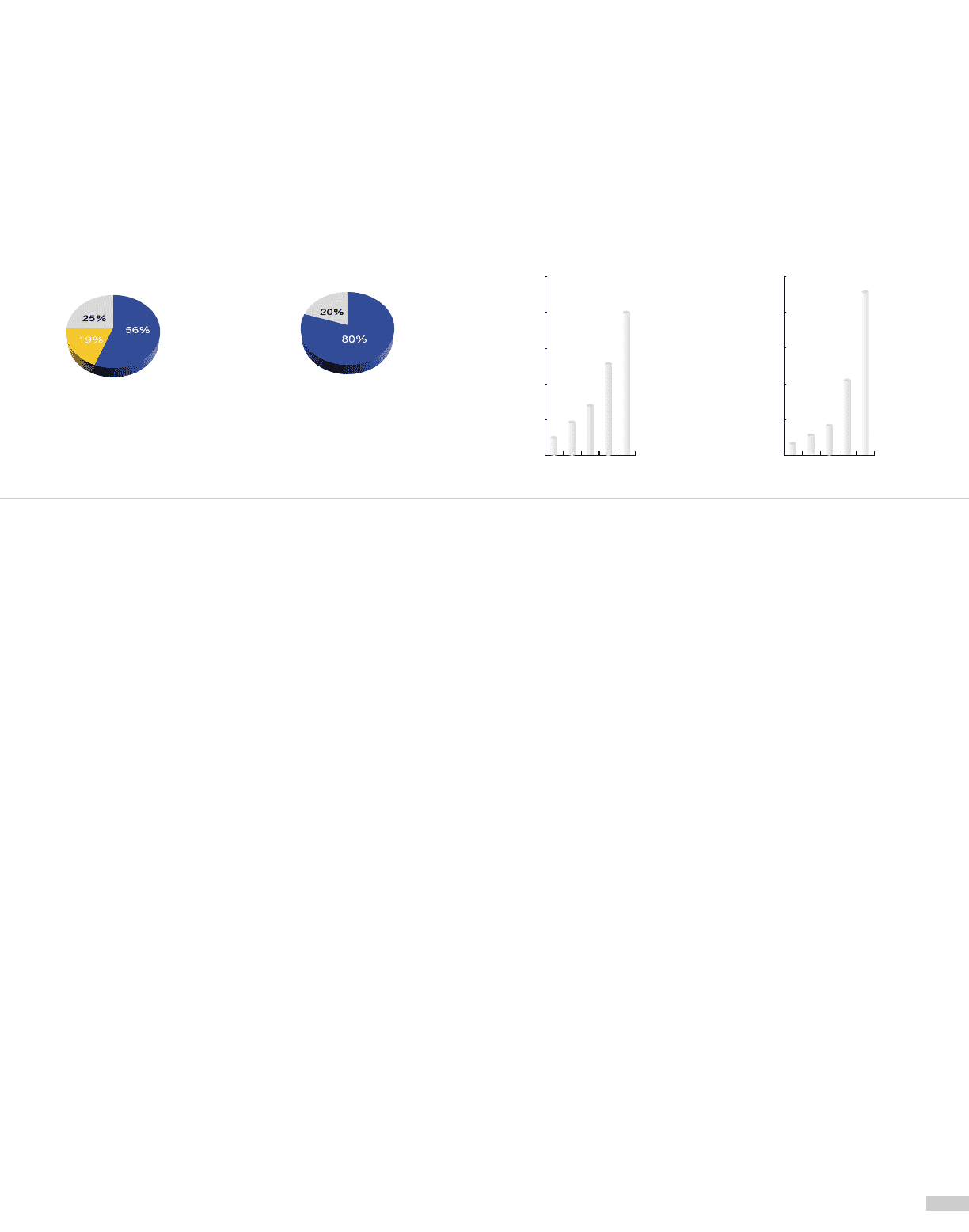

Selling, Marketing

and Administration

($ millions)

Gross Research

and Development

($ millions)

Revenue by

Product

Fiscal 1999

0

3

6

9

12

$15

1996 $1.2

1997

1998

1999

2000

$1.9

$2.7

$6.5

$13.9

0

3

6

9

12

$15

1996 $1.7

1997

1998

1999

2000

$3.0

$4.4

$7.9

$12.2

Research In Motion Limited ■Incorporated Under the Laws of Ontario

■ RIM Wireless Handhelds

■ BlackBerry

■ OEM & Other

■ RIM Wireless Handhelds

■ OEM & Other