Bed, Bath and Beyond 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2010 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)

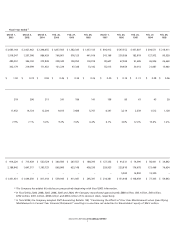

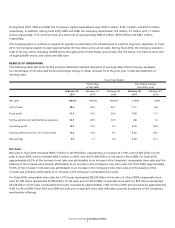

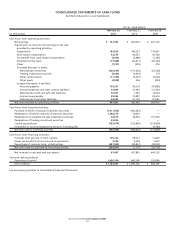

Gross Profit

net sales was primarily due to a decrease in coupon expense as a percentage of net sales, partially offset by a shift in the mix of

sales was primarily due to decreases in inventory acquisition costs, coupon expense and markdowns, partially offset by a shift in

the mix of merchandise sold to lower margin categories.

Selling, General and Administrative expenses

due to relative decreases in payroll and occupancy expenses, as well as a relative decrease in advertising expenses resulting

from a reduction in the distribution of advertising pieces. Payroll and occupancy (including rent and depreciation) expense

as a percentage of net sales was primarily due to a relative decrease in advertising expenses resulting from a decrease in the

distribution of advertising pieces. Also contributing to the decrease were relative decreases in payroll expenses and occupancy

costs (including rent, utilities and depreciation).

Operating Profit

Interest Income

fair value of the trading investment securities related to the Company’s nonqualified deferred compensation plan.

Income Taxes

million provision primarily due to the recognition of certain discrete tax items partially offset by the changing of the blended

state taxes.

The Company expects continued volatility in the effective tax rate from year to year because the Company is required each year

to determine whether new information changes the assessment of both the probability that a tax position will effectively be

sustained and the appropriateness of the amount of recognized benefit.