Bed, Bath and Beyond 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

55

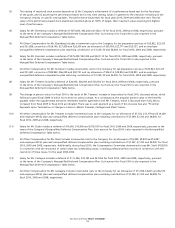

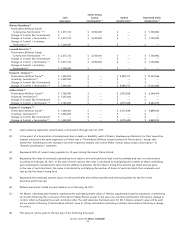

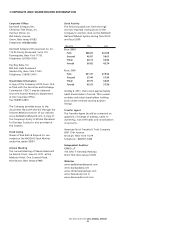

Nonqualified

Benefit Compensation Supplemental Life Insurance

Continuation (5) Balance Pension (7) Substitute Payment Total

$ 818,499 $ 841,107 $ 476,852 $ 2,125,000 $ 20,089,812

$ — $ — $ — $ — $ —

$ 818,499 $ 841,107 $ 476,852 $ 2,125,000 $ 20,089,812

$ 818,499 $ 841,107 $ 2,287,863 $ 2,125,000 $ 9,372,469

$ 1,690,246 $ 841,107 $ 862,071 $ 2,080,000 $ 21,301,778

$ — $ — $ — $ — $ —

$ 1,690,246 $ 841,107 $ 862,071 $ 2,080,000 $ 21,301,778

$ 1,690,246 $ 841,107 $ 2,866,279 $ 2,080,000 $ 10,777,632

$ — $ 128,132 $ 12,186,192 $ — $ 42,717,162

$ — $ 128,132 $ — $ — $ 2,628,132

$ — $ — $ — $ — $ —

$ — $ 128,132 $ 12,186,192 $ — $ 42,717,162

$ — $ 597,031 $ — $ — $ 12,702,053

$ — $ 597,031 $ — $ — $ 1,852,031

$ — $ — $ — $ — $ —

$ — $ 597,031 $ — $ — $ 12,702,053

$ — $ 435,965 $ — $ — $ 8,420,538

$ — $ 435,965 $ — $ — $ 1,475,965

$ — $ — $ — $ — $ —

$ — $ 435,965 $ — $ — $ 8,420,538

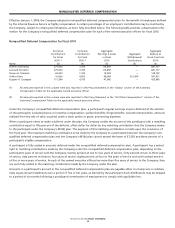

(9) The employment agreements of Messrs. Eisenberg and Feinstein provide that in the event any amounts paid or provided to the

executive in connection with a change in control are determined to constitute “excess parachute payments” under Section 280G of

the Code which would be subject to the excise tax imposed by Section 4999 of the Code, the payments and benefits due to the

executive will be reduced if the reduction would result in a greater amount payable to the executive after taking into account the

excise tax imposed by Section 4999 of the Code. However, no reduction of payments and benefits are disclosed above since neither

of these executives would have been subject to excise taxes as a result of payments subject to Section 280G of the Code that would

have been made in connection with a change in control occurring on February 26, 2011.

(10) Cash severance represents three times current salary payable over a period of three years.

(11) In the event of a termination of employment due to death or disability, Mr. Temares (or his estate) will receive the same payments

as if there was a “Termination Without Cause”.

(12) Cash severance represents one times current salary payable over a period of one year.

(13) In the event of a termination of employment due to death or disability, Mr. Stark (or his estate) will receive the same payments

as if there was a “Termination Without Cause”.

(14) In the event of a termination of employment due to death or disability, Mr. Castagna (or his estate) will receive the same payments

as if there was a “Termination Without Cause”.