Bed, Bath and Beyond 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND 2010 ANNUAL REPORT

4

OVERVIEW

Bed Bath & Beyond Inc. and subsidiaries (the “Company”) is a chain of retail stores, operating under the names Bed Bath &

Beyond (“BBB”), Christmas Tree Shops (“CTS”), Harmon and Harmon Face Values (“Harmon”) and buybuy BABY. In addition, the

Company is a partner in a joint venture which operates two stores in the Mexico City market under the name “Home & More.”

The Company sells a wide assortment of domestics merchandise and home furnishings. Domestics merchandise includes categories

such as bed linens and related items, bath items and kitchen textiles. Home furnishings include categories such as kitchen and

tabletop items, fine tabletop, basic housewares, general home furnishings, consumables and certain juvenile products. The

Company’s objective is to be a customer’s first choice for products and services in the categories offered, in the markets in which

the Company operates.

The Company’s strategy is to achieve this objective through excellent customer service, an extensive breadth and depth of

assortment, everyday low prices and introduction of new merchandising offerings, supported by the continuous development and

improvement of its infrastructure.

Operating in the highly competitive retail industry, the Company, along with other retail companies, is influenced by a number

of factors including, but not limited to, general economic conditions including the housing market, the overall macroeconomic

environment and related changes in the retailing environment, consumer preferences and spending habits, unusual weather

patterns, competition from existing and potential competitors, and the ability to find suitable locations at acceptable occupancy

costs to support the Company’s expansion program.

While it appears that the economic environment has stabilized, a number of challenges, including higher commodity prices, and

relatively high unemployment could continue to pressure consumers and affect their spending. The Company cannot predict

whether, when or the manner in which these economic conditions will change.

The Company remains committed to making the required investments in its infrastructure to help position the Company for

continued success. The Company continues to review and prioritize its capital needs while continuing to make investments,

principally for new stores, existing store improvements, information technology enhancements including increased spending on

its interactive platforms, and other projects whose impact is considered important to its future.

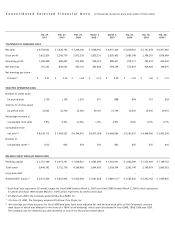

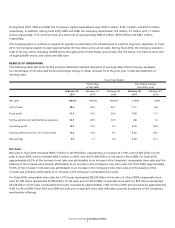

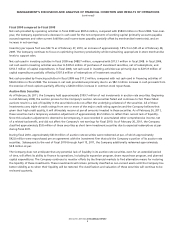

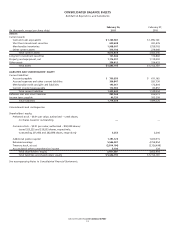

The following represents an overview of the Company’s financial performance for the periods indicated:

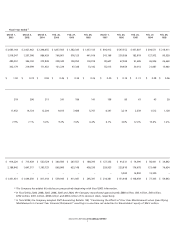

A store is considered a comparable store when it has been open for twelve full months following its grand opening

period (typically four to six weeks). Stores relocated or expanded are excluded from comparable store sales if the

change in square footage would cause meaningful disparity in sales over the prior period. In the case of a store to be

closed, such store’s sales are not considered comparable once the store closing process has commenced.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS