Bed, Bath and Beyond 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2010 ANNUAL REPORT

24

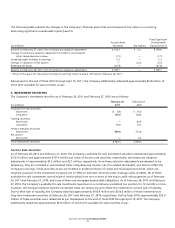

As of February 27, 2010, the Company’s trading investment securities included approximately $40.5 million at fair value ($42.8

million at par) of additional auction rate securities which were invested in securities collateralized by student loans. During the

first six months of fiscal 2010, pursuant to an agreement with the investment firm that sold the Company these securities, the

remaining $42.8 million of these securities were redeemed at par.

U.S. Treasury Securities

As of February 26, 2011 and February 27, 2010, the Company’s short term held-to-maturity securities included approximately

$599.8 million and approximately $373.6 million, respectively, of U.S. Treasury Bills with remaining maturities of less than one

year. These securities are stated at their amortized cost which approximates fair value.

Long Term Trading Investment Securities

The Company’s long term trading investment securities, which are provided as investment options to the participants of the

nonqualified deferred compensation plan, are stated at fair market value. The values of these trading investment securities

included in the table above are approximately $17.6 million and $12.1 million as of February 26, 2011 and February 27, 2010,

respectively.

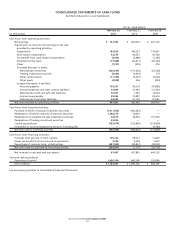

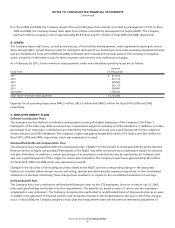

6. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

February 26, February 27, February 28,

(in thousands) 2011 2010 2009

Current:

Federal $ 426,956 $ 346,875 $ 233,216

State and local 90,689 61,080 47,294

517,645 407,955 280,510

Deferred:

Federal (7,698) (17,851) (19,419)

State and local (8,302) (4,882) (2,906)

(16,000) (22,733) (22,325)

$ 501,645 $ 385,222 $ 258,185

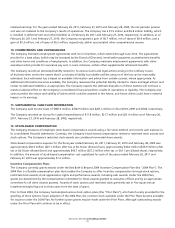

At February 26, 2011 and February 27, 2010, included in other current assets and in other assets is a net current deferred

income tax asset of $189.1 million and $167.2 million, respectively, and a net noncurrent deferred income tax asset of $90.9

million and $96.6 million, respectively. These amounts represent the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The

significant components of the Company’s deferred tax assets and liabilities consist of the following:

February 26, February 27,

(in thousands) 2011 2010

Deferred tax assets:

Inventories $ 26,151 $ 34,659

Deferred rent and other rent credits 75,007 64,707

Insurance 51,906 44,386

Stock-based compensation 48,743 60,994

Merchandise credits and gift card liabilities 29,043 27,409

Accrued expenses 86,927 64,388

Other 33,616 25,543

Deferred tax liabilities:

Depreciation (18,991) (15,593)

Goodwill (31,213) (25,648)

Other (21,152) (17,000)

$ 280,037 $ 263,845

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)