Bed, Bath and Beyond 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BED BATH & BEYOND PROXY STATEMENT

46

period in order to earn the restricted stock, further aligning the executive’s interest with the long-term interests of the Company.

For each of fiscal 2010 and fiscal 2009, the performance-based test was satisfied in that the Company’s net income exceeded the

Company’s net income for the prior fiscal year.

All executives (other than named executive officers and other key executives whose compensation is determined by the

Compensation Committee) and associates awarded incentive compensation receive grants consisting solely of restricted stock.

Vesting of restricted stock awarded to these associates is based solely on time-vesting with no performance-based test.

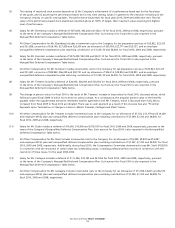

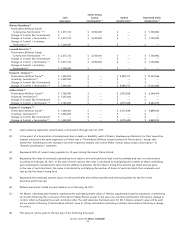

Prior to fiscal 2008, stock option awards were made by the Compensation Committee based on the number of shares covered

by the options. Beginning in fiscal 2008, based on advice from JFR, stock option awards have been made in dollars (with the

number of shares covered by the options determined by dividing the dollar amount of the grant by the Stock Option Fair Value,

as described below). The Compensation Committee believes that making stock option awards in dollar amounts rather than

share amounts is an increasingly prevalent practice and is advisable because making stock option awards in dollar amounts allows

the Compensation Committee to align stock option awards with the value of the option grants. Making stock option awards in

dollars also enables the Compensation Committee to more readily evaluate appropriate aggregate compensation amounts and

percentage increases or decreases for executives, in comparison to making stock option awards in share amounts (the value of

which varies depending on the trading price of the Company’s stock and other factors).

In making the awards, the Compensation Committee considered the fair value of these options on the date of grant determined

in accordance with Accounting Standards Codification Topic No. 718, “Compensation – Stock Compensation” (the “Stock Option

Fair Value”).

All awards of restricted stock and stock options are made under the Company’s 2004 Incentive Compensation Plan, approved by

the Company’s shareholders (the performance goals under such plan having been re-approved in 2009), which is the only equity

incentive plan under which the Company can currently make awards of equity compensation.

Senior Executive Compensation

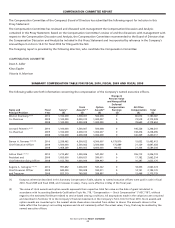

In addition to considering the Company’s compensation policies generally, the Compensation Committee reviews executive

compensation and concentrates on the compensation packages for the Company’s senior executive officers, namely, the

Co-Chairmen (Warren Eisenberg and Leonard Feinstein, who are the Company’s Co-Founders) and the Chief Executive Officer

(Steven H. Temares), believing that these three named executive officers are the most important and influential in determining

the continued success of the Company. The Company has enjoyed considerable success in the 19 years it has been a public

company, and in both fiscal 2009 and fiscal 2010 achieved strong financial results.

In 2010, the employment agreements for the Co-Chairmen were amended to extend their terms until June 30, 2013. At that time,

the employment agreements for the Co-Chairmen were amended to eliminate the entitlement to receive excise tax gross-up

payments due to change in control payments that would trigger an excise tax pursuant to Sections 280G and 4999 of the Code.

Instead, the employment agreements were amended to provide that the change in control payments and benefits payable to

each of the Co-Chairmen will be reduced if the reduction would result in a greater amount payable to each of the Co-Chairmen

after taking into account the excise tax under Section 4999 of the Code. In connection with these amendments, the Company

agreed that in the event of a change in control of the Company, the Company will fund a “rabbi trust” to hold an amount equal

to the value of the payments and certain benefits payable to each of the Co-Chairmen upon his termination of employment with

the Company.

For fiscal 2010, the base salaries for the Co-Chairmen remained at $1,100,000, the same as they were for the prior four fiscal years.

For fiscal 2010, the base salary for Mr. Temares increased by $1,000,000 to $2,500,000. The Compensation Committee determined

that Mr. Temares’ base salary increase was warranted based on the Company’s strong financial performance and Mr. Temares’

strong individual performance. According to the analysis prepared by JFR, Mr. Temares’ increased base salary for fiscal 2010 was

below the median of the cash compensation of the 18-company peer group.

For fiscal 2010, the base salaries for each of Mr. Stark and Mr. Castagna increased by $200,000. The Compensation Committee

determined that these increases were warranted based on the Company’s growth and strong financial results in 2009.

For fiscal 2010, while authorizing increases in base salaries for all of the named executive officers other than the Co-Chairmen,

the Compensation Committee determined that there would be no increase in aggregate equity compensation for the top three