Bed, Bath and Beyond 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2010 ANNUAL REPORT

Other Fiscal 2010 Information

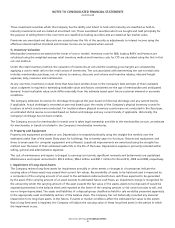

credit. Although no assurances can be provided, the Company intends to renew both uncommitted lines of credit before the

planning that the new share repurchase program will commence after completion of the existing share repurchase program. The

Company anticipates that this new program will be funded from current cash and from present and expected future cash flows.

conditions.

The Company has authorization to make repurchases from time to time in the open market or through other parameters

approved by the Board of Directors pursuant to existing rules and regulations.

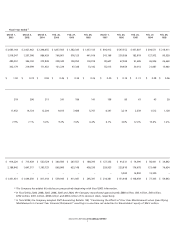

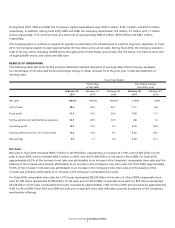

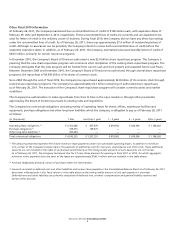

The Company has contractual obligations consisting mainly of operating leases for stores, offices, warehouse facilities and

as follows:

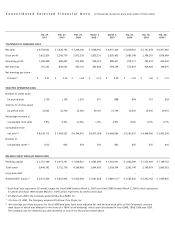

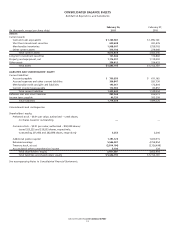

(in thousands)

Operating lease obligations

Purchase obligations

(1) The amounts presented represent the future minimum lease payments under non-cancelable operating leases. In addition to minimum

rent, certain of the Company’s leases require the payment of additional costs for insurance, maintenance and other costs. These additional

amounts are not included in the table of contractual commitments as the timing and/or amounts of such payments are not known.

As of February 26, 2011, the Company has leased sites for 27 new stores planned for opening in fiscal 2011 or 2012, for which aggregate

minimum rental payments over the term of the leases are approximately $100.1 million and are included in the table above.

(2) Purchase obligations primarily consist of purchase orders for merchandise.

(3) Amounts recorded as deferred rent and other liabilities and income taxes payable in the Consolidated Balance Sheet as of February 26, 2011

have been reflected only in the Total column in the table above as the timing and/or amount of any cash payment is uncertain.

Deferred rent and other liabilities are primarily comprised of deferred rent, workers’ compensation and general liability reserves and

various other accruals.