Bed, Bath and Beyond 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND 2010 ANNUAL REPORT

25

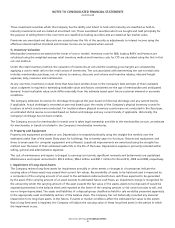

The Company has not established a valuation allowance for the net deferred tax asset as it is considered more likely than not

that it is realizable through a combination of future taxable income and the deductibility of future net deferred tax liabilities.

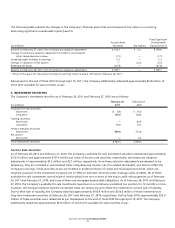

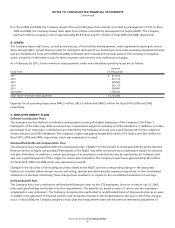

The following table summarizes the activity related to the gross unrecognized tax benefits from uncertain tax positions:

February 26, February 27,

(in thousands) 2011 2010

Balance at beginning of year $ 113,086 $ 96,697

Increase related to current year positions 24,051 17,993

Increase related to prior year positions 16,677 31,904

Decrease related to prior year positions (8,273) (31,949)

Settlements (1,576) (26)

Lapse of statute of limitations (2,096) (1,533)

Balance at end of year $ 141,869 $ 113,086

At February 26, 2011, the Company has recorded approximately $42.2 million and $99.7 million of gross unrecognized tax

benefits in current and non-current taxes payable, respectively, on the consolidated balance sheet of which approximately

$137.6 million would impact the Company’s effective tax rate. At February 27, 2010, the Company has recorded approximately

$9.7 million and $103.4 million of gross unrecognized tax benefits in current and non-current taxes payable, respectively, on

the consolidated balance sheet of which approximately $107.8 million would impact the Company’s effective tax rate. As of

February 26, 2011 and February 27, 2010, the liability for gross unrecognized tax benefits included approximately $30.2 million

and $21.6 million, respectively, of accrued interest. The Company recorded an increase of interest of approximately $9.2 million

and $6.1 million for the years ended February 26, 2011 and February 27, 2010, respectively, for gross unrecognized tax benefits

in the consolidated statement of earnings.

The Company anticipates that any adjustments to gross unrecognized tax benefits which will impact income tax expense, due to

the settlement of audits and the expiration of statutes of limitations, could be approximately $5.0 to $10.0 million in the next

twelve months. However, actual results could differ from those currently anticipated.

As of February 26, 2011, the Company operated in 50 states, the District of Columbia, Puerto Rico and Canada and files

income tax returns in the United States and various state, local and international jurisdictions. The Company is currently under

examination by the Internal Revenue Service for tax years 2006 through 2008. The Company is also open to examination for

state and local jurisdictions with varying statutes of limitations, generally ranging from three to five years.

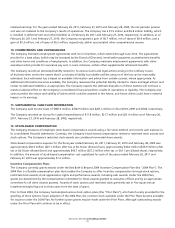

For fiscal 2010, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00%, the State income tax rate,

net of Federal benefit, of 2.77%, provision for uncertain tax positions of 1.86% and other income tax benefits of 0.83%. For

fiscal 2009, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00%, the State income tax rate, net

of Federal benefit, of 3.29%, provision for uncertain tax positions of 1.96% and other income tax benefits of 1.15%. For fiscal

2008, the effective tax rate is comprised of the Federal statutory income tax rate of 35.00%, the State income tax rate, net of

Federal benefit, of 2.90% and other income tax benefits of 0.12%.

7. TRANSACTIONS AND BALANCES WITH RELATED PARTIES

A. In fiscal 2002, the Company had an interest in certain life insurance policies on the lives of its Co-Chairmen and their spouses.

The Company’s interest in these policies was equivalent to the net premiums paid by the Company. The agreements relating

to the Company’s interest in the life insurance policies on the lives of its Co-Chairmen and their spouses were terminated

in fiscal 2003. Upon termination in fiscal 2003, the Co-Chairmen paid to the Company $5.4 million, representing the total

amount of premiums paid by the Company under the agreements and the Company was released from its contractual

obligation to make substantial future premium payments. In order to confer a benefit to its Co-Chairmen in substitution

for the aforementioned terminated agreements, the Company has agreed to pay to the Co-Chairmen, at a future date, an

aggregate amount of $4.2 million, which is included in accrued expenses and other current liabilities as of February 26, 2011

and February 27, 2010.