Bed, Bath and Beyond 2010 Annual Report Download - page 55

Download and view the complete annual report

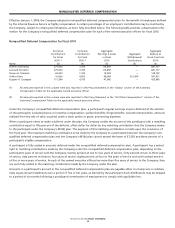

Please find page 55 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other than for “cause,” all unvested options will vest and become exercisable. In addition, pursuant to their respective restricted

stock agreements, shares of restricted stock granted to Messrs. Temares, Stark and Castagna will vest upon death, disability or

termination of employment without “cause,” and for restricted stock awards granted since fiscal 2009, vesting upon termination

without “cause” will be subject to attainment of performance goals. These agreements also provide for non-competition

and non-solicitation during the term of employment and for one year thereafter (two years in the case of Mr. Castagna), and

confidentiality during the term of employment and surviving the end of the term of employment.

On November 16, 2009, the Company entered into an amendment and restatement of the supplemental executive retirement

benefit agreement, dated January 11, 2006, with Mr. Steven H. Temares, and a related escrow agreement, as described below.

Under the supplemental executive retirement benefit agreement, if he remains employed by the Company through June 12,

2012 (the twentieth anniversary of his employment with the Company) or the earlier occurrence of a change of control of the

Company (as defined in the agreement), he is entitled to receive a supplemental retirement benefit on his retirement or other

separation from service from the Company. The retirement benefit will be payable in the form of a lump sum equal to the

present value of an annual amount equal to 50% of Mr. Temares’ annual base salary on the date of termination of employment

if such annual amount were paid for a period of 10 years in accordance with the Company’s normal payroll practices. In the event

Mr. Temares is terminated without cause or his employment is terminated due to death or disability prior to June 12, 2012, he

will also be eligible to receive the supplemental retirement benefit. Except in the case of Mr. Temares’ death (in which case the

supplemental retirement benefit will be immediately payable) and the agreement as to escrow, the supplemental retirement

benefit will be paid on the first business day following the six month anniversary of Mr. Temares’ termination and will be

includible in his income for tax purposes at such time.

In the event Mr. Temares elects to retire or voluntarily terminates his employment with the Company after June 12, 2012, a

portion of the supplemental retirement benefit, net of withholdings, will be deposited into an escrow account governed by a

separate agreement. No portion of the supplemental retirement benefit will be deposited into the escrow account, however, in

the event Mr. Temares dies, is terminated by the Company without cause (as such term is defined in his employment agreement),

terminates due to disability, or terminates employment within 12 months following a change of control. In the event Mr.

Temares elects to retire or voluntarily terminates his employment with the Company after June 12, 2012, 1/10 of the lump sum

of the lump sum supplemental retirement benefit distribution (net of applicable withholding taxes) will be deposited into an

escrow account to be distributed in nine equal annual installments on each of the following nine anniversaries of the deposit

date, subject to acceleration in the case of Mr. Temares’ death or a change of control of the Company. The entire escrow account

will be distributed to Mr. Temares’ beneficiary no later than 30 days following his death or to Mr. Temares no later than 30 days

following a change of control of the Company. If Mr. Temares does not comply with the restrictive covenant not to compete with

the Company (as described in his employment agreement, for the term of the escrow agreement) prior to the payment of the

entire escrow amount, the Company will have the right to direct the escrow agent to pay the remaining escrow amount to the

Company no later than 15 days after notice to the escrow agent and Mr. Temares will forfeit any and all rights to such remaining

escrow amount. Mr. Temares has agreed that in the event any amount in escrow is forfeited, he will use commercially reasonable

efforts to obtain a refund of applicable taxes and remit such refund to the Company and the Company has agreed to reimburse

Mr. Temares, or to pay on his behalf, reasonable legal fees and expenses incurred in connection with such a refund request.

Although the amended SERP provides that Mr. Temares will be protected from any impact resulting from the possible application

of Section 409A to the terms of the SERP due to the complexities surrounding Section 409A, the Company believes that no such

payment will be required.

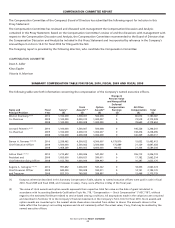

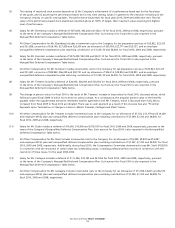

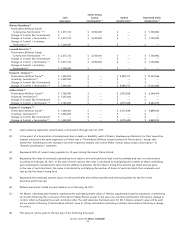

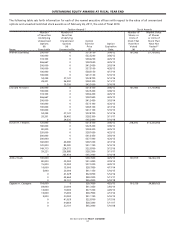

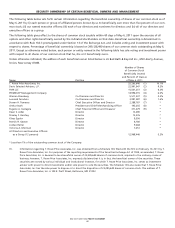

Table and related footnotes follow on the next two pages.

BED BATH & BEYOND PROXY STATEMENT

53