Bed, Bath and Beyond 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH & BEYOND PROXY STATEMENT

54

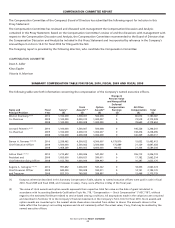

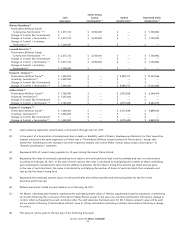

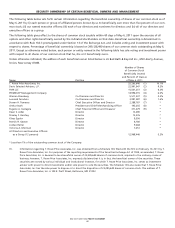

Cash Salary Option Restricted Stock

Severance Continuation (3) Acceleration (4) Acceleration (4)

Warren Eisenberg

Termination Without Cause/

Constructive Termination

(1) (2) $ 2,577,372 $ 5,500,000 $ — $ 7,750,982

Change in Control (No Termination) $ — $ — $ — $ —

Change in Control + Termination (1) $ 2,577,372 $ 5,500,000 $ — $ 7,750,982

Change in Control + Voluntary

Termination

(10) $ 3,300,000 $ — $ — $ —

Leonard Feinstein

Termination Without Cause/

Constructive Termination

(1) (2) $ 2,577,372 $ 5,500,000 $ — $ 7,750,982

Change in Control (No Termination) $ — $ — $ — $ —

Change in Control + Termination (1) $ 2,577,372 $ 5,500,000 $ — $ 7,750,982

Change in Control + Voluntary

Termination(10) $ 3,300,000 $ — $ — $ —

(11)

Termination Without Cause(10) $ 7,500,000 $ — $ 9,599,772 $ 13,303,066

Voluntary Termination(12) $ 2,500,000 $ — $ — $ —

Change in Control (No Termination) $ — $ — $ — $ —

Change in Control + Termination (10) $ 7,500,000 $ — $ 9,599,772 $ 13,303,066

Arthur Stark (13)

Termination Without Cause(10) $ 3,765,000 $ — $ 2,075,548 $ 6,264,474

Voluntary Termination(12) $ 1,255,000 $ — $ — $ —

Change in Control (No Termination) $ — $ — $ — $ —

Change in Control + Termination (10) $ 3,765,000 $ — $ 2,075,548 $ 6,264,474

(14)

Termination Without Cause(12) $ 1,040,000 $ — $ 2,075,548 $ 4,869,025

Voluntary Termination(12) $ 1,040,000 $ — $ — $ —

Change in Control (No Termination) $ — $ — $ — $ —

Change in Control + Termination(12) $ 1,040,000 $ — $ 2,075,548 $ 4,869,025

(1) Cash severance represents current salary continuation through June 30, 2013.

(2) In the event of a termination of employment due to death or disability, each of Messrs. Eisenberg and Feinstein (or their respective

estates) will receive the same payments as if there was a “Termination Without Cause/Constructive Termination”, except that

neither Mr. Eisenberg nor Mr. Feinstein (nor their respective estates) will receive either “Senior Status Salary Continuation” or

“Benefit Continuation” payments.

(3) Represents 50% of current salary payable for 10 years during the Senior Status Period.

(4) Represents the value of unvested outstanding stock options and restricted stock that would accelerate and vest on a termination

occurring on February 26, 2011. In the case of stock options, the value is calculated by multiplying the number of shares underlying

each accelerated unvested stock option by the difference between the Per Share Closing Price and the per share exercise price.

In the case of restricted stock, the value is calculated by multiplying the number of shares of restricted stock that accelerate and

vest by the Per Share Closing Price.

(5) Represents the estimated present value of continued health and welfare benefits and other perquisites for the life of the

executive and his spouse.

(6) Reflects executives’ vested account balances as of February 26, 2011.

(7) For Messrs. Eisenberg and Feinstein, represents the estimated present value of lifetime supplemental pension payments, commencing

six months following the conclusion of the Senior Status Period, except in the case of a voluntary termination following a change in

control, when such payments would commence after the cash severance has been paid. For Mr. Temares, present value will be paid

out six months following (1) termination without cause or (2) any termination (including voluntary termination) following a change

in control.

(8) This amount will be paid on the last day of the following fiscal year.