Bed, Bath and Beyond 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notice of 2011 Annual Meeting of Shareholders

Proxy Statement

2010 Annual Report

BED BATH & BEYOND INC.

Table of contents

-

Page 1

BED BATH & BEYOND INC. Notice of 2011 Annual Meeting of Shareholders Proxy Statement 2010 Annual Report -

Page 2

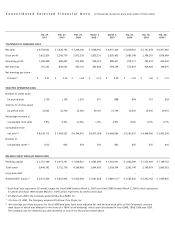

... the Company's common stock (each of which was effected in the form of a 100% stock dividend), which were distributed in ï¬scal 2000, 1998, 1996 and 1993. The Company has not declared any cash dividends in any of the ï¬scal years noted above. (2) (3) (4) BED BATH & BEYOND 2010 ANNUAL REPORT B -

Page 3

...the Company adopted Staff Accounting Bulletin 108, "Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements" resulting in a one-time net reduction to Shareholders' equity of $34.3 million. (6) (7) BED BATH & BEYOND 2010 ANNUAL REPORT... -

Page 4

... under the name "Home & More." Our fundamental business strategy remains unchanged: to offer a broad assortment of merchandise at everyday low prices with superior customer service. In doing so, we are conï¬dent that our Company is well positioned and has BED BATH & BEYOND 2010 ANNUAL REPORT 2 -

Page 5

... are registered directly in your name with Bed Bath & Beyond's transfer agent, you are considered the shareholder of record with respect to those shares, and these proxy materials are being sent directly to you. If you hold restricted stock under the Company's 2004 Incentive Compensation Plan, you... -

Page 6

... comparable store sales if the change in square footage would cause meaningful disparity in sales over the prior period. In the case of a store to be closed, such store's sales are not considered comparable once the store closing process has commenced BED BATH & BEYOND 2010 ANNUAL REPORT 4 -

Page 7

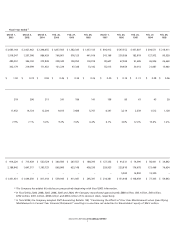

... 31.9 Selling, general and administrative expenses Operating proï¬t Earnings before provision for income taxes Net earnings Net Sales increase was primarily attributable to an increase in the Company's comparable store sales merchandise offerings. BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 8

... rate from year to year because the Company is required each year to determine whether new information changes the assessment of both the probability that a tax position will effectively be sustained and the appropriateness of the amount of recognized beneï¬t BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 9

...in net earnings, partially offset by an increase in cash used for the net components of working capital (primarily merchandise inventories and income taxes payable, partially offset by deferred rent and other liabilities and the timing of merchandise receipts BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 10

... Company continues to monitor efforts by the ï¬nancial markets to ï¬nd alternative means for restoring better visibility as to when their liquidity will be restored. The classiï¬cation and valuation of these securities will continue to be reviewed quarterly. BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 11

...Total column in the table above as the timing and/or amount of any cash payment is uncertain. Deferred rent and other liabilities are primarily comprised of deferred rent, workers' compensation and general liability reserves and various other accruals. (2) (3) BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 12

... depreciated. The assets and liabilities of a disposal group classiï¬ed as held for sale would be presented separately in the appropriate asset and liability sections of the balance sheet. The Company has not historically period in which the impairment occurs. BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 13

.... Self Insurance: The Company utilizes a combination of insurance and self insurance for a number of risks including workers' compensation, general liability, automobile liability and employee related health care beneï¬ts (a portion of which is paid by its employees). Liabilities associated with... -

Page 14

..., without limitation: general economic conditions including the housing market, a challenging overall macroeconomic without limitation, changes to lease accounting standards. The Company does not undertake any obligation to update its ฀ ฀ ฀ ฀ ฀ ฀ BED BATH & BEYOND 2010 ANNUAL REPORT -

Page 15

...Accounts payable Accrued expenses and other current liabilities Merchandise credit and gift card liabilities Current income taxes payable Total current liabilities Deferred rent and other liabilities Income taxes payable Total...,499) 728 3,652,904 $ 5,152,130 BED BATH & BEYOND 2010 ANNUAL REPORT 13 -

Page 16

... STATEMENTS OF EARNINGS Bed Bath & Beyond Inc. and Subsidiaries (in thousands, except per share data) Net sales Cost of sales Gross proï¬t Selling, general and administrative expenses Operating proï¬t Interest income Earnings before provision for income taxes Provision for income taxes Net... -

Page 17

... under employee stock option plans, net of taxes Issuance of restricted shares, net Stock-based compensation expense, net Director fees paid in stock Repurchase of common stock, including fees Effect of change in pension plan measurement date Balance at February 28, 2009 Comprehensive Income (Loss... -

Page 18

... (decrease) in liabilities: Accounts payable Accrued expenses and other current liabilities Merchandise credit and gift card liabilities Income taxes payable Deferred rent and other liabilities Net cash provided by operating activities Cash Flows from Investing Activities: Purchase of held-to... -

Page 19

... self insurance, litigation, store opening, expansion, relocation and closing costs, the provision for sales returns, vendor allowances, stock-based compensation and income and certain other taxes. Actual results could differ from these estimates. E. Cash and Cash Equivalents The Company considers... -

Page 20

..., net of returns to vendors, discounts and volume and incentive rebates; inbound freight expenses; duty, insurance and commissions. At any one time, inventories include items that have been written down to the Company's best estimate of their realizable value. Judgment is required in estimating... -

Page 21

... Self Insurance The Company utilizes a combination of insurance and self insurance for a number of risks including workers' compensation, general liability, automobile liability and employee related health care beneï¬ts (a portion of which is paid by its employees). Liabilities associated with the... -

Page 22

... for reduction in the value of unused card balances over deï¬ned time periods and have no expiration dates, but are subject to state escheat regulations; as such, the Company does not record income associated with unredeemed gift cards. Sales returns are provided for in the period that the... -

Page 23

..., with expiration dates of February 29, 2012 and September 2, 2011, respectively. These uncommitted lines of credit are currently and are expected to be used for letters of credit in the ordinary course of business. During ï¬scal 2010 and 2009, the Company did not have any direct borrowings under... -

Page 24

...in Active Markets Unobservable for Identical Assets Inputs (Level 1) (Level 3) $ - - 17.6 $ 17.6 $ 5.8 103.9 - $ 109.7 $ (in millions Auction rate securities Auction rate securities Nonqualiï¬ed deferred compensation plan assets Total Total 5.8 103.9 17.6 $ 127.3 BED BATH & BEYOND 2010 ANNUAL... -

Page 25

...ï¬scal 2010, approximately $25.0 million of these securities were redeemed at par. Subsequent to the end of ï¬scal 2010 through April 15, 2011, the Company additionally redeemed approximately $5.8 million of short term available-for-sale securities at par. BED BATH & BEYOND 2010 ANNUAL REPORT 23 -

Page 26

...(in thousands) Deferred tax assets: Inventories Deferred rent and other rent credits Insurance Stock-based compensation Merchandise credits and gift card liabilities Accrued expenses Other Deferred tax liabilities: Depreciation Goodwill Other February 26, 2011 $ 26,151 75,007 51,906 48,743 29,043 86... -

Page 27

... aforementioned terminated agreements, the Company has agreed to pay to the Co-Chairmen, at a future date, an aggregate amount of $4.2 million, which is included in accrued expenses and other current liabilities as of February 26, 2011 and February 27, 2010. BED BATH & BEYOND 2010 ANNUAL REPORT 25 -

Page 28

..., these changes have resulted in no impact to the consolidated statements of earnings. Deï¬ned Beneï¬t Plan The Company has a non-contributory deï¬ned beneï¬t pension plan for the CTS employees, hired on or before July 31, 2003, who meet speciï¬ed age and length-of-service requirements. The... -

Page 29

... 2011, February 27, 2010 and February 28, 2009, respectively. 12. STOCK-BASED COMPENSATION The Company measures all employee stock-based compensation awards using a fair value method and records such expense in its consolidated ï¬nancial statements. Currently, the Company's stock-based compensation... -

Page 30

... during ï¬scal 2010, 2009 and 2008 were $50.5 million, $61.9 million and $20.4 million, respectively. Net cash proceeds from the exercise of stock options for ï¬scal 2010 were $125.7 million and the net associated income tax detriment was $0.5 million. BED BATH & BEYOND 2010 ANNUAL REPORT 28 -

Page 31

... Company's employ on speciï¬ed vesting dates. The Company recognizes compensation expense related to these awards based on the assumption that the performance-based test will be achieved. Vesting of restricted stock awarded to the Company's other employees is based solely on time vesting. Changes... -

Page 32

... of February 26, 2011, based on criteria established in Internal Control report dated April 26, 2011 expressed an unqualiï¬ed opinion on the effectiveness of the Company's internal control over ï¬nancial reporting. Short Hills, New Jersey April 26, 2011 BED BATH & BEYOND 2010 ANNUAL REPORT 30 -

Page 33

... internal control over ï¬nancial reporting as of We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Bed Bath & Beyond Inc. and subsidiaries as of February 26, 2011 and February 27, 2010... -

Page 34

BED BATH & BEYOND INC. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS JUNE 23, 2011 TIME 9:00 A.M. on Thursday, June 23, 2011 PLACE Madison Hotel One Convent Road Morristown, New Jersey 07960 ITEMS OF BUSINESS (1) To elect nine directors until the Annual Meeting in 2012 and until their respective ... -

Page 35

... Bath & Beyond Inc. 650 Liberty Avenue Union, New Jersey 07083 PROXY STATEMENT These proxy materials are delivered in connection with the solicitation by the Board of Directors of Bed Bath & Beyond Inc. (the "Company", "we", or "us"), a New York corporation, of proxies to be voted at our 2011 Annual... -

Page 36

...฀ Mark, sign and date your proxy card and return it in the postage-paid envelope we've provided, or return it to Bed Bath & Beyond Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Voting by any of these methods will not affect your right to attend the Annual Meeting and vote in person... -

Page 37

... Meeting or would like additional copies of this document or our 2010 Annual Report on Form 10-K, please contact: Bed Bath & Beyond Inc., 650 Liberty Avenue, Union, NJ 07083, Attention: Investor Relations Dept., Telephone: (908) 688-0888. ELECTION OF DIRECTORS (PROPOSAL 1) How is the Board of... -

Page 38

...the Executive Vice President & General Counsel of Edison Properties, LLC, a diversiï¬ed real estate company, since 2007. Ms. Morrison was previously practicing law as a partner in the law ï¬rm of Riker, Danzig, Scherer, Hyland & Perretti LLP since 1986. She has been a director of the Company since... -

Page 39

... on the date of the Company's 2010 Annual Meeting of Shareholders ($37.96 per share, the average of the high and low trading prices on June 29, 2010). (2) This director fee was paid in shares of common stock of the Company pursuant to the Bed Bath & Beyond Plan to Pay Directors Fees in Stock and the... -

Page 40

... of Board agendas and schedules for meetings), arranges for Board committee functions and acts as Secretary of all Board committees (other than when another independent director acts in such capacity), and receives communications from the Company's shareholders. BED BATH & BEYOND PROXY STATEMENT... -

Page 41

... during ï¬scal 2010 were Messrs. Adler and Eppler and Ms. Morrison. In addition to meeting the NASDAQ independence requirements, these members are "non-employee directors" for applicable SEC rules and are "outside directors" for purposes of applicable tax law. BED BATH & BEYOND PROXY STATEMENT 39 -

Page 42

... Information; Risk Management A complete copy of the charter of each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, as well as the Company's policies on director attendance at the Annual Meeting and how shareholders can communicate with the... -

Page 43

... of XBRL reporting requirements. In ï¬scal 2009, "audit-related fees" included fees associated with the Company's response to an SEC comment letter and the implementation of XBRL reporting requirements. In ï¬scal 2010 and ï¬scal 2009, "tax fees" included fees associated with tax planning, tax... -

Page 44

... Operations, Allan N. Rauch, Vice President - Legal and General Counsel, and G. William Waltzinger, Jr., Vice President - Bed Bath & Beyond Inc. - Corporate Development and President - Harmon Stores, Inc. EXECUTIVE COMPENSATION Compensation Discussion and Analysis The following is a discussion and... -

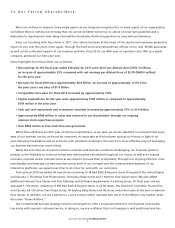

Page 45

... on the 2011 Fortune 500 annual ranking of America's largest corporations. Since the initial public offering of its common stock in 1992 through the end of ï¬scal 2010, the Company's stock price has increased at an average annual rate of 23.6%. For ï¬scal 2009, the Company reported net earnings... -

Page 46

... ï¬scal 2009, 2010 and 2011. The Compensation Committee also receives advice and assistance from the law ï¬rm of Chadbourne & Parke LLP, which has acted as counsel only to the Company's independent directors and its Board committees. Methodology Under the direction of the Compensation Committee... -

Page 47

..., consolidations or dispositions, (ii) changes in accounting methods, and (iii) extraordinary items, as deï¬ned in Accounting Standards Codiï¬cation Topic No. 225, "Income Statement", or stock repurchase or dividend activity. The Company believes that this performance-based test meets the standard... -

Page 48

.... In 2010, the employment agreements for the Co-Chairmen were amended to extend their terms until June 30, 2013. At that time, the employment agreements for the Co-Chairmen were amended to eliminate the entitlement to receive excise tax gross-up payments due to change in control payments that would... -

Page 49

... to the Company. For further discussion related to equity grants to the named executive ofï¬cers, see "Potential Payments Upon Termination or Change in Control" below. Fiscal 2011 Compensation Developments In early ï¬scal 2011, the Compensation Committee continued its engagement of JFR to conduct... -

Page 50

...'s total compensation. Key beneï¬ts include paid vacation, premiums paid for long-term disability insurance, a matching contribution to the named executive ofï¬cer's 401(k) plan account, and the payment of a portion of the named executive ofï¬cer's premiums for healthcare and basic life insurance... -

Page 51

...Compensation Table, salaries to named executive ofï¬cers were paid in cash in ï¬scal 2010, ï¬scal 2009 and ï¬scal 2008, and increases in salary, if any, were effective in May of the ï¬scal year. The value of stock awards and option awards represents their respective total fair value on the date... -

Page 52

... the performance-based test is met, time vesting, subject in general to the executive remaining in the Company's employ on speciï¬c vesting dates. The performance-based tests for ï¬scal years 2010, 2009 and 2008 were met. The fair value of the performance-based stock awards are reported above at... -

Page 53

... the term of employment. Potential Payments Upon Termination or Change in Control The named executive ofï¬cers' employment agreements and certain of the plans in which the executives participate require the Company to pay compensation to the executives if their employment terminates. The estimated... -

Page 54

... of the term of employment and the Senior Status Period. Following a change in control of the Company (as deï¬ned in the agreements), each of the executives may, at his option, upon 90 days' written notice, terminate employment and shall be paid an amount equal to three times salary then in effect... -

Page 55

... at such time. In the event Mr. Temares elects to retire or voluntarily terminates his employment with the Company after June 12, 2012, a portion of the supplemental retirement beneï¬t, net of withholdings, will be deposited into an escrow account governed by a separate agreement. No portion of the... -

Page 56

... the life of the executive and his spouse. Reï¬,ects executives' vested account balances as of February 26, 2011. For Messrs. Eisenberg and Feinstein, represents the estimated present value of lifetime supplemental pension payments, commencing six months following the conclusion of the Senior Status... -

Page 57

... result of payments subject to Section 280G of the Code that would have been made in connection with a change in control occurring on February 26, 2011. Cash severance represents three times current salary payable over a period of three years. In the event of a termination of employment due to death... -

Page 58

... met, time vesting, subject in general to the executive remaining in the Company's employ on speciï¬c vesting dates. The performance-based test for ï¬scal 2010 was met. The performance test is designed to meet the standard for performance-based compensation under the Code, so that restricted stock... -

Page 59

... AT FISCAL YEAR END The following table sets forth information for each of the named executive ofï¬cers with respect to the value of all unexercised options and unvested restricted stock awards as of February 26, 2011, the end of ï¬scal 2010. Number of Securities Underlying Unexercised Options... -

Page 60

... may appear in this table as multiple entries where the exercise price was increased for only a portion of such grant. Market value is based on the closing price of the Company's common stock of $47.85 per share on February 25, 2011, the last trading day in ï¬scal 2010. (2) OPTION EXERCISES AND... -

Page 61

... bonus or incentive compensation, welfare beneï¬ts, fringe beneï¬ts, noncash remuneration, amounts realized from the sale of stock acquired under a stock option or grant, and moving expenses. When a participant elects to make a deferral under the plan, the Company credits the account of the... -

Page 62

...to vote is required to approve this Proposal 3. THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS FOR FISCAL 2010 AS DISCLOSED IN THIS PROXY STATEMENT. BED BATH & BEYOND PROXY STATEMENT... -

Page 63

... be once every year. The Board of Directors recommends an annual advisory vote because an annual vote will allow shareholders to provide direct input on the Company's compensation policies and practices, and the resulting compensation for the named executive ofï¬cers, every year. Shareholders would... -

Page 64

... owner listed below is c/o Bed Bath & Beyond Inc., 650 Liberty Avenue, Union, New Jersey 07083. Number of Shares of Common Stock Beneï¬cially Owned and Percent of Class as Position of May 6, 2011 25,285,640 (1) 22,991,947 (2) 15,501,251 (3) 14,996,015 (4) Co-Chairman and Director 5,511,537 (5) Co... -

Page 65

...persons or entities for transactions in our common stock and their common stock holdings for ï¬scal 2010, we believe that all reporting requirements under Section 16(a) for such ï¬scal year were met in a timely manner by our directors and executive ofï¬cers. BED BATH & BEYOND PROXY STATEMENT 63 -

Page 66

... principal executive ofï¬ces at 650 Liberty Avenue, Union, New Jersey 07083 between the close of business on February 24, 2012 and the close of business on March 26, 2012, and is otherwise in compliance with the requirements set forth in the Company's Amended By-laws. If the date of the 2012 Annual... -

Page 67

..., Inc. Harmon Stores, Inc. 650 Liberty Avenue Union, New Jersey 07083 Telephone: 908/688-0888 Bed Bath & Beyond Procurement Co. Inc. 110 Bi-County Boulevard, Suite 114 Farmingdale, New York 11735 Telephone: 631/420-7050 Buy Buy Baby, Inc. 895 East Gate Boulevard Garden City, New York 11530 Telephone... -

Page 68

BED BATH & BEYOND INC.