Bed, Bath and Beyond 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2005

7

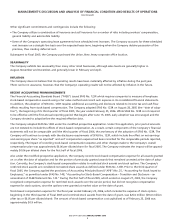

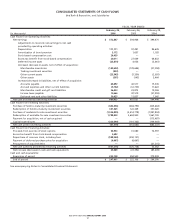

During fiscal 2004, in anticipation of adopting SFAS No. 123R, the Company revised its overall approach to compensation for

its employees, including stock-based compensation, and adopted the Bed Bath & Beyond 2004 Incentive Compensation Plan

(the “2004 Plan”). The 2004 Plan is a flexible compensation plan that enables the Company to offer incentive compensation

through stock options, stock appreciation rights, restricted stock awards and performance awards, including cash awards. As

aresult, during fiscal 2005, awards consisting of a combination of stock options and performance-based restricted stock were

granted to executive officers and other executives and awards consisting of restricted stock were granted to the Company’s other

employees who traditionally have received stock options. Awards of stock options and restricted stock generally vest in five equal

annual installments beginning one to three years from the date of grant.

Prior to fiscal 2004, the Company had adopted various stock option plans (the “Prior Plans”), all of which solely provided for the

granting of stock options. Upon adoption of the 2004 Plan, the common stock available under the Prior Plans became available

for issuance under the 2004 Plan. No further option grants may be made under the Prior Plans, although outstanding awards

under the Prior Plans will continue to be in effect.

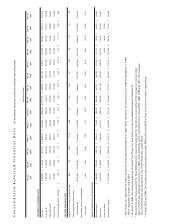

Under the 2004 Plan and the Prior Plans, an aggregate of 83.4 million shares of common stock were authorized for issuance.

The Company generally issues new shares for stock option exercises and restricted stock awards. The number of shares and

the price per share is determined by the Compensation Committee for those awards granted to executive officers and by an

appropriate committee for all other awards granted.

As of February 25, 2006, unrecognized compensation expense related to the unvested portion of the Company’s stock options

and restricted stock awards was $123.1 million and $33.1 million, respectively, which is expected to be recognized over a weighted

average period of 3.6 years and 5.2 years, respectively.

In October 2005, the FASB issued FASB StaffPosition (“FSP”) 13-1, “Accounting for Rental Costs Incurred during a Construction

Period.” FSP 13-1 requires rental costs associated with ground or building operating leases that are incurred during a construction

period be recognized as rental expense. FSP 13-1 becomes effective for the first reporting period beginning after December 15,

2005. The Company does not believe that the adoption of FSP 13-1 will have a material impact on the Company’sconsolidated

financial statements.

In June 2005, the FASB’s Emerging Issues Task Force (“EITF”) reached a consensus on Issue No. 05-6, “Determining the

Amortization Period for Leasehold Improvements Purchased after Lease Inception or Acquired in a Business Combination.”

EITF 05-6 requires leasehold improvements purchased after the beginning of the initial lease term to be amortized over the short-

er of the assets’ useful life or a termthat includes the original lease termplus any renewals that are reasonably assured at the

date the leasehold improvements are purchased. This guidance was effective for reporting periods beginning after June 29, 2005.

The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections - a replacement of APB No. 20 and SFAS

No. 3,” which changes the requirements for the accounting for, and reporting of, a change in accounting principle. SFAS No. 154

is effective for accounting changes and correction of errors made in fiscal years beginning after December 15, 2005; however,

the statement does not change the transition provisions of any existing accounting pronouncements. The Company does not

believe that the adoption of SFAS No.154 will have a material impact on the Company’s consolidated financial statements.

In March 2005, the FASB issued FASB Interpretation (“FIN”) No. 47, “Accounting for Conditional Asset Retirement Obligations.”

FIN No. 47 clarifies the term “conditional asset retirement obligation” as used in FASB Statement No. 143, “Accounting for Asset

Retirement Obligations.” This interpretation requires companies to recognize a liability for the fair value of a legal obligation to

perform asset-retirement activities that are conditional on a future event if the amount can be reasonably estimated. FIN No. 47

also clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement

obligation. FIN No. 47 is effective no later than the end of fiscal years ending after December 15, 2005. The adoption of FIN No. 47

did not have a material impact on the Company’s consolidated financial statements.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs, an Amendment of ARB No. 43, Chapter 4.” SFAS No. 151

amends the guidance to clarify that abnormal amounts of idle facility expense, freight, handling costs and wasted materials

should be recognized as current period charges. In addition, SFAS No. 151 requires that allocation of fixed production overhead

to the costs of conversions be based on the normal capacity of the production facilities. The statement is effective for inventory

costs incurred during fiscal years beginning after June 15, 2005. The Company does not believe that the adoption of SFAS No. 151

will have a material impact on the Company’sconsolidated financial statements.